In June, spending at US retailers continued its positive growth trend for the third consecutive month, showcasing resilience among American consumers. According to the Commerce Department’s report on…

Continue readingWeek in Review: Interest Rates Higher for Longer

After a strong performance in the first half of 2023, markets experienced a slight setback in the first week of the third quarter. The catalyst behind this week’s pullback was the release of the Fed’s…

Continue readingWeek in Review: Reflecting at the Halfway Point of 2023

As we bid farewell to June and conclude the second quarter of 2023, it’s essential to reflect on the plethora of news and data that has shaped the past three months. From inflation and interest rates…

Continue readingWeek in Review: Bank of England Surprises Markets

On Thursday, the Bank of England, implemented a 50 basis point interest rate hike (pushing the lending rate to 5%), surprising markets that had priced in a 60% chance of a 25 bps hike. Following the decision, markets saw a nearly 50% chance that Bank Rate would peak at 6.25% by the end of this year. The move comes after U.K’s May inflation figure was published on Wednesday, which showed that inflation in the region remains stubbornly high, with core inflation rising to its highest level since 1992. Headline inflation defied predictions, coming in at 8.7% y/y vs 8.4% expected, keeping in line with April’s figure. Core inflation jumped 7.1% y/y, up from 6.8% in April. In May, the central bank forecasted that inflation would drop to just over 5% by year end and be below its 2% target in early 2025.

Keeping with the inflation theme, U.S. Federal Reserve Chair Jerome Powell stated this week, while addressing the Senate Banking Committee, that more rate hikes may be needed this year. Powell additionally mentioned that policymakers feel “it will be appropriate to raise rates again this year, and perhaps twice,” if the economy performs about as expected. Decisions will be made on a meeting-by-meeting basis, Powell said, while noting that there is a long way to go to get inflation back down to its 2% goal.

The latest release of flash purchasing managers index’s (PMI) data on Friday indicates a stagnation in the eurozone economy. The composite S&P Global PMI registered at 50.3. The manufacturing index declined from 44.8 in May to 43.6, while the services measure experienced a significant monthly deterioration, dropping from 55.1 to 52.4, which is an unusually substantial decrease.

On Saturday, Russian President Vladimir Putin made a firm commitment to mete out consequences to those responsible for an “armed uprising” following the apparent insurrection led by the head of the Wagner private military group – which threatened to end Putin’s 24-year rule. The insurrection involved taking control of military installations in two Russian cities, namely Rostov-on-Don and Voronezh, and included a warning that the troops could advance towards Moscow. In a sudden change of direction, Yevgeny Prigozhin, the leader of Wagner, announced that he had halted the advance of his troops towards Moscow and issued orders for them to evacuate Rostov. As part of a negotiated agreement facilitated by Belarus, Prigozhin agreed to depart from Russia and relocate to Belarus. In a statement, Prigozhin said that he wanted to avoid the spilling of “Russian blood”.

This week, the yen continued to depreciate against other major currencies, crossing the 143 mark against the dollar, coinciding with Japan’s announcement of its highest core inflation rate since 1981, standing at 4.1%. While other central banks adopted a more hawkish stance, the Bank of Japan maintained its super loose monetary policy approach. If the yen experiences further decline, it may necessitate adjustments to the Bank of Japan’s yield curve control policy.

No major indicators were released in China during the week. However, mounting evidence that the country’s recovery is losing steam raised fresh concerns about the economic outlook. China’s People’s Bank of China was the lone major central bank to lower rates this week, cutting the important loan prime rate 0.1% to 4.2% in an effort to lower borrowing costs and boost confidence and consumption.

