This week, the S&P 500 hit a historic milestone, surpassing 5,000 and setting a new record. This shows the market’s resilience against significant shifts in interest rates. The index closing above 5,000 on Friday reflects confidence in the U.S. economy, with low unemployment and stable inflation. However, caution is advised about the S&P 500’s 20% surge since November. The Federal Reserve has kept its interest rate high at its four last meetings, hinting at potential rate cuts but not immediately.

Comments from Fed officials throughout the week reinforced this narrative of rates being held “higher for longer”. Fed Chair Jerome Powell, in a “60 Minutes” TV interview, reiterated his stance of no immediate need for rate cuts. Similarly, Federal Reserve Bank of Richmond President, Thomas Barkin highlighted that the central bank has the luxury of time to determine the next steps in monetary policy, awaiting further confirmation that inflation is returning to its target levels.

European Central Bank officials equally warned about the risk of cutting interest rates too early, citing sticky services prices, a resilient labour market, and attacks on vessels in the Red Sea disrupting supply chains.

Economic data remained supportive of the U.S. economy, with services sector activity unexpectedly surging to a four-month high, firmly back into expansion territory. The index rose from 50.5 in December to 53.4 in January, indicating growth (readings above 50 signify expansion). Additionally, initial jobless claims saw a decline, surpassing market expectations, and MBA mortgage applications showed improvement.

This week, worries about the U.S. commercial property market spread to Europe, sparking concerns of broader contagion. Deutsche Pfandbriefbank AG in Germany faced bond declines due to fears of its exposure to the troubled sector, reflecting the impact of rising global interest rates on loans and property values. New York Community Bancorp and Japan’s Aozora Bank also encountered hurdles, with the latter reporting its first loss in 15 years from U.S. commercial property loans. Meanwhile, economist Arthur Laffer warned of a looming decade-long debt crisis, citing a staggering global debt of $307.4 trillion in September, representing 336% of the global GDP, a worrisome increase compared to 2012 figures of 110% for advanced economies and 35% for emerging economies.

December retail sales in the eurozone experienced a sharper decline than expected, dropping by 1.1% month-on-month. This decline exceeded market forecasts and contrasted with a revised increase of 0.3% in the previous month, indicating volatility and potential challenges in consumer spending.

House prices in the UK increased by 1.3% month-on-month in January. This follows the previous month’s growth of 1.1%, suggesting a continued recovery in the UK housing market. Manufacturing data also improved, indicating some recovery in the construction industry despite ongoing challenges.

Pacific Investment Management Co. (PIMCO) forecasts a significant shift in the Bank of Japan’s (BOJ) monetary policy, suggesting the abandonment of its negative interest-rate policy as early as March. According to PIMCO’s market-outlook report, the BOJ, the last proponent of sub-zero borrowing costs, may raise its benchmark rate to 0% by March or April. Moreover, PIMCO anticipates multiple rate hikes throughout the year, with the benchmark potentially reaching 0.25% by the end of 2024.

China’s securities regulator announced an unexpected leadership change, suggesting a potentially more assertive approach by Xi Jinping’s government to stabilise the $8 trillion stock market. This follows authorities’ struggles to curb market selloffs despite piecemeal support measures. Approximately $5 trillion in market value has evaporated from onshore equities since their peak in 2021.

Chinese economic data continues to be weak. January’s consumer price index declined by 0.8% year-on-year, marking its sharpest decline since 2009, largely influenced by decreased food prices, while core inflation increased by 0.4%, the slowest rise since June 2023. The producer price index fell by 2.5% year-on-year, indicating the 16th consecutive month of deflation for factory gate costs. Similarly, the Caixin/S&P Global survey reported a dip in services activity to 52.7 from December’s 52.9.

