As the United States celebrated Thanksgiving on Thursday, global markets experienced a more subdued week. Most stock markets have shown a decent recovery from this time last year. Artificial intelligence chipmaker NVIDIA, the sixth-largest global company by market capitalisation, reported its third-quarter earnings, exceeding expectations but provided cautious guidance amid export restrictions to China.

U.S. Black Friday spending showed consumer caution, hinting at a potentially subdued holiday season and lacklustre retailer earnings in early 2024. Unlike pandemic-driven splurges in previous years, spending didn’t maintain the same pace. Salesforce predicted a modest 1% growth in online U.S. sales for November and December, marking the slowest in at least five years.

At the same time, Federal Reserve minutes revealed a united front among policymakers to proceed cautiously on future interest-rate moves, emphasising progress toward their inflation goal and acknowledging the impact on households and businesses.

U.S. economic signals were mixed, with the Chicago Fed National Activity Index falling to -0.49 in October, and existing home sales dropping 4.1% month-on-month. Additionally, durable goods orders declined by 5.4% in October, marking the second-biggest decline since April 2020. On a positive note, MBA mortgage applications rose by 3.0% and initial jobless claims fell to 209.00K in the week ending November 17, exceeding market expectations.

At the same time, concerns about U.S. net national savings have risen, as the budget deficit and personal savings turned negative for the second time since 1947. Only 65.8% of surveyed individuals are confident in meeting an unexpected $2,000 expense within a month, according to the NY Fed.

ECB President Christine Lagarde stressed caution, stating it’s too early to declare victory over inflation. Despite some easing in energy and supply-chain shocks, labour markets are adjusting, and wages are rising. ECB officials, including Governing Council member Francois Villeroy de Galhau, ruled out near-term rate hikes but emphasised the ECB’s commitment to the 2% inflation target by 2025.

UK Chancellor Jeremy Hunt aims to stimulate business investment by £20 billion annually through measures, including 100% tax relief on investment spending by British businesses.

In Japan, the year-on-year national Consumer Price Index (CPI) saw a 3.3% increase in October, surpassing the 3.0% rise reported in the previous month.

Over $25 billion in foreign funds have exited the Chinese stock market, despite efforts to restore confidence. Regulators are working on a list of 50 developers eligible for financing to stabilise the property market, with Goldman strategists estimating a 42% default rate this year.

In the Netherlands, far-right politician Geert Wilders secured a resounding victory in recent elections, positioning his anti-EU Freedom Party to lead the country’s next government. Wilders advocates for a binding referendum on EU departure, withdrawal from international climate commitments, and a significant reduction in immigration.

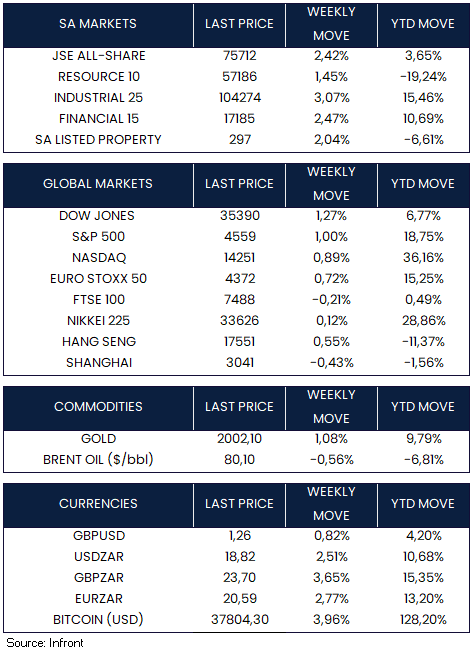

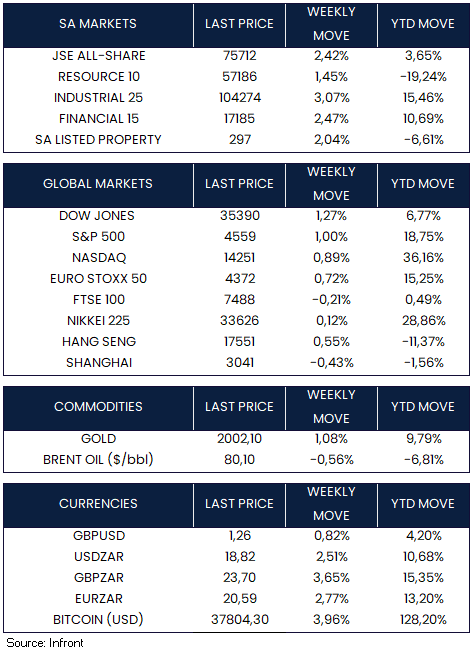

The week concluded with mostly positive outcomes in global equity markets. In the U.S., the Dow Jones (+1.27%), S&P 500 (+1.00%), and Nasdaq (+0.89%) all showed gains. Similarly, European and Asian markets generally performed well, with positive movements in the Euro Stoxx 50 (+0.72%), Nikkei 225 (+0.12%), and Hang Seng (+0.55%) Indexes. Notably, the FTSE 100 (-0.21%) and Shanghai Composite Index (-0.43%) were the exceptions, showing slight declines.

Market Moves of the Week:

South Africa’s Consumer Price Index (CPI) increased to 5.9% YoY in October, exceeding market expectations. The monthly CPI increase of 0.9%, driven by higher food and fuel prices, further contributed to the unexpected inflation. Nevertheless, the South African Reserve Bank (SARB) maintained its key interest rate at 8.25%, in line with expectations. Consensus expects headline inflation to retreat to its targeted 4.5% midpoint in the first half of 2024.

Economically, a Transnet backlog in Durban’s key port has caused a substantial financial loss, with around 71,000 containers stranded. Transnet predicts a clearance process until March 2024, highlighting the severity of the situation.

The JSE All-Share Index (+2.42%) was positive this week, driven higher by all three of the major sectors including the resource (+1.45%), industrial (+3.07%) and financial (+2.47%) sectors. By Friday close, the rand was trading at R18.82 to the U.S. Dollar.

Chart of the Week:

As winter approaches, the outlook for European natural gas prices seems optimistic, with recent pricing trends indicating a favourable scenario for the continent. Despite concerns, the mild winter in 2022 led to a collapse in natural gas prices. Thankfully, Europe appears well-prepared with alternatives, providing a more favourable situation this winter than previously anticipated.

Source: Bloomberg