Thursday’s release of the U.S. Commerce Department’s core PCE price index, the Federal Reserve’s preferred inflation measure, defined the week’s market sentiment. The print met market expectations, showing a 0.4% month-over-month (2.8% y/y) increase in January, alleviating investors’ concerns about a potential upside surprise. Despite a surge in stocks following the release, it seemed to have a minimal effect on the overall tone of Federal Reserve communications. At the close of the week, the futures markets reflected only a marginal increase in the probability of a rate cut over the next two policy meetings – 24.6%, compared to the previous week’s 23.4%.

In other U.S. data, the Institute for Supply Management’s (ISM) measure of manufacturing activity significantly fell short of expectations, dropping from January’s 18-month high of 49.1 to 47.8 in February (Readings above 50 indicate expansion). Economists had expected a rise to 49.5. The new orders subcomponent fell to 49.2 from 52.5 in January.

In January, inflation in the eurozone eased less than anticipated, dipping from 2.8% to 2.6% at the headline level but remaining above the expected 2.5% rate. Core inflation showed a decline from 3.3% to 3.1%, surpassing the anticipated drop to 2.9%. European Central Bank (ECB) President Christine Lagarde mentioned that the desired level of inflation has not been reached yet, emphasizing the ECB’s aim for prices to fall sustainably to 2%. Lagarde also expressed optimism about the European economy, stating that there are growing indications that the period of economic weakness is stabilizing, with expectations for improvement later in the year.

In February, China’s economic data presented a varied picture. The official manufacturing purchasing managers index dropped to 49.1 from January’s 49.2, remaining below the growth-indicating 50-mark due to declines in production and exports. Conversely, the nonmanufacturing PMI exceeded expectations, rising to 51.4 from January’s 50.7. On the property front, the China Real Estate Information Corp reported a 60% decline in the value of new home sales by the top 100 developers compared to the same period in the previous year, marking an acceleration from January’s 34.2% decrease.

Japan’s core CPI cooled to 2% y/y in January from December’s 2.3% level, beating estimates and supporting the case for the Bank of Japan to continue moving toward ending its negative interest rate policy in April. Inflation has matched or exceeded the BOJ’s target for 22 months. In other news, Japan’s demographic challenges intensified in 2023, marked by an eighth consecutive annual decline in births, reaching a historic low of 759,000 – a 5.1% decrease from the previous year. The number of deaths, totalling 1,591,000, more than doubled the birth count while marriages hit a post-World War II low.

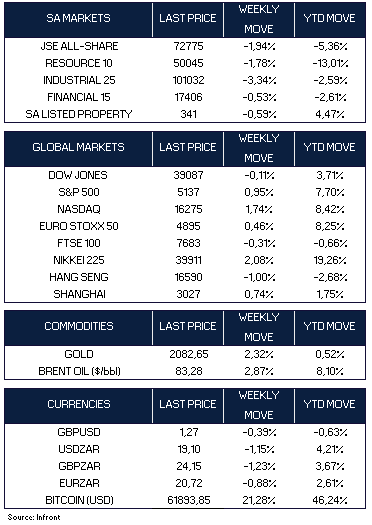

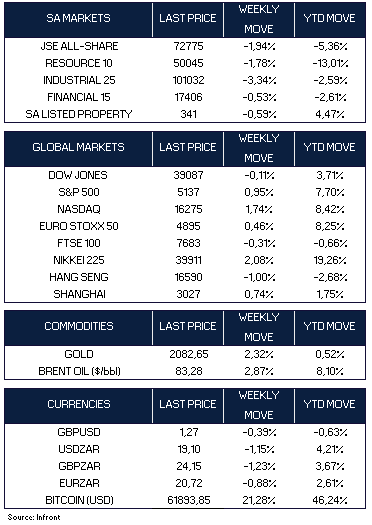

On the market front, most of the major U.S. benchmarks ended the week higher, with the Nasdaq Composite (+1.74%) joining the S&P 500 Index (+0.95%) in record territory for the first time in over two years. The Dow Jones ended the week relatively flat, down -0.11%. The yield on the benchmark US 10-year Treasury note fell to 4.23% from 4.31% a week ago. In the U.S. investment-grade corporate bond market, spreads expanded over the week as the sector grappled with substantial supply. February marked a record-breaking month with over USD 150 billion in new issuances.

