In the U.S., S&P Global has released early estimations of its Purchasing Managers’ Indexes (PMI) for both the services and manufacturing sectors. The gauge of manufacturing activity surpassed expectations, rising to 51.5, marking its highest level in 17 months, partly bolstered by an uptick in export orders. Conversely, business activity in the services sector eased slightly, with the PMI pulling back to 51.3 from January’s 52.5. Nonetheless, the latest services PMI reading stayed above 50, the threshold between expansion and contraction, signalling continued growth in activity.

According to the recently released minutes from the Federal Reserve’s last meeting, officials expressed a cautious approach towards cutting interest rates and emphasized both optimism and concerns regarding inflation. The majority of policymakers highlighted the uncertainty surrounding the duration of maintaining current borrowing costs, underscoring the need for a careful assessment of the monetary policy stance necessary to achieve the Fed’s 2% inflation target. While there was a sense of optimism regarding the effectiveness of the Fed’s measures in reducing inflation rates, there was a consensus among officials to await further evidence before considering policy adjustments, although indications suggested that future rate hikes are unlikely. Despite reports indicating a gradual return of inflation towards the Fed’s 2% target before the meeting, the committee viewed some progress as temporary and urged a careful assessment of incoming data to determine long-term inflation trends.

In February, the UK experienced faster economic growth, as indicated by early PMI survey data, marking the most rapid business activity expansion in nine months. The headline indicator of economic growth, the seasonally adjusted S&P Global UK Composite Output Index derived from the flash PMI surveys, increased from 52.9 in January to 53.3 in February. This upward trend reflects sustained output growth for the fourth consecutive month, following a three-month decline. Presently, the PMI level broadly suggests GDP expansion.

Bank of England (BoE) Governor Andrew Bailey informed a parliamentary committee that he felt “comfortable” with investors speculating on rate cuts this year, while also noting that the economy was “showing distinct signs of an upturn” following last year’s recession. He emphasized that the BoE does not endorse the market curve and refrained from predicting when or by how much rates would be cut. However, he acknowledged that it was not unreasonable for the market to entertain such expectations.

The initial PMI figures for February indicated a possible stabilization of the Eurozone economy, driven by a revival in the services sector. The preliminary estimate of the Hamburg Commercial Bank Eurozone composite PMI for output increased to 48.9 from January’s 47.9, marking an eight-month high, albeit remaining in contractionary territory. (PMI readings below 50 signify a contraction in business activity). In Germany, the composite PMI for economic output continued its eighth consecutive monthly decline. Similarly, output weakened in France. Nevertheless, output in the remaining Eurozone countries expanded for a second consecutive month.

On Tuesday, the People’s Bank of China announced a notable adjustment to the benchmark five-year loan prime rate, reducing it from 4.2 percent to 3.95 percent. This 0.25 percentage point cut represents the most substantial change to the benchmark rate since its inception in 2019. The decrease in the five-year rate is expected to lower mortgage rates for homebuyers, aiming to stimulate demand in the struggling property sector. Policymakers left the one-year lending rate unchanged.

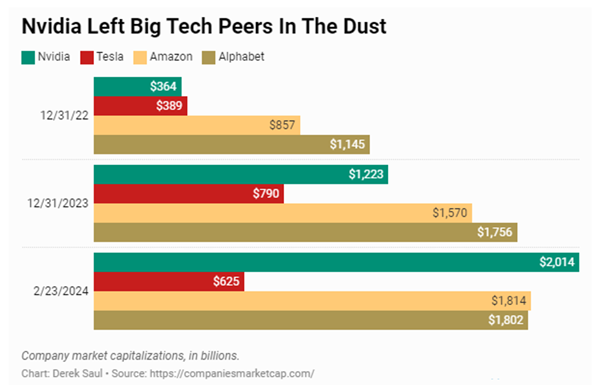

In company news, shares of Nvidia, a graphic-processing-unit-maker, surged after the company exceeded exceptionally bullish earnings estimates on Wednesday afternoon, leading to a substantial increase in Nvidia’s market capitalization by a record USD 277 billion. This news sparked a widespread rally in the broader markets.