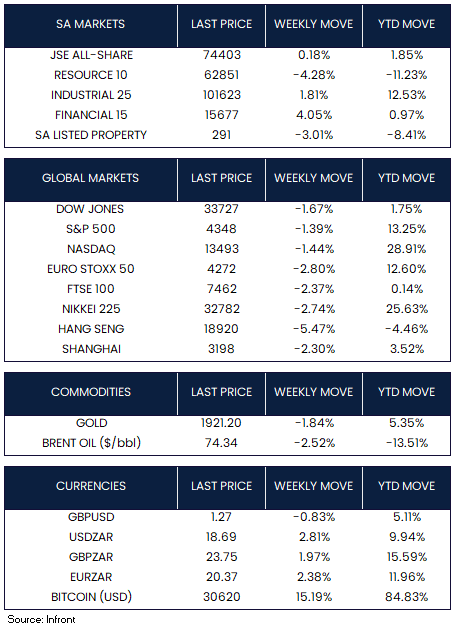

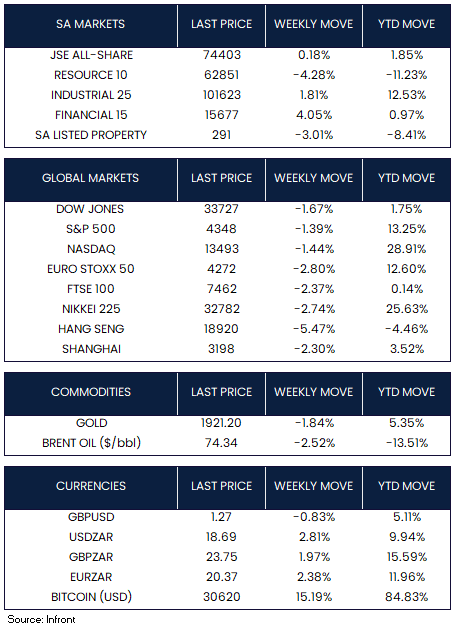

On the market front, global indices ended the week in the red. Growth stocks outperformed value shares, while large-caps fared better than small-caps. The S&P 500 Index fell -1.39%, while the Dow Jones slipped -1.67%. The technology-heavy Nasdaq Composite had a strong start to the week but ended the week down -1.44%. Shares in Europe (Euro Stoxx 50, -2.80%) and the UK (FTSE 100, -2.37%) fell over the week on worries that further interest rate increases might cause a recession in Britain and the eurozone.

Chinese shares (the Shanghai index) ended the week down -2.30%, while in Hong Kong, the benchmark Hang Seng Index declined -5.74%, its largest drop in three months. In Japan, the Nikkei 225 fell -2.74%. Gold dipped -1.84% while Brent Oil declined by -2.52% over the week.

Market Moves of the Week:

Inflation in South Africa moderated and surprised to the downside in May, with headline inflation falling to 6.3% y/y (expectations: 6.5% y/y) from 6.8% y/y in April. Importantly, the inflationary impact of food and non-alcoholic beverages, which had been a major contributing factor in the recent months, was considerably lower than expected – coming in at 11.8% y/y vs April’s 13.9% y/y print. Last year’s high fuel price also fell out of the index’s base, improving the figure. The annual rate for fuel decreased to 3.5% from 5.0% in April. Core inflation also edged lower to 5.2% y/y, as expected. Moving forward, although inflation is starting to exhibit noticeable signs of decreasing, it remains above the South African Reserve Bank’s (SARB) target range of 3%-6%.

Given the downside surprises in inflation in the past two months, the strengthening of the rand and a decline in oil prices, the inflation outlook has improved. The market is gaining confidence that the SARB has completed its hiking cycle (staying on hold in July – the next Monetary Policy Committee meeting). However economists have not ruled out further hikes, saying this would depend on the course of load-shedding and the rand’s behaviour.

According to a statement from the South African presidency, Invest International, a company owned by the Netherlands finance ministry and state development bank FMO, has committed €300 million ($330 million) to establish a public infrastructure fund for investing in water and energy projects in South Africa. The funding will be provided through a combination of €200 million in loans and €100 million in grants.

Eskom is making progress in its efforts to restructure and operationalize its transmission company by November’s end. This is part of a comprehensive plan to improve the financial and operational performance of the financially struggling power utility. Eskom’s acting group CEO, Calib Cassim, informed members of parliament that two critical requirements remain for the successful spin-off of the transmission company. These include obtaining the transmission license from the National Energy Regulator of SA (Nersa) by the end of July and securing the consent of lenders, which is expected to be achieved by the end of August.

The JSE (+0.18%) managed a marginal gain over the week. Sectors were mixed with Resources selling off (-4.28%) and Financials rallying (+4.05%). The local currency weakened against the U.S. dollar over the week, rising to R18.69/$ from last week’s R18.18/$ level.

Chart of the Week:

The persistence of the country’s cost-of-living crisis, with U.K. CPI the highest in the G7, will be a headache for the government. Prime Minister Rishi Sunak promised to halve inflation by the end of this year ahead of a general election in 2024.