Stocks in China rose on hopes that Beijing may boost monetary easing measures to stimulate growth. The Shanghai Composite Index gained 0.74% as a result. Japan’s stock market had another robust week, with the Nikkei 225 gaining 2.08%, hovering around a new record high and taking February’s gains to circa +10.0%. Shares in Europe (Euro Stoxx 50) rose by +0.46% while the UK’s FTSE 100 dropped -0.31%. Oil prices (Brent) gained +2.87% while Gold rose by +2.32%.

Market Moves of the Week

South African (SA) manufacturing activity rebounded in February, following a sharp drop in January, as indicated by Absa’s Purchasing Managers’ Index (PMI) survey. The PMI increased to 51.7 points in February from 43.6 in January. Although the business activity sub-index and new sales orders improved in February, they remained in negative territory. Absa, the PMI sponsor, noted increased optimism about exports, suggesting relief from congestion and disruptions at local ports.

SA Reserve Bank Governor Lesetja Kganyago affirmed, in an interview with Bloomberg on Wednesday, that there will be no interest-rate cuts until inflation is effectively managed, maintaining his stance despite calls for such measures ahead of national elections. The Monetary Policy Committee will deliver one more rate decision before the elections when it gathers at the end of next month.

The National Treasury stated on Thursday that although SA is making progress in addressing outstanding action items relating to the Financial Action Task Force’s (FATF) greylisting of SA in February last year, the challenge remains formidable to tackle all 17 items by February 2025. It has therefore warned that it “will require a significant effort from all the relevant South African authorities to address the remaining deficiencies for SA to exit the FATF greylist by February 2025.”

On the SOE front, Michelle Phillips, who has more than 20 years of experience working at Transnet, has been appointed as the new CEO of the beleaguered logistics company. This decision comes four months after the departure of the former CEO. Busisiwe Mavuso, CEO of Business Leadership SA, expressed her “relief, elation, and happiness” regarding Phillips’ appointment, as reported by Business Day. Cas Coovadia, CEO of Business Unity SA, also welcomed the decision.

The JSE fell (-1.94%) this week, with Industrials (-3.34%) leading the decline. Resources (-1.78%) continue to struggle amidst a global lack of demand, while Financials faired best, down -0.53%. The local currency strengthened against the U.S. dollar over the week, falling to R19.10/$ from last week’s R19.32/$ level.

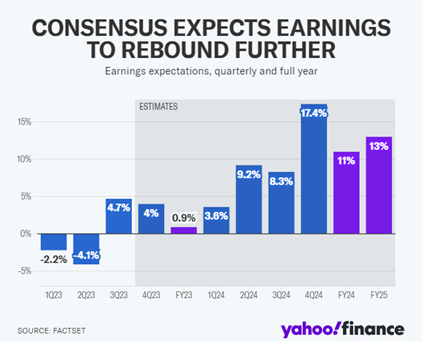

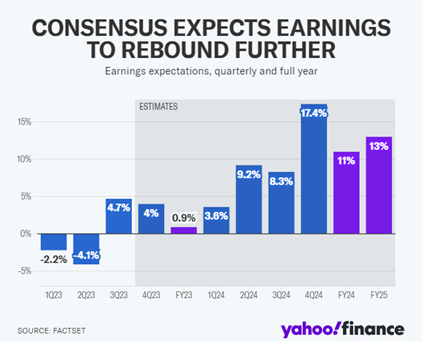

Chart of the Week

With 97% of the S&P 500 done reporting earnings for the fourth quarter, the S&P 500 is projected to have earnings growth of 4% in Q4 2023 compared to the same period a year prior, per new FactSet data. Notably, the current quarter’s earnings growth outlook is not declining at its usual rate. Analysts usually trim estimates by an average of 2.9% in the first two months, but this quarter has seen a milder 2.2% reduction, suggesting a more optimistic outlook. Source: Yahoo!finance