U.S. stock markets experienced mixed performance as long-term interest rates fell amid concerns about a cooling labour market. While the S&P 500 Index reached record highs earlier in the week, they pulled back late Friday. Small-cap and value shares outperformed, while mega-cap tech shares lagged due to reports of slowing iPhone sales in China. Novo Nordisk, a Danish pharmaceuticals company, surpassed Tesla as the 12th biggest public company by market capitalization.

The week started with a decline, attributed in part to disappointing policy news from China, but regained momentum midweek as domestic demand and inflation pressures eased. However, concerns about rising prices persisted, with consumers showing more sensitivity to inflation. Additionally, job openings fell to a three-month low, and the quits rate dropped to its lowest level since August 2020.

Friday’s jobs report initially reassured investors about the labour market, with employers adding more jobs than expected in February. However, January’s job gain was revised lower, and the unemployment rate unexpectedly rose to its highest level in over two years.

Fed Chair Jerome Powell’s testimony suggested a less hawkish stance on rate cuts, stating that policymakers were “not far” from having confidence in sustained inflation downtrend to begin cutting rates. Consequently, futures markets priced in a higher chance of a rate cut by June. As a result, the yield on the benchmark 10-year U.S. Treasury note fell to its lowest level since February.

In political news, Nikki Haley withdrew her challenge to Republican frontrunner Donald Trump, solidifying his position as the party’s candidate for the upcoming election against Democratic President Joe Biden. Additionally, the U.S. Supreme Court ruled in favour of Trump, allowing him to appear on presidential ballots despite efforts to bar him due to his actions following the 2020 election.

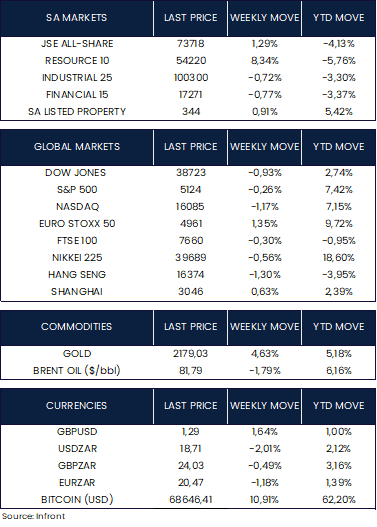

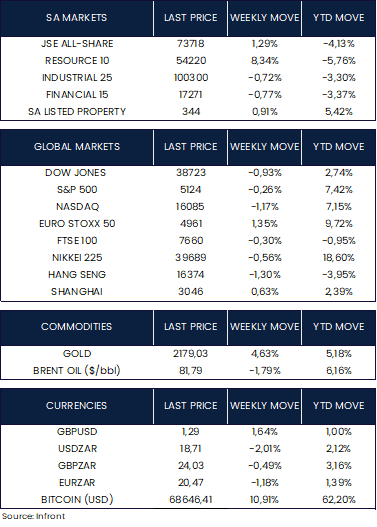

All major U.S. equity markets ended the week lower. The Dow Jones Industrial Average down 0.93%, followed by the tech heavy NASDAQ composite down 1.17%. The S&P 500 faired best, still in negative territory, but only marginally lower, down 0.26%.

In the U.K. Chancellor of the Exchequer Jeremy Hunt presented the final Spring Budget before a general election, announcing a GBP 10 billion payroll tax cut through a reduction in national insurance rates. The budget also proposed more generous changes to child benefit rules. To partly fund these measures, Hunt outlined less favourable tax treatment for foreign residents with permanent homes outside the UK and extended the windfall tax on oil and gas companies for another year. The FTSE 100 closed the week in the red, down 0.30%.

European Central Bank President Christine Lagarde indicated policymakers may be in a position to lower interest rates in June as fresh projections showed inflation hitting the 2% target in 2025. Speaking after policymakers left the deposit rate at 4% for a fourth straight meeting, Lagarde said there’s a definite slowdown in consumer prices but that she and her colleagues aren’t “sufficiently confident” at present to commence monetary easing. “We clearly need more evidence, more detail,” she told reporters Thursday in Frankfurt, highlighting upcoming figures on wages. “We know that this data will come in the next few months. We will know a little more in April, but we will know a lot more in June.” The Euro Stoxx 50 responded positively to these developments, closing the week up 1.35%.

Strong wage data in Japan has raised the likelihood that the Bank of Japan (BOJ) will abandon its negative interest rate policy in upcoming rate-setting meetings, potentially as early as March 19. Government officials are reportedly becoming more open to ending the negative rate regime, seeing it as a signal of the domestic economy’s return to normalcy after years of deflation. The Nikkei 225 closed the week in the red, ending down -0.56%.

China has announced a growth target of around 5% for the year, signalling potential for increased stimulus measures. The government also aims for an unemployment rate of about 5.5% and plans to add 12 million urban jobs. To bolster the economy, China plans to issue 1 trillion yuan ($139 billion) of ultra-long special central government bonds this year. In January-February, both export and import values exceeded expectations, with export growth improving across major trading partners except for the European Union and Japan. Import growth remained robust, particularly for tech-related products like chips and diodes. As a result, the trade surplus for January-February reached US$125.2 billion, surpassing consensus estimates. The Shanghai Composite closed the week higher up 0.63%, while Hong Kong’s Hang Seng Composite ended lower, down 1.30%.

