Global equity markets experienced a rally over the week as investors processed slower inflation prints in various developed economies. The S&P 500 Index extended its strong gains from the previous two weeks, surpassing the 4,500 level for the first time since September.

In the United States, October’s core Consumer Price Index (CPI) rose by 0.23%, slightly below consensus and the prior three-month average. The year-on-year rate declined to 4.0%, with declines in auto categories contributing to the core decrease. Used car prices are expected to continue declining in the coming months. Notably, the sharp increase in owners’ equivalent rent inflation in September reversed in October. October retail sales declined by 0.1%, while core retail sales rose by 0.2%, and real core retail sales are estimated to have increased by 0.1%. The Producer Price Index (PPI) decreased by 0.5% in October, contrary to expectations.

The recent indications of cooling inflation contributed to a decline in long-term Treasury yields. The benchmark 10-year note reached an intraday low of around 4.40% on Friday, marking its lowest level since mid-September.

In legislative news, the House passed a bill known as a “continuing resolution” (CR) to extend government funding at current levels until the next quarter, likely to pass the Senate and be signed by the President.

In recent geopolitical developments, US President Joe Biden engaged in talks with his Chinese counterpart, Xi Jinping, resulting in progress towards repairing strained ties between the two nations. Agreements were reached to restore high-level military communications, address the issue of fentanyl, and initiate a dialogue on artificial intelligence. China characterized the discussions as a “candid and in-depth exchange of views,” emphasizing the significance of the US-China relationship as “the most important bilateral relationship in the world.” While Biden acknowledged the critical global challenges requiring joint leadership, he maintained his belief that Xi Jinping is a dictator, expressing a complex perspective on the Chinese leader.

In the UK, annual consumer price inflation slowed to 4.6% in October from 6.7% in September, leading to increased expectations of interest rate cuts. Core inflation and services inflation also decelerated. Bank of England Chief Economist Huw Pill noted that even with the expected drop, inflation would still be “much too high” relative to the 2% target. The tight labour market persisted, with wages rising by 7.7% in the three months through September, and unemployment remained unchanged at 4.2% in the three months through October.

ECB President Christine Lagarde stated that policymakers expect inflation to increase at the start of next year due to base effects, suggesting that even if inflation accelerates, another interest rate increase may not be necessary. Lagarde emphasized the belief that the current level, if maintained long enough, will guide the economy toward the 2% medium-term target. Vice President Luis de Guindos echoed this sentiment, rejecting market expectations for rate cuts and emphasizing a commitment to maintaining sufficiently restrictive monetary policy to bring inflation back to the target. Eurozone’s latest data confirmed a fall in the annual inflation rate to 2.9% in October, the lowest level since July 2021.

In October, China experienced better-than-expected consumer spending and injected the most cash into the financial system since late 2016. However, there is a challenging economic landscape with a mixed set of data. Retail sales growth and the services industry output index showed improvement, surpassing expectations. Industrial production also edged up, but fixed asset investment growth fell short of estimates. Notably, China’s home prices recorded the most significant decline in eight years in October, indicating a deepening property slump despite government efforts to stimulate demand.

The Hang Seng Composite Index ended the week in the green, up 1.62%, while the Shanghai Composite Index produced modest relative gains, up 0.51%.

In Japan, the domestic Corporate Goods Price Index (CGPI) declined for the second consecutive month in October, with a noticeable drop in materials sectors. Year-on-year, the index slowed sharply to +0.8%. The initial estimate for Q3 2023 real GDP growth was -2.1%, well below market expectations of -0.4%, driven by weak private sector demand and negative contributions from consumption. In October, year-on-year export value growth remained positive for the second straight month, while import value continued to decline, resulting in a narrowed trade deficit of -¥662.5 billion, smaller than expected. Japan’s Nikkei 225 Index produced strong performance this week, up 3.12%.

