The Commerce Department’s advanced GDP print released on Thursday showed the U.S. economy grew 1.6% in the January-through-March period (Q1) of 2024, much weaker than was expected and the slowest pace of growth in nearly two years. Economists surveyed by Dow Jones had been looking for an increase of 2.4% following a 3.4% gain in the fourth quarter of 2023 and 4.9% in the previous period. Consumer spending increased 2.5% in the period, down from a 3.3% gain in the fourth quarter and below the 3% Wall Street estimate.

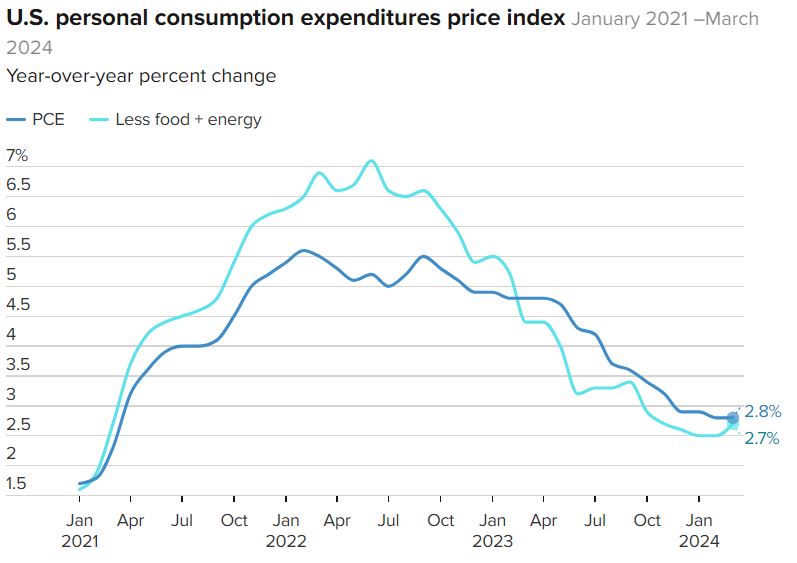

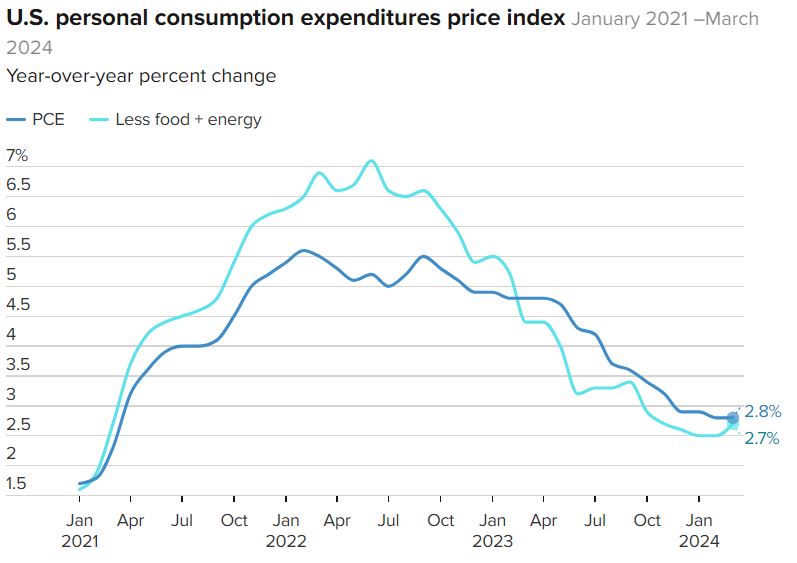

More unease followed on Thursday as the closely watched core Personal Consumption Expenditures Price Index (PCE) rose at an annualised rate of 3.7% in the first quarter, more than expected and well above both the fourth quarter’s 1.7% increase and the Federal Reserve’s 2% long-term inflation target. However, there was some relief on the inflation front on Friday after the Commerce Department’s release of the monthly core PCE data. Core PCE inflation continued to decline on an annual basis in March, falling to 2.82% from 2.84% in February, continuing a downward trajectory that began in October 2022.

U.S. yields took another leg higher this week following the upside surprises in Q1 PCE data, offering further evidence that the Fed will likely delay any interest-rate cuts, allowing tight policy more time to wrestle stubborn inflation.

