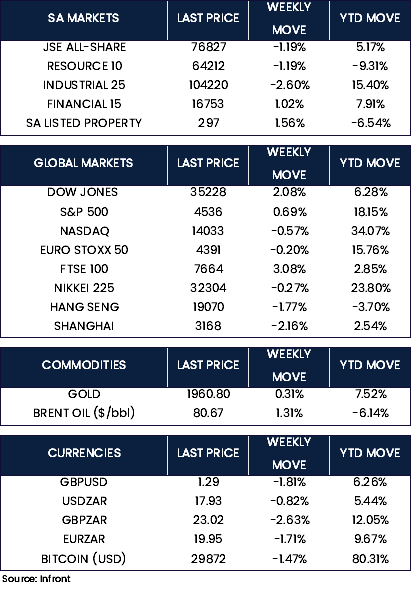

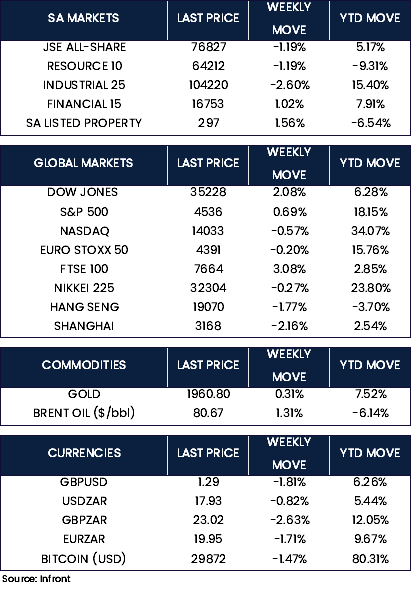

The past week witnessed a varied performance in the major U.S. stock markets. Investors grappled with the implications of subdued inflation data against concerns stemming from the recent uptick in long-term interest rates. Notably, value stocks displayed stronger performance compared to growth stocks. The trading activity remained subdued, partially attributable to the ongoing summer vacation period and the gradual conclusion of the quarterly earnings reporting season.

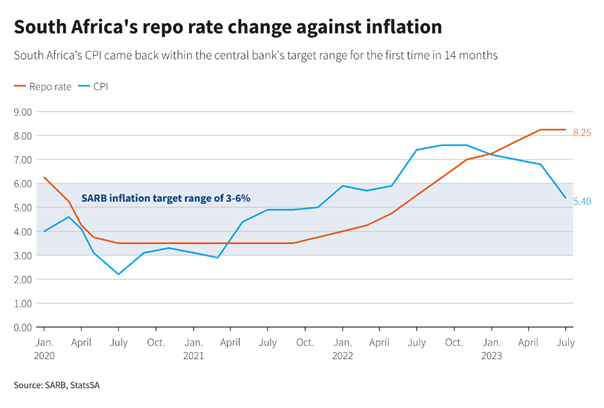

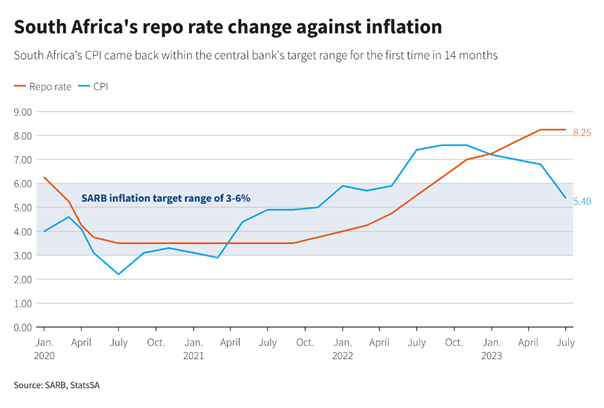

U.S. inflation continued to show signs of moderating, core CPI rose 0.16% month-on-month, below market consensus, matching the lowest previous reading since February 2021. Headline CPI rose 0.17% in July and up 3.2% from last year, as food prices rose 0.2% and energy prices rose 0.1% over the month. Initial jobless claims increased by 21k to 248k this week, above consensus expectations of a 3k increase. The current path of inflation is easing concerns that the Federal Reserve will continue its current interest rate hiking cycle.

