The Federal Reserve’s (the Fed) scheduled policy meeting on Wednesday, played a significant role in influencing market sentiment. As expected, policymakers kept short-term interest rates unchanged. However, during the post-meeting press conference, Fed Chair Jerome Powell expressed scepticism about the likelihood of a rate cut in March, saying that the committee wants to feel more confident that inflation is on a sustainable path toward its 2% target before cutting interest rates. Consequently, futures markets, by the week’s end, were indicating only a 20.5% probability of a rate cut in the upcoming Fed policy meeting, down from the previous week’s 47.7%.

In the United States, nonfarm payrolls surged by 353,000, nearly doubling initial estimates. Revisions to the previous two months contributed an additional 126,000 jobs to the January count. Furthermore, the month-over-month average hourly earnings exceeded expectations by doubling, registering a 0.6% increase from the previous month. The week also delivered encouraging updates on the beleaguered U.S. manufacturing sector. Revisions to S&P Global and the Institute for Supply Management’s January gauges surpassed expectations on Wednesday. S&P Global reported the sector’s best, albeit moderate, growth pace since September 2022.

European Central Bank President Christine Lagarde stated this week that the governing council anticipates a rate cut as their next move, contingent on further data to address current inflation concerns. Lagarde underscored the importance of wage data in their decision-making. Notably, eurozone unemployment was reported to remain constant at a record-low 6.4% in November. Unexpectedly avoiding a recession in the final quarter of 2023, the eurozone’s Gross Domestic Product (GDP) remained unchanged compared to the previous three months and registered a 0.1% y/y increase. Additionally, annual consumer price inflation improved, with the headline rate decreasing to 2.8% in January, down from 2.9% in December.

This week, the Bank of England, with differing opinions among policymakers, opted to keep rates unchanged. While two members advocated for a hike, one voted for a rate cut. Notably, the bank abandoned its cautionary note on the potential for rate increases, stating that the matter would be “kept under review.”

January’s economic data presented a nuanced view of China’s economy. The official manufacturing Purchasing Managers’ Index (PMI) increased to 49.2 from December’s 49.0, indicating improved production growth but remaining below the 50-mark threshold signifying contraction. The nonmanufacturing PMI slightly rose to 50.7 from December’s 50.4, surpassing expectations. In other news, following its default on offshore bonds in December 2021, a Hong Kong court has mandated the liquidation of China Evergrande, previously the nation’s largest property developer, as it was unable to secure a restructuring agreement with creditors.

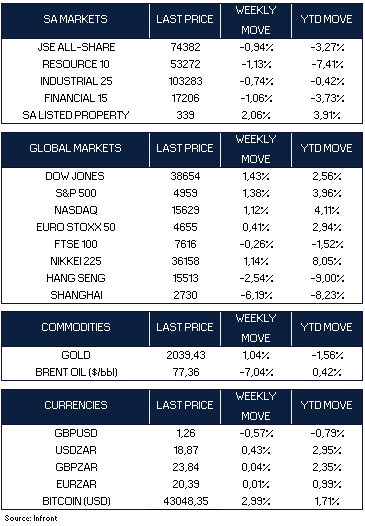

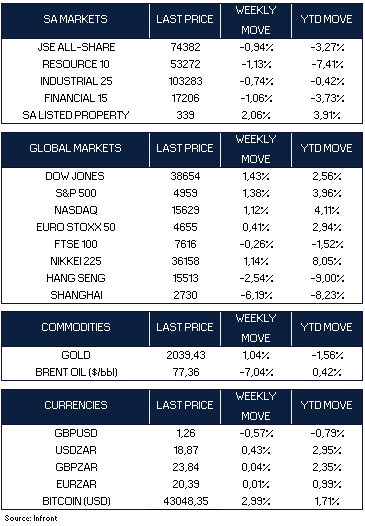

In the fourth-quarter earnings reporting season’s busiest week, major U.S. benchmarks were influenced by releases from influential tech giants. On Wednesday, the S&P 500 and Nasdaq Composite Index experienced a significant decline, triggered by lower-than-expected earnings guidance from Microsoft and Google parent Alphabet. However, the benchmarks rebounded on Thursday, largely recovering losses due to positive earnings surprises from Amazon.com and Meta Platforms. The S&P 500 (+1.38%), the Dow Jones (+1.43%) and the Nasdaq Composite (+1.12%) all ended the week higher.

Chinese stocks declined as negative economic data and concerning news regarding the property sector heightened investors’ pessimism about the country’s growth prospects. The Shanghai Composite Index fell -6.19%, its worst week since 2018. Japan’s stock market saw a +1.14% gain in the Nikkei 225 Index for the week, supported by a robust corporate earnings season. Domestically focused firms, benefiting from increased prices and strong tourism, were particularly boosted.

Shares in Europe (Euro Stoxx 50) rose by +0.41% while the UK’s FTSE 100 dropped -0.26%. Oil prices fell Thursday as traders monitored efforts to negotiate a cease-fire in the Israel-Hamas war. Brent Oil ended the week down -7.04% while Gold rose by +1.04%.

Market Moves of the Week

Mixed headlines emerged in South Africa (SA) this week. SA’s trade surplus remained somewhat resilient in December, narrowing less than economists expected, to R14.1b (estimate R10.0b). The aggregate data closely aligned with expectations, having no significant effect on financial markets or investor perspectives.

Private sector credit extension (PSCE) surged in December 2023 to 4.9% y/y, up from November’s 3.8% y/y move. This was even stronger than consensus forecast, but despite the positive acceleration, the growth remains negative in real terms. Although credit trends haven’t been a primary factor in recent South African Reserve Bank interest rate decisions, the persistent weakness suggests a dovish outlook for monetary policy.

In other news, the International Monetary Fund has lowered SA’s 2024 economic growth forecast to 1%, citing logistical challenges as a significant constraint on activity in the region. This downgrade is a notable decline from the October forecast of 1.8%, primarily attributed to disruptions in the energy sector and logistics, including transportation, freight, and ports.

On the political front, Cyril Ramaphosa is likely to sign off on the controversial health insurance bill (NHI Bill) before this year’s national elections, according to Khumbudzo Ntshavheni, a minister in the presidency.

The JSE dipped (-0.94%) this week, with Resources (-1.13%) leading the decline. Property (2.06%) continued to run, after leading the local sectors over January. The local currency weakened against the U.S. dollar over the week, rising to R18.87/$ from last week’s R18.79/$ level.

Chart of the Week

On Wednesday, U.S. stocks experienced their worst day in months, with Powell’s pushback on imminent rate cuts overshadowing major events like Alphabet and Microsoft results, New York Community Bank struggles, unexpected Treasury bond auction plans, and labour market concerns. Indicating that the stock market appeared to have put more weight on imminent cuts than anyone else. In contrast, bonds rallied smoothly amid the tumultuous day.

Source: Bloomberg