In September, the U.S. economy saw the creation of 360,000 new jobs, and an extra 119,000 positions were included in the count through revisions. The print surged passed expectations of only 170,000 new jobs, re-igniting the bonds sell-off that has swept global markets over the past two weeks. The U.S. 10-year Treasury yields climbed by approximately 14 basis points, reaching 4.88%, marking their highest point since 2007, coinciding with a roughly 50% increase in the likelihood of a rate hike before the end of the year. The unemployment rate remained unchanged at 3.8%. Wage growth remained stagnant, rising 0.2% m/m and 4.2% y/y, while the workforce participation rate stayed steady at 62.8%. However, digging deeper, the data suggests that the labour market is driven more by increased worker supply than excessive demand, creating a more favourable inflation outlook.

In U.S. political news, after failing to secure Republican caucus support in the U.S. House of Representatives for a government funding bill that included spending cuts and increased border security, Speaker Kevin McCarthy allowed a bipartisan bill to proceed. It passed with a 335 to 91 vote, but 90 Republicans opposed it. On Monday, a motion to remove McCarthy as Speaker was filed and succeeded with a 216 to 210 vote on Tuesday. Eight Republican renegades joined with a united Democratic caucus to remove a speaker for the first time in history. The House is in recess until next week when a new Speaker will be elected.

Throughout most of 2023, the U.S. services sector remained strong, while manufacturing experienced a contraction. However, in September, this trend flipped, with the manufacturing index improving to 49 from 47.6, while the nonmanufacturing measure dropped to 53.6 from the previous month’s 54.5. Notably, the nonmanufacturing new orders index hit a low point, declining to 51.8, marking its lowest level in a year, down from 57.5.

Both official and private-sector data indicated a potential slowdown in the eurozone economy during the third quarter. The September reading of the final Composite Purchasing Managers’ Index (PMI) from S&P Global stood at 47.2, marking the fourth consecutive month of contraction. (A PMI reading below 50 signifies a decrease in business output.)

China’s manufacturing sector showed signs of recovery, marking its first expansion since March and suggesting a potential economic turnaround. The official manufacturing Purchasing Managers’ Index (PMI) exceeded expectations, rising to 50.2 in September from August’s 49.7. Additionally, the nonmanufacturing PMI surpassed forecasts, expanding to 51.7 compared to August’s 51.0.

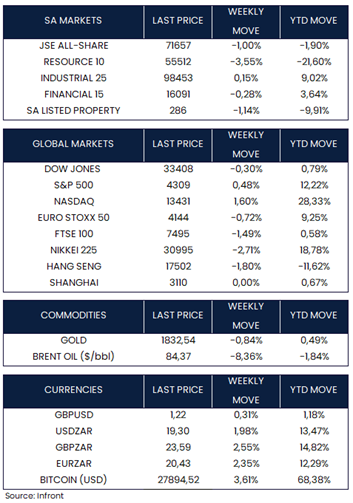

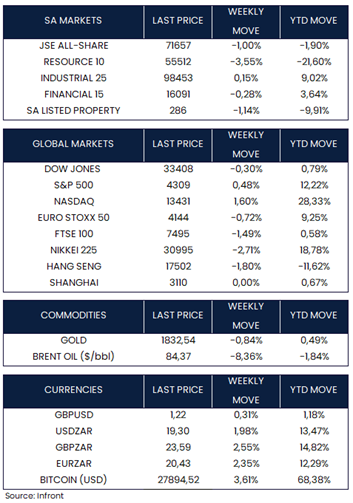

During another week of trading dominated by large-cap growth stocks, especially in the mega-cap information technology and internet sectors, the major U.S. indexes closed with a mix of performances. The Nasdaq (+1.60%) and the S&P 500 (+0.48%) ended the week higher while the Dow Jones dipped -0.30%. Shares in Europe (Euro Stoxx 50) declined by -0.72%, while the FTSE 100 dropped by -1.49%. Financial markets in China were closed last week for the Mid-Autumn Festival and National Day holiday and will reopen on Monday, October 9. The Hong Kong Stock Exchange resumed trading on Tuesday, and the benchmark Hang Seng Index slipped by -1.80% for the shortened holiday week. Japan’s Nikkei 225 fell by -1.68%. Brent oil prices declined by -8.36% as demand fears outweighed supply cuts, while gold dropped by -0.84%.

Early Saturday morning, Palestinian group Hamas launched one of the biggest attacks on Israel in years with many killed, hostages taken, and fighting raging after a surprise assault that included gunmen entering Israeli towns after a barrage of rockets were fired from the Gaza Strip. Israeli Prime Minister Benjamin Netanyahu has declared a state of war.

Market Moves of the Week:

In South Africa (SA), Absa’s Purchasing Managers Index (PMI) declined to 45.4 in September from 49.7 in August, missing the consensus estimate of 49.5. The weak reading of the headline PMI was a result of exceptionally low demand and constrained production. Both external and domestic demand for South African manufactured goods came under pressure in the month. Factory production also suffered due to heightened and more severe power disruptions in September, leading to a sharp decline of 8.1 points in the business activity index, which fell to 41.9.

SA Reserve Bank Governor, Lesetja Kganyago, told a webinar on Thursday that inflation has eased, but stressed it was premature to declare victory in the battle to contain price pressures. Kganyago also mentioned that the bank would not step in to protect the local currency despite its current weakness. He stated that the bank was only concerned about the currency to the extent that it fed into inflation. On a related note, Finance Minister Enoch Godongwana is anticipated to caution SA about a widening budget shortfall and diminishing revenues when he delivers an assessment of SA’s fiscal status on November 1st this year.

Public Enterprises Minister Pravin Gordhan said new Eskom and Transnet CEOs will be named shortly. Eskom has not had a permanent leader for over seven months and is being overseen by Interim Chief Executive Officer, Calib Cassim. Last week Friday, Transnet lost two senior leaders within the organisation. CEO Portia Derby resigned amid rail infrastructure challenges while Nonkululeko Dlamini, the CFO of Transnet, also handed in her resignation. “Finding the right people is a difficult challenge in the southern African context,” Gordhan said.

The JSE (-1.00%) dipped over the week with resource companies (-3.55%) continuing to struggle in the current market environment. The rand slumped against the dollar over the week as risk-off sentiment took hold. The local currency ended at R19.30/$ from last week’s 18.92/$ level.

Chart of the Week:

An index of the dollar’s strength is pushing toward its highest level since November. Risk aversion and rising U.S. yields meant the U.S. dollar was stronger against most currencies in recent weeks.

Source: Bloomberg