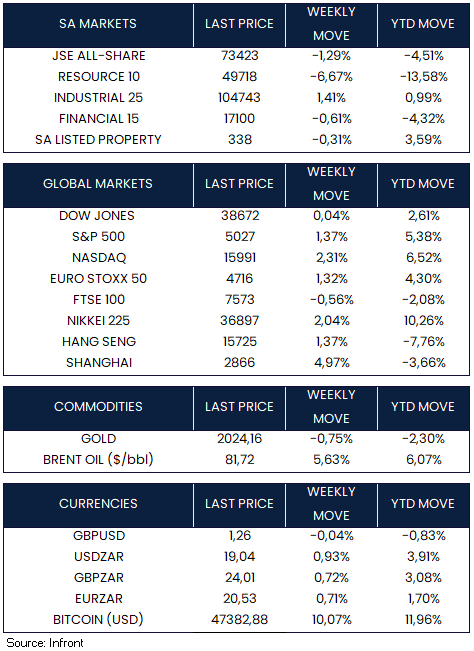

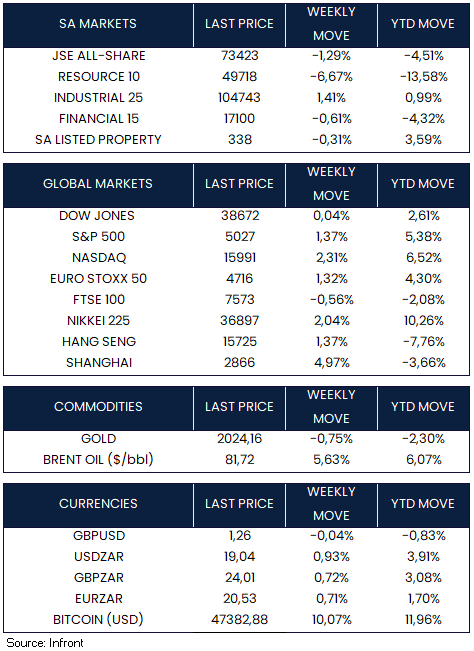

During this week, global equity markets demonstrated strong performances overall. In the United States, the Dow Jones showed marginal strength, increasing by +0.04%, while the S&P 500 and Nasdaq indices displayed significant strength, advancing by +1.37% and +2.31% respectively. European and Asian markets also witnessed upward trends, with positive movements observed across the Euro Stoxx 50, Nikkei 225, Hang Seng, and Shanghai Composite indices. However, the FTSE 100 stood out with a decline of -0.56%.

Market Moves of the Week

The State of the Nation Address (SONA) in South Africa, held ahead of a crucial general election, diverged from past patterns of major infrastructure announcements, instead reflecting on the ruling ANC’s three-decade tenure. Despite facing significant challenges such as ailing infrastructure, skyrocketing youth unemployment, and deteriorating municipal services, President Ramaphosa’s speech highlighted the ANC’s achievements over the past 30 year, with many opposition parties believing that President Cyril Ramaphosa used the event to campaign for the ANC.

Notably, Ramaphosa hinted at a staggered rollout of the National Health Insurance (NHI) bill and unveiled the Climate Change Response Fund, acknowledging South Africa’s vulnerability to climate-related disasters. However, details on crucial matters like election dates, the extension of social relief grants, and infrastructure projects were notably absent, suggesting that more information may be provided in subsequent budget speeches.

Unlike the prevailing global market trends, the JSE All-Share Index experienced weakness this week, declining by -1.29%, primarily influenced by the downturn in resource shares (-6.67%) and financial shares (-0.61%), although industrial shares showed resilience with a gain of +1.4%, benefitting from rand weakness. At the week’s end on Friday, the rand closed trading at R19.04 against the U.S. Dollar.