President Joe Biden recently introduced strategic measures to limit U.S. investments in China, specifically targeting firms involved in next-generation military and surveillance technologies. This move aims to curtail China’s advancements in these critical sectors. The regulations encompass certain Chinese semiconductor, quantum computing, and artificial intelligence companies. President Biden’s commentary on China’s economic challenges, referring to the economy as a “ticking time-bomb,” and his candid remarks about the leadership in Beijing, including labelling Communist Party leaders as “bad folks,” highlight a complex diplomatic landscape. While the Biden administration aims to enhance overall relations with China, these statements and regulations could potentially strain bilateral ties once more.

The Chinese economy is faced with the opposite problems to the U.S., China is in the uncomfortable position of managing deflation, as CPI continues to sink, and the economy weakens. High youth unemployment, falling exports and a challenging property sector are all weighing on the world’s second largest economy. Recent inflation data revealed a tandem fall in both consumer and producer price inflation, this for the first time since November 2020, underscoring the weak demand throughout the economy.

The U.K.’s economic trajectory continues to show resilience. June witnessed a 0.5% month-on-month expansion in the country’s Gross Domestic Product (GDP), surpassing consensus expectations. The production and construction sectors were notable contributors to this growth, with a 1.8% and 1.6% increase, respectively. Services output also played a positive role. Goldman Sachs’ 2023 forecast for the U.K.’s annual growth stands at +0.6% year-on-year, surpassing both consensus projections (+0.2% YoY) and the Bank of England’s latest estimate (+0.5% YoY). U.K. inflation remains among the highest of developed economies at 7.9%, well above the BoE target range of 2%.

Over the weekend, geopolitical tensions heightened as the conflict in Ukraine extended to the Black Sea region. Innovative sea drones incapacitated a Russian naval vessel and an oil tanker. This unprecedented incident now jeopardises Russia’s commodity exports via this vital route. The Black Sea route constitutes a significant portion of Russia’s daily global sales of grain and approximately 15%-20% of its oil exports. Ukraine’s counteroffensive actions could potentially disrupt Russia’s capacity to deliver oil to its customers.

The European Central Bank indicated that the near-term economic outlook for the block has deteriorated due to weaker domestic demand. The ECB believes that outlook for economic growth and inflation remains highly uncertain. Inflation is expected to moderate in 2023 but will likely remain above the 2% target rate for an extended period.

US stocks ended the week mixed, with the S&P 500 down 0.31%, the more value orientated Dow Jones Industrial Average up 0.62%, and the tech heavy Nasdaq Composite closing in the red, down 1.90%.

The mixed trend carried through to other global markets. Euro Stoxx 50 ended the week marginally lower, down 0.27%, the FTSE 100 also closed the week in negative territory down 0.53%. Japan’s Nikkei 225 index gained 0.87% this week. Chinese equities came under pressure this week, the Hang Seng Composite down 2.29% and Shanghai Composite down 3.01%.

At Friday close, Brent crude oil was slightly higher, up 0.65% for the week at $86.55 ($/bbl).

Market Moves of the Week:

In South African political news, former President Zuma received a ‘special remission’ by Correctional Services Minister Ronald Lamola, effectively nullifying the remainder of his prison sentence. Mr Zuma was found guilty of contempt of court and sentenced to 15-months imprisonment by the Constitutional Court. To date Mr Zuma has only served 2-months of his sentence and was unlawfully released on medical parole in September 2021. The approved remission of non-violent offenders by President Cyril Ramaphosa covers 212,286 inmates, and Minister Lamola has stated that the remission of prison sentences is a crucial part of managing the overcrowding in the correctional services system.

Global inflation and interest rate uncertainly was digested by the local market, through a shortened trading week. The JSE ALSI posted a modest gain for the week 0.02%, only financials contributed positively from a sector level, closing the week up 0.65%. The SA listed property sector continued to recover, closing this week up 2.11%.

Once again, the Rand came under pressure against the dollar, depreciating 2.61% this week. The currency was trading at R18.94/$ by Friday close.

Chart of the Week:

July core CPI rose by 0.16%, slightly below consensus. The year-on-year rate fell to 4.7%. The print was broadly encouraging from a disinflation standpoint, rent inflation slowed further, the wage sensitive service category was also net softer. The softer core CPI print has further reduced the possibility of a September hike by the FOMC, and called into question whether a final hike in November is still necessary.

Source: Department of Labor, Goldman Sachs Global Investment Research.