In October, China experienced a return to deflation, underscoring the ongoing challenge of boosting growth through domestic demand. According to the National Bureau of Statistics, consumer prices declined by -0.2% (-0.1% expected) last month, following a near-zero trend in the preceding two months. Concurrently, producer prices continued their decline for the 13th consecutive month, registering a 2.6% decrease, slightly less than the estimated 2.7% decline.

Benefiting from multiple rounds of fiscal and monetary stimulus, China saw an upward revision in its economic growth projections for 2023 and 2024 by the International Monetary Fund. The IMF anticipates that growth will surpass China’s 5% target for 2023, reaching 5.4% this year. However, it is expected to moderate to 4.6% in the following year due to subdued external demand and ongoing weaknesses in property markets. The revisions were made despite the backdrop of challenges, including a 6.4% decline in exports for October, marking the sixth consecutive monthly decrease, and the first decline in foreign direct investment since 1989.

Bank of England (BoE) Governor Andrew Bailey, addressing a central bank conference in Ireland, remarked that it was premature to discuss interest rate cuts. His comments followed BoE Chief Economist Huw Pill’s observation that financial markets anticipating an initial rate cut in August next year “doesn’t seem entirely unreasonable.” In other news, UK gross domestic product (GDP) in the third quarter matched the BoE’s forecast for zero growth, after expanding by 0.2% in the prior three months.

In the U.S., Jerome Powell cautioned markets this week, stating that the Federal Reserve is ready to implement further tightening measures as needed. He expressed a lack of confidence in the current policy stance, emphasizing the challenge of reaching the 2% inflation target. In response, market conditions tightened, resulting in higher bond yields and a stronger dollar, accompanied by a decline in equities. The market now anticipates the first rate cut by the Fed to happen in July of 2024 instead of June. There were very few economic data releases this week, and most were in line with expectations.

As of the latest data, almost 92% of the S&P 500 Index constituents have reported their Q3 2023 results. Blended earnings per share, which combines reported figures with estimates for yet-to-report companies, indicate a 4% increase compared to 2022’s corresponding quarter, as reported by FactSet. Additionally, year-over-year sales growth stands at 2.2%.

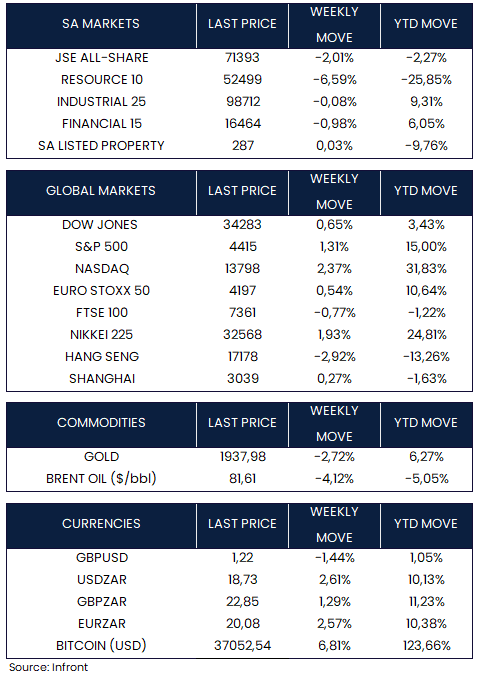

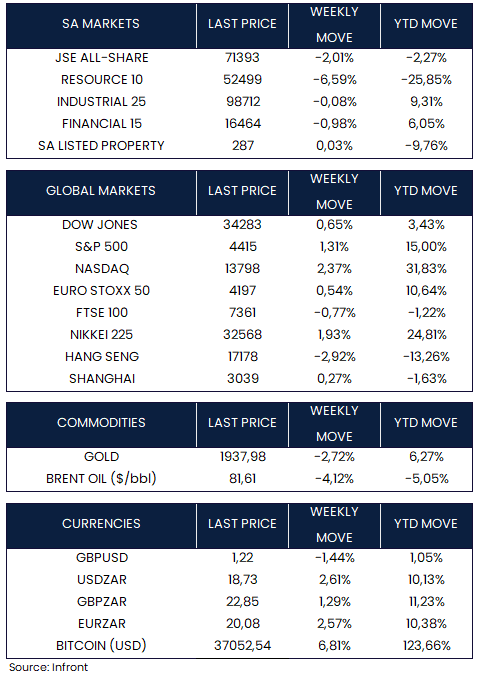

The major global indexes finished mixed for the week. The Nasdaq (+2.37%), the S&P 500 (+1.31%) and the Dow Jones ended the week higher, with upside earnings surprises from some technology-oriented firms providing support to growth indexes. The Euro Stoxx 50 managed a +0.54% gain after European Central Bank President Christine Lagarde said the ECB will not start cutting rates “in the next couple of quarters.”

In the UK, the FTSE 100 dropped by -0.77%. Chinese equities rose as investors remained broadly unmoved by weak economic data, with the Shanghai Composite Index rising +0.27%. Japan’s Nikkei 225 rose by 1.93%, buoyed by robust corporate earnings, the government’s commitment to further economic stimulus, and ongoing currency tailwinds. Brent oil prices declined by -4.12%, while gold dropped by -2.72%.

Market Moves of the Week:

In South Africa (SA), manufacturing production fell more than economists expected in September, falling -4.3% y/y (estimate -2.5%) from an expansion of +1.5% in August. The manufacturing sector continues to face lacklustre conditions with the headline Purchasing Managers’ Index (PMI) experiencing a significant decline in September, primarily driven by a sharp decrease in new sales orders. Additionally, early indications from the October PMI reading suggest that the index extended its move into contractionary territory. Although producers are gaining resilience against electricity shortages through private generation, overall activity is constrained by infrastructure bottlenecks, sluggish demand and increasing trade barriers.

SA mining production fell by -1.9% y/y (estimate -2.4%) in September, following August’s -2.0% y/y decline. Mining output is down -1.8% y/y year-to-date, reflecting poor growth within the coal, iron ore and platinum group metals (PGMs) divisions. Conversely, the gold division outperformed. Overall, the mining sector continues to face difficulties arising from an unstable energy supply, logistical constraints (Transnet), and diminishing external demand. Waning economic growth in both China and Europe has also hindered the export of critical commodities.

South Africa is set to fall short of its mandated 2030 carbon emissions targets outlined in the Paris climate agreement, according to three high-ranking government officials. The country’s intention to extend the operation of eight coal-fired power plants beyond the initially planned timeframe contributes to this shortfall. An official from the president’s office acknowledged, “Our models indicate that we will not achieve the 2030 target,” but also mentioned ongoing discussions about a new decommissioning goal for 2035. Despite this setback, South Africa remains committed to achieving net-zero emissions by 2050.

The JSE (-2.01%) dipped over the week with Resources (-6.59%) selling off. The rand weakened against the dollar, with the local currency ending at R18.73/$ from last week’s 18.25/$ level.

Chart of the Week:

The consumer price index slipped into deflation in July and has been teetering on and off the edge of negative year-on-year growth. While the People’s Bank of China said in August that prices would rebound from the summer rough patch, the latest data shows that assessment is overly optimistic.

Source: Bloomberg