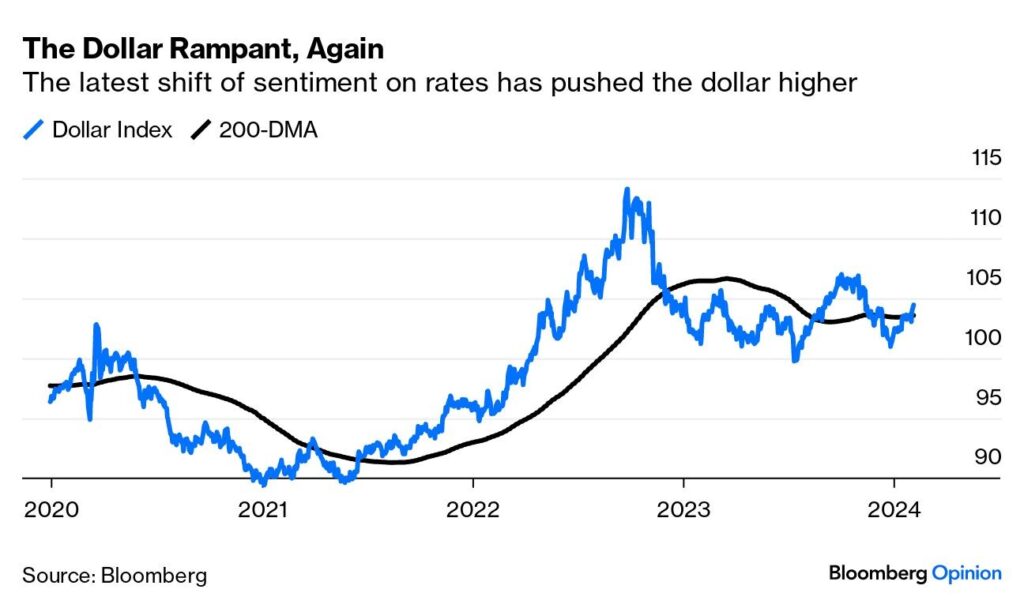

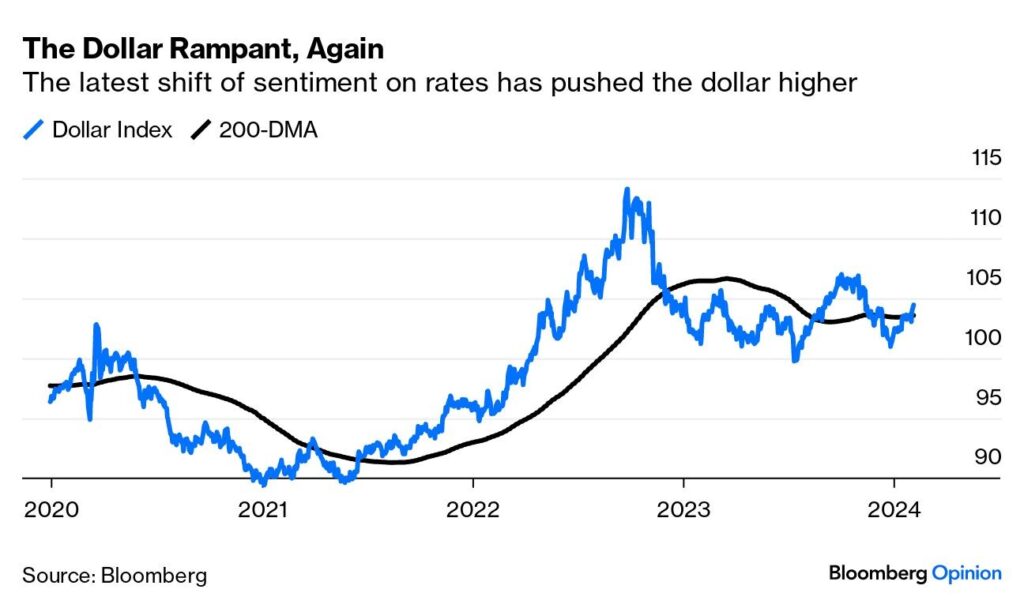

Chart of the Week

The debate regarding whether the Federal Reserve will cut interest rates in March seems to be all but over, with the focus now more on the magnitude of the cuts compared to the rest of the world over the next two years. The Dollar Index had a positive week as traders significantly scaled back their expectations of rate cuts, causing the Dollar Index to surpass its 200-day moving average. For now, it remains dangerous to stand in the way of the U.S. juggernaut.

Source: Bloomberg