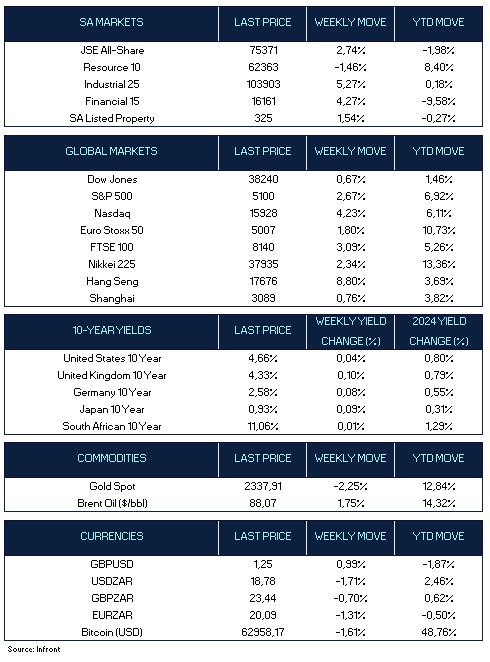

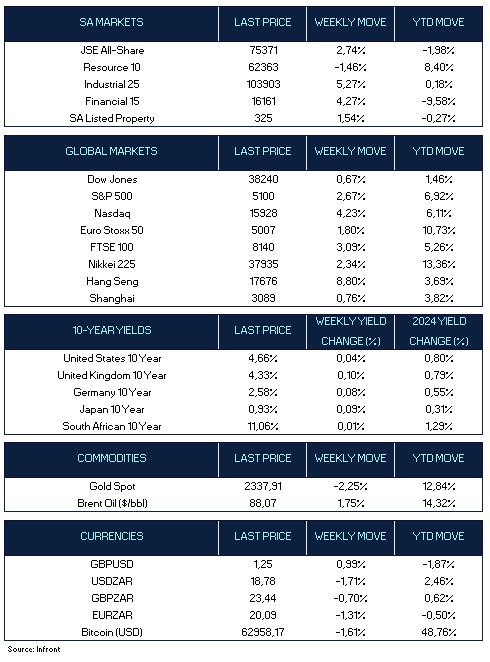

U.S. stocks ended the week higher on Friday, with both the S&P 500 and Nasdaq Composite Index notching their best weekly gains since November as Big Tech names rallied on strong earnings. Stocks got a boost from robust results from artificial intelligence competitors Alphabet and Microsoft after the bell Thursday. Alphabet jumped more than 10% on better-than-expected first-quarter earnings and recorded its best day since July 2015. The company also authorized its first-ever dividend and a $70 billion buyback. Microsoft added nearly 2% as the software maker posted strong results and showed an acceleration in cloud growth.

The busy earnings season continues next week, headlined by results from technology giants Apple and Amazon. The Federal Reserve’s next rate decision is due out Wednesday.

In Europe, the pan-European STOXX Europe 50 Index snapped a three-week losing streak and ended 1.8% higher. An easing of Middle East tensions and some encouraging corporate earnings results helped to boost sentiment, while in the UK, the benchmark FTSE 100 Index climbed to fresh all-time highs, gaining 3.09%.

Business activity in the eurozone grew at the fastest pace in nearly a year in April, driven by a recovery in the services industry, according to purchasing managers’ surveys compiled by S&P Global. This was also the case in the UK with business activity also rebounding strongly, with the composite PMI rising to 54.0 from 52.8 in March.

The Bank of Japan kept rates unchanged at its Friday meeting despite rapid yen depreciation this week. BOJ Governor Kazuo Ueda downplayed the weak currency’s impact on inflation, setting off another wave of yen selling. The Nikkei 225 index was stronger on the week, gaining 2.3%, while in the fixed income markets, the yield on the 10-year Japanese government bond rose to 0.93% from the prior week’s 0.84%.

Chinese stocks were also stronger on the week, as investors grew more optimistic about the economy with the Shanghai Composite Index gaining 0.76%. In Hong Kong, the benchmark Hang Seng Index soared 8.8% for the week.

Gold rose past $2 350 per ounce on Friday, before giving up some gains at the close to end the week at $2 337 per ounce, as investors continued assessing the Federal Reserve’s monetary policy direction following the mixed results from recent economic data. Brent crude futures strengthened above $89 per barrel on Friday, gaining 1.75% for the week, underpinned by an improving demand outlook and persistent supply risks related to the Middle East conflict.

Market Moves of the Week

South African stocks touched their highest levels since January and the rand surged by the most this year after publication of a poll by Ipsos which was seen as boosting the odds of a market-friendly coalition emerging from national elections on the 29th May.

The poll has the ruling African National Congress dropping to 40.2%. That’s down from 40.5% in a survey published on Feb. 6, and 43% in October. Meanwhile, support for the main opposition Democratic Alliance strengthened to 21.9% from 20.5% in February. The Ipsos poll placed the Economic Freedom Fighters (EFF) at 11.5%, down significantly from 19.6% in February and the Zuma-backed uMkhonto weSizwe Party (MKP) at 8.4% of the vote.

The Ipsos poll was based on the views of 2,545 registered voters. Interviews were conducted by Ipsos interviewers in the homes and home languages of respondents, the company said.

In corporate news, Anglo American Plc, the UK-listed miner received an unsolicited takeover approach from Australia’s BHP Group Ltd earlier this week. BHP has proposed an acquisition that values its smaller rival at $38.9 billion and would create the world’s top copper producer. In a stock exchange news statement on Friday morning, Anglo Chairman Stuart Chambers said the all-share BHP proposal was “opportunistic and fails to value Anglo American’s prospects”. BHP has until 22 May 2024 to either announce a firm intention to make an offer for Anglo American or not.

Eskom, the state power utility, has forecasted that this winter will be lighter in terms of energy interruptions than during the winter of 2023, with the power utility anticipating that it can stave off higher stages of load shedding. A month before the general election, the lights are on, with South Africans enjoying 30 consecutive days without rolling blackouts, the longest streak in more than a year.

The South African Reserve Bank and government launched a deposit insurance fund on Thursday that will protect individual customer cash deposits up to R100,000 from any bank failure. The Corporation for Deposit Insurance scheme will formalise how customer deposits are treated in the unlikely event of a bank failure, Governor Lesetja Kganyago said at a conference in Johannesburg.

On Thursday, Statistics South Africa data showed producer inflation rose slightly to 4.6% year on year in March from 4.5% in February. Stats SA said the main contributors to the acceleration in overall PPI inflation were food products, beverages and tobacco products.

On the stock market, the benchmark all-share index ended the week up 2.74%, in line with major global peers. The rand ended the week at 18.78 against the dollar, strengthening by over 1.7% for the week.

Chart of the Week

The personal consumption expenditures (PCE) price index, the Fed’s key measure in determining inflation pressures, moved up to 2.7% in March when including all items, and held at 2.8% for the vital core measure that takes out more volatile food and energy prices. A day earlier, the department reported that annualised inflation in the first quarter ran at a 3.7% core rate. Recent stubborn inflation data has strengthened market commentator views that the Fed may have to keep rates elevated for longer than it or financial markets would like, threatening the hoped-for soft economic landing.