In June, spending at US retailers continued its positive growth trend for the third consecutive month, showcasing resilience among American consumers. According to the Commerce Department’s report on Tuesday, retail spending increased by +0.2%, adjusted for seasonality but not inflation. However, this growth rate was slower than the revised +0.5% increase observed in the previous month falling short of economists’ expectations. Overall, the Commerce Department’s mixed report highlighted consumer resilience while also indicating a deceleration in spending momentum. Nevertheless, these findings did not alter the expectations that the Federal Reserve would resume raising interest rates this month, following the unchanged rates in June.

U.S. factories also experienced an unexpected decline in production in June. However, there was a notable rebound in the second quarter as motor vehicle output accelerated, following two consecutive quarterly declines. The Federal Reserve reported a -0.3% drop in manufacturing output for the last month, and data for May was also revised down.

In the UK, June’s inflation rate decreased to 7.9%, falling below economists’ expectations. Prior to this, analysts had projected an annual rise in the headline consumer price index of 8.2%, following May’s unexpected higher reading of 8.7%. Despite this reduction, the annual rise in the headline consumer price index remained significantly higher than the Bank of England’s 2% target, indicating ongoing inflationary pressures. Core inflation, which excludes volatile energy, food, alcohol, and tobacco prices, remained steady at an annualized 6.9% but did show a decline from the 31-year peak of 7.1% recorded in May. The persistently high inflation in the UK has raised concerns from both the government and the Bank of England about its potential impact on the economy. Factors such as a cost-of-living crisis and a tight labour market contributing to wage price increases have been cited as contributors to the ongoing inflationary pressures.

The eurozone economy managed to avoid a recession in the first quarter of this year, as per revised figures released by the EU’s statistics agency, Eurostat, on Thursday. The updated data revealed that the Gross Domestic Product (GDP) remained unchanged instead of contracting, as previously estimated. Specifically, the GDP for the first three months of the year was reported as flat, reflecting an improvement from the earlier estimate of a 0.1% contraction.

According to the National Bureau of Statistics (NBS), China’s economy expanded by 6.3% in the second quarter compared to the previous year. However, this growth fell short of market expectations due to tepid export demand and declining property prices, which affected consumer confidence. The 6.3% GDP print for the second quarter reflects a 0.8% pace of growth from the first quarter, slower than the 2.2% quarter-on-quarter pace recorded in the initial three months of the year. Fu Linghui, the spokesperson for the National Bureau of Statistics, highlighted that China faces a complex geopolitical and economic international environment. Nevertheless, he expressed confidence that China can still achieve its full-year growth target, set at around 5% for 2023. Regarding specific economic indicators, retail sales for June rose by 3.1%, slightly below the expected 3.2%, with catering, sports, entertainment products, alcohol, and tobacco recording the highest growth within the retail sector. On a more positive note, industrial production for June rose by a robust 4.4% year-on-year, surpassing the forecasted 2.7% growth rate.

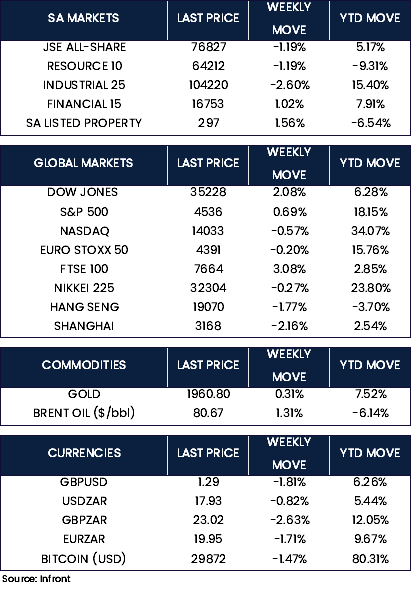

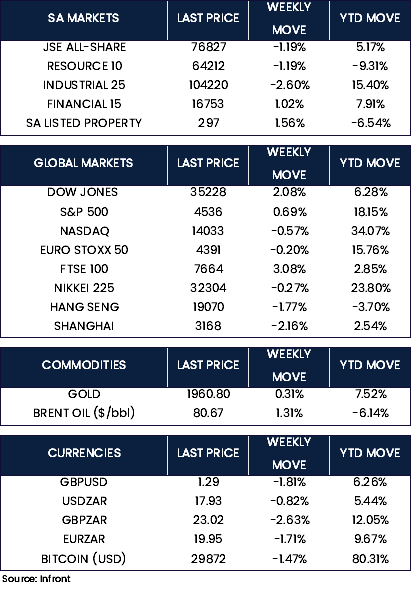

The majority of U.S. equity indexes posted gains for the week driven by optimism surrounding the tight labour market and expectations of moderated inflation, which could potentially safeguard the economy from a hard landing. Notably, the Dow Jones index increased by +2.08% during the week, while the S&P 500 index also rose by +0.69%. However, the tech-heavy Nasdaq Composite was moderately weaker , declining by -0.57%.

In the UK, the FTSE 100 Index gained +3.08%, partly influenced by the depreciation of the British pound relative to the U.S. dollar. Conversely, the Euro Stoxx 50 Index ended the week -0.20% lower.

