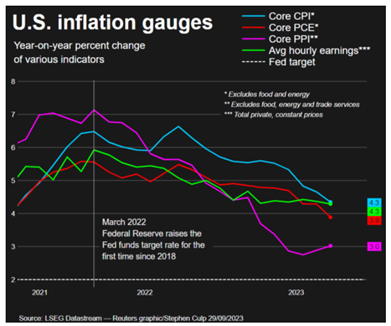

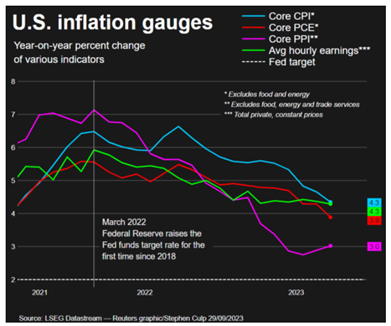

In August, the core Personal Consumption Expenditures (PCE) price index, excluding food and energy, saw a modest 0.1% increase, marking the smallest monthly rise since November 2020. Over 12 months, the annual increase for core PCE was 3.9%, down from an upwardly revised 4.3% in July. This PCE index is a favoured economic indicator by the Federal Reserve for assessing inflation. This smaller-than-anticipated rise in August indicates that the central bank’s efforts to combat rising prices are showing progress.

Revised figures for the first quarter of the year show that the UK economy experienced a more rapid expansion than initially projected, as per the latest gross domestic product (GDP) data. The Office of National Statistics has revised the first-quarter growth rate to 0.3%, an increase from the prior estimate of 0.1%. Meanwhile, their assessment of second-quarter GDP growth remains unaltered at 0.2%.

Despite the surge in oil prices, inflation decreased across most European countries in September, resulting in the overall rate hitting its lowest point since before the onset of the war in Ukraine. According to the European Commission’s statistical branch, consumer prices in the 20 eurozone countries increased at an annual rate of 4.3 percent in September, a drop from August’s 5.2 percent. Over the past year, inflation in the eurozone has shown a consistent decline, following its peak at an annual rate of 10.6 percent the previous year. Core inflation, which excludes volatile categories such as food and energy and is considered a more reliable indicator of underlying price pressures, also experienced a recent easing, dropping to 4.5 percent in September from 5.3 percent in August.

In September, China’s factory activity saw its first expansion in six months. According to the National Bureau of Statistics, the Purchasing Managers’ Index (PMI), which is based on a survey of major manufacturers, increased from 49.7 to 50.2, surpassing the critical 50-point threshold that distinguishes between contraction and expansion. This reading exceeded the forecasted 50.0. The PMI data reinforces the signs of economic stabilization, following a preceding period of decline after the initial surge earlier in the year when China relaxed its stringent COVID-19 policies.

Global equity markets concluded the week on a downtrend. The S&P 500 Index sustained its fourth consecutive weekly pullback, driven by upward pressure on interest rates, which appeared to dampen investor sentiment. The S&P 500 Index posted a decline of -0.74%. Similarly, the Dow Jones Industrial Average experienced a downturn of -1.34% for the week. In contrast, the tech-heavy Nasdaq Composite posted a modest +0.06% gain. In Europe, both the Euro Stoxx 50 and the UK’s FTSE 100 recorded losses, sliding by -0.77% and -0.99%, respectively. The Asian markets mirrored this trend, with the Nikkei 225 (-1.68%), Hang Seng (-1.42%), and Shanghai Composite Index (-0.70%) all showing weakness.

Market Moves of the Week:

In the second quarter of 2023, South Africa witnessed a substantial increase in foreign direct investment inflows, reaching R53.8 billion ($2.8 billion), as revealed in data from the central bank. This surge marked a significant rise from the 0.5 billion rand recorded in the preceding quarter. The Quarterly Bulletin from the South African Reserve Bank (SARB) attributed this growth to a non-resident firm’s acquisition of a domestic beverage company.

Moreover, the Quarterly Bulletin disclosed that during the first quarter of fiscal year 2023/24, the national government reported a cash book deficit of R47.1 billion. This represented a notable contrast to the R11.5 billion cash book surplus reported during the same period in the previous fiscal year. The central bank indicated that this deficit was primarily covered by the issuance of long-term government bonds in the domestic financial markets.

Additionally, the Quarterly Bulletin noted a decrease in portfolio investment outflows in the second quarter, which dropped to R4.6 billion from R32.0 billion in the preceding quarter.

During the week, the JSE All-Share Index recorded a decline of -1.38%, led by losses in the financial sector at -1.75%, followed closely by industrials at -1.60%, and property at -1.50%. The resource sector also contributed to the week’s losses, ending with a decline of -1.05%. Additionally, the South African rand depreciated during the week, closing at R18.84 against the US dollar.

Chart of the Week:

In August, US consumers’ inflation expectations remained largely stable. The decrease in underlying price pressures has increased optimism that the US central bank may not implement an interest rate hike in November.