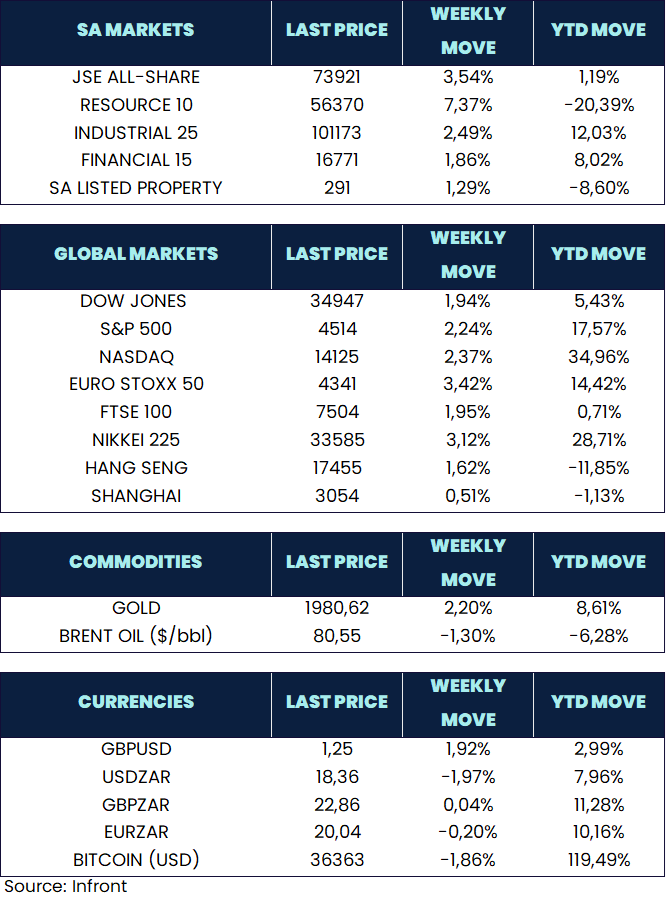

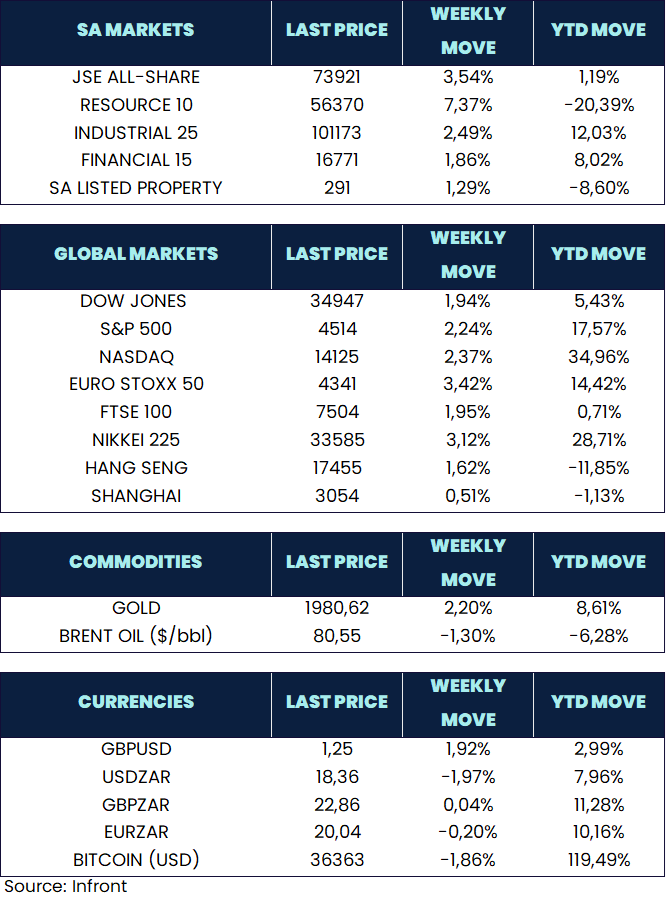

Risk on sentiment filtered through developed market equity markets this week, with positive performance across the regions. US stocks end higher, with the S&P 500 up 2.24%, the Dow Jones Industrial Average up 1.94%, and the tech heavy Nasdaq Composite closing, up 2.37%. Euro Stoxx 50 was the standout performer, ending the week with a stellar return of 3.42%, the FTSE 100 also closed the week up, 1.94%. Oil continued to decline, closing the week lower -1.30%, with Brent Crude Oil trading at 80,55 ($/bbl) at Friday’s close.

Market Moves of the Week:

In South Africa, employment has surpassed pre-pandemic levels, reaching 16.7 million in the three months through September. This growth was driven by the finance and community and social service sectors, according to data from Statistics South Africa. Additionally, the official jobless rate declined more than anticipated, dropping to 31.9% in the quarter from 32.6% in the previous three months.

The local equity market took direction from global peers, with the JSE ALSI ending the week up 3.54%. All sectors were stronger, with Resources leading the market higher, up 7.37%. The rise in Iron ore prices benefited the resource counters, with the steelmaking ingredient trading at a near eight-month high. Industrials gained 2.49% for the week, while Financial were also up 1.86%. The Rand caught a bid this week, appreciating 1.97% against the greenback, to close the week at R18.36/$.

Chart of the Week:

The US’s the interest bill rose significantly last month to start the fiscal year, and there are indications that it may continue to climb. The Treasuries market has been steadily growing and has now surpassed $26 trillion, representing an increase of over $10 trillion in the last five years. The continuous growth of the market and the higher interest bills contribute to the challenges, potentially leading to further spikes in Treasury yields and increased volatility.

Source: US Department of Treasury, Bloomberg.