In Asia, Chinese equities faced a decline as recent economic data pointed to signs of faltering growth, with the Shanghai Stock Exchange Composite Index down -2.16%, while the benchmark Hang Seng Index in Hong Kong fell by -1.74%. In Japan, the benchmark Nikkei 225 Index also ended lower, falling by -0.27%.

Market Moves of the Week:

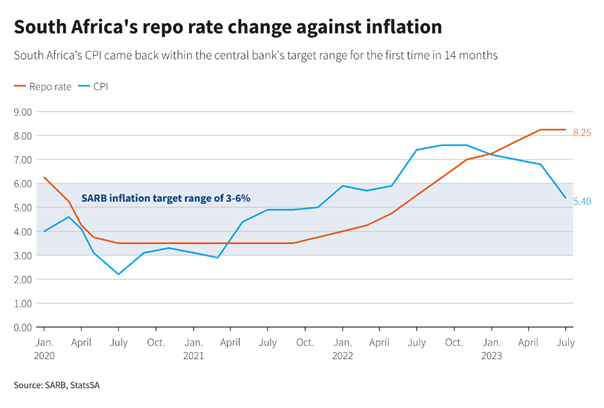

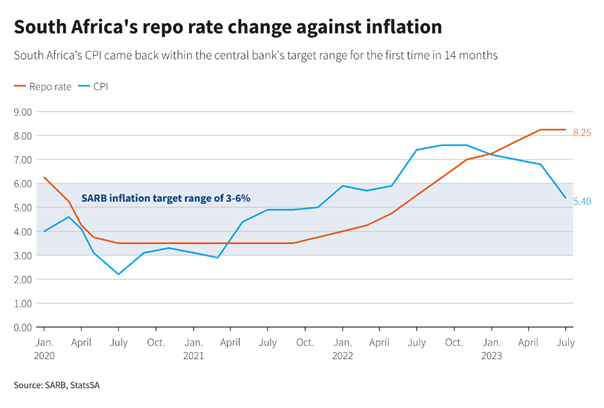

Statistics South Africa (Stats SA) published its latest inflation figures for South Africa this week, showing a notable improvement as headline inflation cooled from 6.3% in May to 5.4% in June. This positive development brings June’s inflation rate back below the upper limit (6%) of the South African Reserve Bank’s (SARB) monetary policy target range. Moreover, June’s inflation rate of 5.4% is the lowest recorded since October 2021. Notably, the 0.9 percentage point drop in headline inflation between May and June is the most substantial decline since May 2020. The Consumer Price Index (CPI) analysis showed that six of the twelve main categories experienced a decline in annual inflation, five saw an increase, and one remained unchanged. In terms of specific sectors, annual goods inflation dropped from 8.0% in May to 6.3% in June, while services inflation decreased slightly from 4.6% in May to 4.5% in June. Core inflation, which excludes food and fuel, also showed a slight decrease, reaching 5.0% in June.

In addition to the inflation figures, Stats SA also reported a year-on-year decline of 1.4% in South African retail sales for May, following a revised 1.8% decrease in April. This marks the sixth consecutive month of year-on-year declines in retail activity. The prolonged power crisis has been a significant factor impacting several retailers, leading to a negative impact on their operations. According to Raquel Floris, Stats SA’s deputy director for distributive trade statistics, among the retailer groups, five out of seven registered decreases in May, with general dealers and hardware stores being the largest negative contributors.

South Africa’s central bank made the decision to pause interest rate hikes on Thursday, marking the first such pause since November 2021. However, Governor Lesetja Kganyago was prompt to clarify that this pause does not signal the end of the hiking cycle. During the recent meeting, the South African Reserve Bank’s (SARB)monetary policy committee (MPC) maintained the key repo rate at 8.25% and the prime lending rate at 11.75%, attributing this decision to improved economic conditions and lower inflation forecasts compared to previous projections. Since initiating the hiking cycle in November 2021, the SARB has raised rates by a cumulative 475 basis points. Looking ahead, future rate decisions will continue to be contingent on economic data and risks associated with the inflation outlook. The latest projections from the SARB indicate an expected inflation average of 6.0% in 2023, slightly revised from the previous forecast of 6.2% in May. However, the central bank foresees inflation returning sustainably to the midpoint of the target range only by the third quarter of 2025. Additionally, the GDP growth forecast for 2023 was revised upward to 0.4% from 0.3%. Despite acknowledging improved economic conditions, the SARB cautions about the longer-term outlook, highlighting potential risks to inflation and overall economic stability due to ongoing power cuts, logistical bottlenecks, and sustained food price pressures.

The JSE All-Share Index ended the week lower by-1.19%, mainly impacted by weaker performances in the resource (-1.19%) and industrial (-2.6%) sectors. Tthe financial sector saw a positive gain of +1.02%, and the property sector also ended the week on a positive note, with an increase of +1.56%. By the close of trading on Friday, the rand strengthened against the U.S. Dollar, trading at R17.93 and appreciating by +0.82% for the week.

Chart of the Week:

South Africa’s consumer inflation fell within the SARB’s target range of between 3% and 6% for the first time in 14 months. Following the improved inflation print, the South African Reserve Bank decided to halt interest rate hikes on Thursday, citing improved economic conditions and lower inflation forecasts. Governor Lesetja Kganyago cautioned that this may not signal the end of the hiking cycle and that future decisions would depend on economic data and inflation risks.