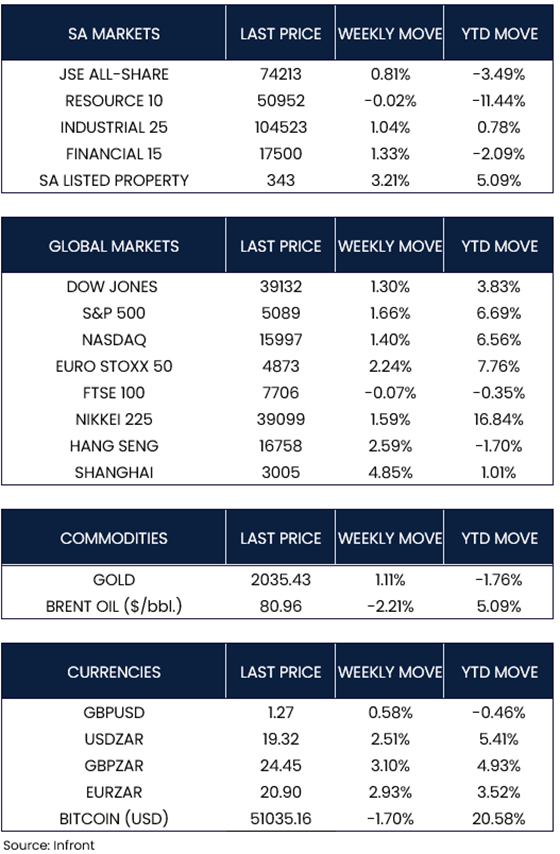

Global equities surged to record levels driven by renewed optimism surrounding rapid advancements in artificial intelligence. In the U.S., major indices such as the Dow Jones (+1.30%), Nasdaq (+1.40%), and S&P 500 (+1.66%) all closed the week higher. Similarly, the pan-European STOXX Europe 50 Index climbed to a record level, posting a gain of 2.24% for the week. However, the UK’s FTSE 100 Index experienced marginal movement (-0.07%), primarily influenced by weakness observed in mining and energy sectors.

In a shortened week, Japanese equities surged to new all-time highs, with the Nikkei 225 Index breaking its previous record set over three decades ago. It recorded a weekly uptick of 1.59%.

Chinese equities also witnessed strong gains on hopes of economic recovery. The Shanghai Composite Index surged by 4.85%, while the Hang Seng Index, a key benchmark in Hong Kong, advanced by 2.59%.

Market Moves of the Week

In the fourth quarter of 2023, South Africa’s unemployment rate experienced an uptick, surpassing pre-pandemic levels. According to the Quarterly Labour Force Survey data published by Statistics South Africa (Stats SA) on Tuesday, the unemployment rate rose from 31.9% in the third quarter to 32.1% in the fourth quarter. According to Stats SA’s findings, the community and social services sector experienced the most significant reduction in employment, shedding 171,000 jobs during this period. Declines in employment were also observed across various sectors, including construction, agriculture, trade, and manufacturing.

In January, South Africa experienced an uptick in its inflation rate, marking the first such increase in three months. The Consumer Price Index (CPI), a key metric for measuring inflation, rose from 5.1% in December to 5.3% in January, as reported by Statistics South Africa (Stats SA). Additionally, core inflation, excluding volatile food and fuel prices, accelerated to 4.7% in January from 4.5% in December. The categories with the largest annual price increases were restaurants & hotels at 8.0%, food & non-alcoholic beverages (NAB) at 7.2%, and health at 6.5%. This development reduces the likelihood of the South African Reserve Bank implementing interest rate cuts soon.

Against the backdrop of South Africa’s sluggish growth rate, Finance Minister Enoch Godongwana delivered the budget speech on Wednesday. A key focus was the utilization of GFECRA drawdowns to significantly reduce borrowing needs in the coming fiscal years, aiming to tackle the challenge of escalating government debt. The minister unveiled several tax policy reforms, such as implementing a two-pot retirement system, making adjustments to international corporate taxes, and providing incentives for local electric vehicle manufacturing and renewable energy initiatives. Notably, there will be no financial assistance for Transnet and the Post Office, signalling a move towards greater private sector involvement in infrastructure funding. However, the speech placed minimal emphasis on government restructuring.

For a comprehensive summary of other key points discussed in the 2024 Budget, please click here.

Much like global markets, local equities in South Africa also saw positive movement. The JSE All-Share Index experienced weekly gains of +0.81%, driven by strong performances in the property (+3.21%), financial (+1.33%), and industrial (+1.04%) sectors. In contrast, the resources sector experienced a slight decline of -0.02% for the week. By Friday’s close, the rand was trading at R19.32 against the U.S. Dollar, marking a weekly depreciation of -2.51%.

Chart of the Week

Nvidia reached a significant milestone by becoming the third American company in history to attain a $2 trillion valuation. This accomplishment follows a surge in post-earnings enthusiasm, driven by investor confidence in the company’s growth trajectory as a leading designer of artificial intelligence chips. Source: Forbes