An increase in the number of job seekers caused the U.S. unemployment rate to rise in August, climbing from 3.5% to 3.8%. The collapse of a major trucking company resulted in the loss of 37,000 jobs in that industry, while the Hollywood writers’ strike led to 17,000 people losing their jobs, as reported by the Bureau of Labor Statistics. Nonfarm payrolls in August exceeded expectations, increasing by 187,000 jobs. The Federal Reserve (Fed) will find solace in the rising labour force participation rate, indicating a healthier labour market balance. The participation rate reached 62.8%, its highest level since the start of the pandemic. Average hourly earnings increased by 4.3% year-on-year last month, slightly slower than July’s 4.4% growth rate. As a result of this data, the market’s odds of another Fed interest rate hike before the end of the year have decreased to approximately 35%.

On the inflation front, core Personal Consumption Expenditures (PCE) Price Index inflation (the Fed’s preferred inflation measure) in the United States increased to 4.2% in July from its June level of 4.1%. This reading came in line with the market’s expectations. Personal Income grew 0.2% while personal spending showed strong growth, rising by 0.8%, indicating ongoing robust consumer demand.

The eurozone’s yearly inflation rate remained stable at 5.3% in August (slightly above the 5.1% consensus expectation). Core inflation, which is a measure of underlying price pressures that excludes the volatile costs of food and energy, decreased as expected, coming in at 5.3% y/y – representing a 20-basis-point improvement compared to July. The minutes from the July meeting of the European Central Bank highlighted the robust labour market in the eurozone and indicated the potential for a possible soft landing scenario.

China intensified efforts to stimulate the economy and support its currency, as investor concerns over the growth outlook persist. Some of the changes implemented this week include reducing the transaction tax on stock purchases by half, lowering reserve requirements, reducing downpayment requirements for both first-time and second-time homebuyers, and decreasing the mortgage rates for existing first-time home buyers. The country’s massive property sector continued to worsen in August, a new business survey found. The sector has slumped in the last few years amid a government crackdown on high debt levels in the industry and remains a key constraint on economic growth. In other news, China’s Purchasing Manufacturing Index (PMI) rose to 49.7 from 49.3 in July but remained in contraction for a fifth straight month.

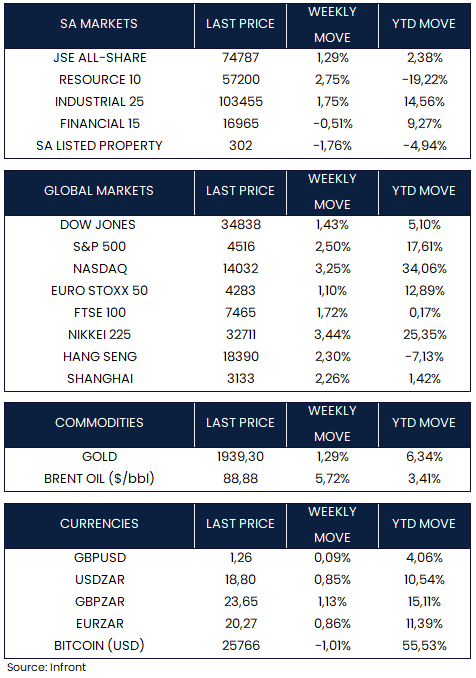

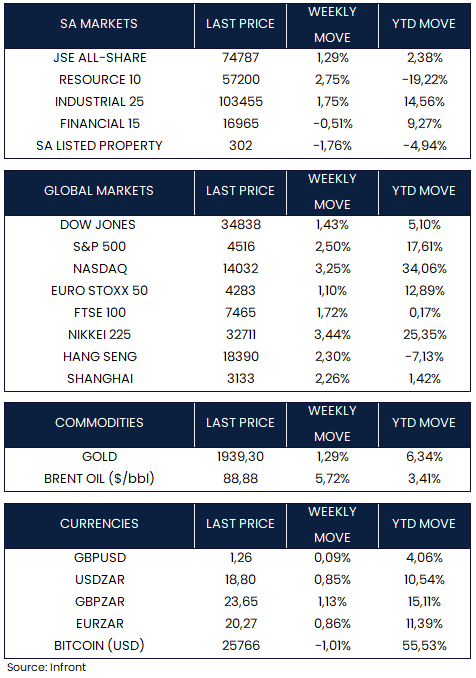

On the market front, global indices ended the week higher. In the U.S., smaller-cap stocks outperformed, narrowing the significant year-to-date gap with large-caps. The S&P 500 Index rose by +2.50%, while the Dow Jones gained +1.43%. The technology-heavy Nasdaq Composite had a strong end to the week, rising +3.25%. Shares in Europe (Euro Stoxx 50) and the UK ( FTSE 100) rose by +1.10% and 1.72% respectively.

Chinese shares rose after the government issued a series of stimulus measures aimed at reviving the economy. The Shanghai index ended the week up +2.26%, while in Hong Kong, the benchmark Hang Seng Index increased +2.30%. In Japan, the Nikkei 225 rallied +3.44%. Gold rose by +1.29% while Brent Oil surged +5.72% over the week.

Market Moves of the Week:

South Africa’s producer price index hit a near three-year-low in July. Producer inflation dropped to 2.7% y/y from 4.8% in June, driven by lower gasoline and other fuel prices. The median forecast of the eight economists surveyed by Bloomberg was 3%. The move marks the 12th consecutive month of slowing inflation, raising the prospects that the South African Reserve Bank may yet again hold rates steady when its Monetary Policy Committee meets later in September. Downside risks remain though, with producer food inflation (+6.8% y/y) remaining a key driver of the overall rate, which will keep feeding into consumer food inflation (+10% y/y in July).

In August, there was a slight improvement in the seasonally adjusted Absa Purchasing Managers’ Index (PMI), which increased by 2.4 points to reach 49.7 – falling just short of the critical 50-point threshold that separates expansion from decline. The surge in the primary PMI was driven by a nearly 12-point surge in the business activity index, pushing it to 50. The PMI figures for July and August do not instill confidence that there will be a recovery in the factory sector job market during the third quarter, Absa warns.

Eskom reported a R5 billion loss before tax in the first quarter of the 2023/24 financial year ended June 2023. This was revealed in Eskom’s unaudited quarterly results released on Tuesday, 29 August. Eskom’s net revenue increased to R70.9 billion for the quarter, up from R66.3 billion for the same quarter in 2022. The company could not generate enough electricity to meet demand. As such, electricity sales and revenue did not meet expectations. Some consolation was that Eskom’s primary energy costs were R3.5 billion lower than budgeted at R43.4 billion.

The JSE (+1.29%) ended the week in the green, following global markets higher. Sectors were mixed with Resources catching a bounce (+2.75%) and Financials dipping -0.51%. The local currency weakened against the U.S. dollar over the week, rising to R18.80/$ from last week’s R18.64/$ level.

Chart of the Week:

U.S. 10-year yields broke decisively above 3% last August and have climbed since. While this August saw 10-year yields climb for a fourth straight month, a big bid returned to the bond market in recent weeks: after rocketing as high as 4.36%, the rate is sitting at about 4.1%. However, various U.S. money managers expect yields to resume their climb higher as a still-strong U.S. economy threatens further Fed hikes.

Source: Bloomberg