This week marked the end of May, with the S&P 500 reaching its highest level since mid-August 2022 and the Nasdaq Composite hitting its best level since mid-April 2022. The agreement reached between the White House and Republican congressional leaders to raise the federal debt limit and avoid a default did not significantly impact investor sentiment, as indications of a deal had already emerged. Economic data took centre stage, with U.S. employment data in the spotlight.

The Senate passed legislation to suspend the U.S. debt ceiling and impose restraints on government spending through the 2024 election. President Joe Biden is set to formally end the month-long debt-limit crisis this weekend.

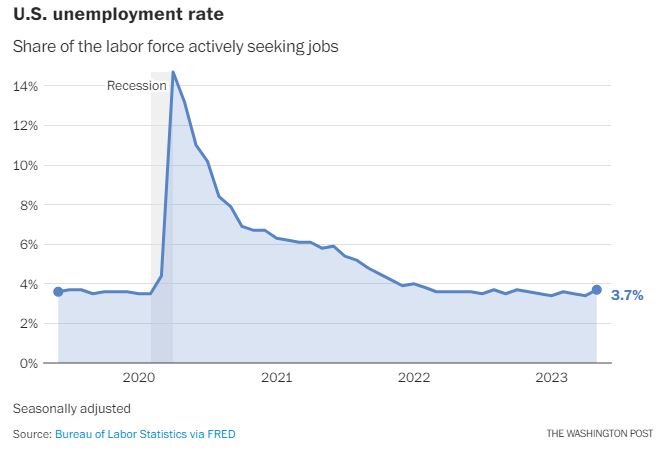

Employment data released during the week was mixed. A report on Wednesday showed that job openings rebounded much more than expected in April and hit their highest level (10.1 million) since January. However, Friday’s release showed that U.S. unemployment unexpectedly rose from 3.4% to 3.7%. The Labor Department also highlighted an increase in the number of people losing jobs or completing temporary positions, reaching the highest level since February 2022. Overall, these findings suggest a more challenging job market for workers. The Federal Reserve is signalling that they plan to keep interest rates steady in June while retaining the option to hike further in coming months. Friday’s unemployment data reinforces this possibility.

Another encouraging sign regarding interest rates was the release of U.S. manufacturing data for May. Data showed a seventh straight monthly contraction in factory activity, as expected. Encouragingly, prices paid for supplies and other inputs by manufacturers contracted at the fastest pace since December, defying expectations for a modest increase.

Eurozone inflation decreased more than expected in May, increasing by 6.1%, also down from a 7.0% increase in the previous month. The unemployment rate decreased to 6.5% in April, in line with market expectations, following a revised rate of 6.6% in March. Manufacturing PMI in the eurozone declined to 44.80 in May, down from 45.80 in the previous month.

UK house prices experienced a marginal decrease of 0.1% on a monthly basis in May, following a revised increase of 0.4% in the previous month. Market expectations had anticipated a 0.5% decline. This decline in house prices reflects wider concerns in the UK property market. Moody’s recently downgraded the debt of Canary Wharf, a prominent symbol of the global real estate downturn. The east London financial district, saw its debt rating lowered from Ba1 to Ba3.

In China, the official manufacturing Purchasing Managers’ Index (PMI) dropped unexpectedly to 48.80 in May, indicating a contraction for the second consecutive month. This suggests that the post-Covid recovery in China’s economy is facing challenges. However, the services PMI rose to 54.5, albeit below expectations, but still indicating expansion.

On the other hand, the private Caixin manufacturing PMI index surprisingly increased to 50.90 in May, contradicting the official data and showing a slight expansion in manufacturing activity. The Caixin index mainly covers smaller and export-oriented businesses.

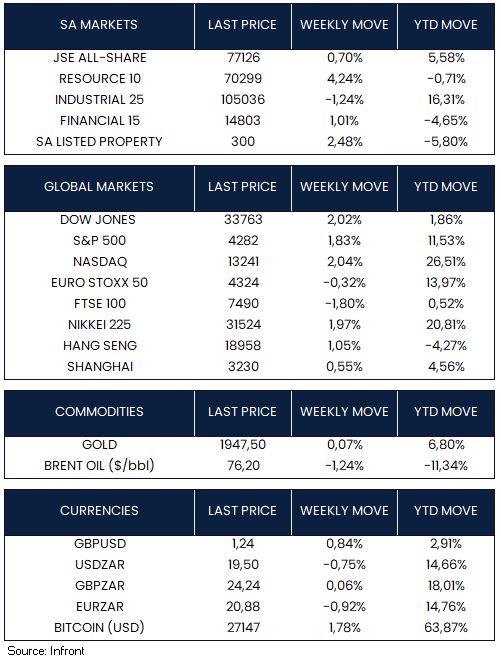

U.S. and Asian markets were stronger this week, whilst European markets ended in negative territory. In the U.S., the Dow Jones (+2.02%), S&P 500 (+1.83%) and Nasdaq (+2.04%) all ended the week higher. Similarly, the Nikkei 225 (+1.97%), Hang Seng (+1.05%) and Shanghai Composite Index (+0.55%) also ended the week higher, whilst the Euro Stoxx 50 (-0.32%) and FTSE 100 (-1.80%) were negative.