Market Moves of the Week

In South Africa, economic output grew marginally by 0.1% quarter-on-quarter in Q4 2023, which was below consensus (0.2%) and South African Reserve Bank (SARB) estimates, but in line with forecasts. Weak final domestic demand and negative contributions from net exports, due to a rebound in imports, were offset by positive contributions from inventories. Goldman Sachs maintains its forecast for growth to improve from 0.6% in 2023 to 1.5% in 2024, with potential risks of a slightly wider current account deficit than the forecasted 0.8% of GDP for Q4.

On the local equity front, the Resource sector caught a bid pushing the JSE ALSI higher for the week, up 1.29%. Resources ended the week up 8.34%. Both Industrials and Financials were lower, down 0.72% and 0.77% respectively. The ZAR appreciated 2.01% against the Dollar, closing the week at R18.71/$.

Chart of the Week

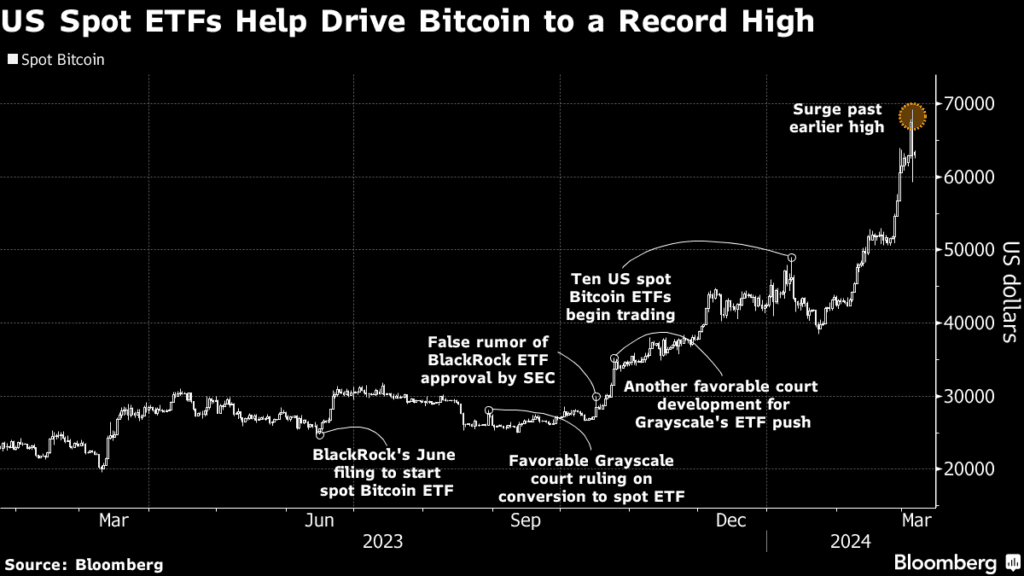

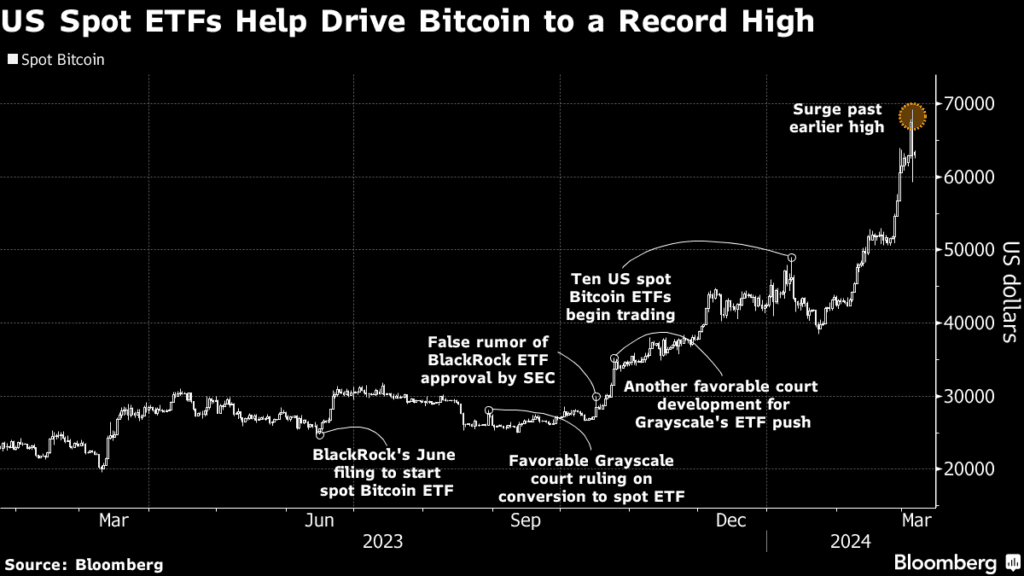

Bitcoin reached all-time highs this week, with BlackRock’s Spot Bitcoin ETF (IBIT) becoming the fastest ETF to reach $10 billion in assets under management, achieving this milestone in just 37 trading days. Trading volumes in IBIT exceeded $1 billion for four consecutive days. Source: Bloomberg.