Source: Reuters, CNBC

Week in Review: Fed Holds Rates as Economy Adjusts

In May, the inflation rate witnessed a notable decrease, reaching its lowest annual level in over two years, as reported by the Labor Department. The consumer price index rose by only 0.1% during the month, resulting in a decline in the annual rate from 4.9% in April to 4% in May. While there has been some easing of price pressures, core inflation, which excludes volatile food and energy prices, increased by 0.4% for the month and remained 5.3% higher than the previous year.

At the wholesale level, US inflation has also experienced a decline, falling well below its pre-pandemic average. The Producer Price Index data released by the Bureau of Labor Statistics shows a modest 1.1% annual increase for the 12-month period ending in May, a sharp drop from the 2.3% growth recorded in April. This marks the lowest annual level since December 2020, with energy and food prices playing a significant role in the decline. On a monthly basis, prices saw a 0.3% decrease, reflecting the fourth decline in six months.

Despite these fluctuations, US retail sales demonstrated resilience and growth in May, defying expectations of a decline. The Commerce Department reported a 0.3% increase in retail sales across various outlets, including physical stores, online platforms, and restaurants, compared to April. This positive trend underscores the vital role of consumer spending in fuelling the economy. While gasoline stations and miscellaneous stores experienced a decrease in sales, spending grew in other categories. Excluding gasoline station sales, retail spending showed a stronger increase of 0.6%, with building materials and gardening items experiencing the highest surge of 2.2% in May. Overall, retail sales rose by 1.6% compared to the previous year.

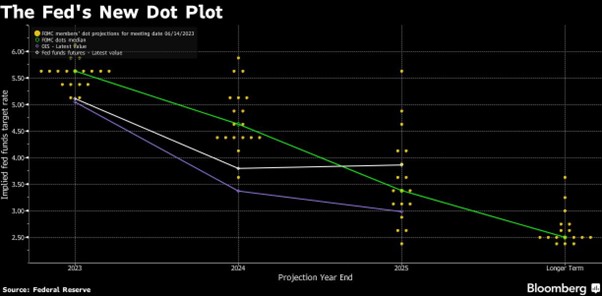

Amid these economic developments, the Federal Reserve made the decision to keep interest rates unchanged, opting to assess the impacts of the previous 10 hikes. The positive inflation data likely helped investors absorb a somewhat hawkish outlook from Fed policymakers. On Wednesday, officials announced that the official federal fund’s target rate would remain steady within the 5.00% to 5.25% range. However, the rate projections indicated by the “dot plot” suggested that this decision was more of a temporary “skip” rather than a long-term “pause,” as the median projection indicated the possibility of two additional quarter-point rate hikes by the end of the year.

The UK economy showed signs of recovery with a 0.2% sequential growth in April, following a contraction of 0.3% in March, driven by increased output in consumer-facing services, car sales, and education. This, combined with stronger-than-expected labour market data, including a 7.2% annual average wage growth and a decline in the unemployment rate to 3.8%, supported market expectations that the Bank of England (BoE) would continue its plan of raising interest rates in July. BoE Governor Andrew Bailey acknowledged the tightness of the labour market and expressed his belief that although inflation would eventually decrease, the process would take longer than initially anticipated.

In the Eurozone, industrial production rebounded more than anticipated in April, showing resilience after a decline in March, according to data released by Eurostat. The surge in output of capital goods, such as buildings and equipment, offset the reduced production of consumer goods. The eurozone experienced a notable 1.0% month-on-month increase in industrial production, resulting in a 0.2% year-on-year rise, surpassing economists’ expectations of 0.8% monthly and annual increases. Notably, capital goods output witnessed a remarkable 14.7% month-on-month increase, reversing the previous month’s 15.2% decline. However, the production of durable consumer goods declined by 2.6%, and non-durable goods saw a 3.0% decrease during the same period.

Concurrently, the European Central Bank (ECB) raised its key deposit rate to 3.5%, reaching its highest level in 22 years. ECB President Christine Lagarde expressed the view that further tightening of borrowing costs may occur in July unless there are significant changes in the economic outlook. The ECB also revised its inflation forecasts upward, supporting the case for continued monetary tightening, while reducing its projections for economic growth. Additionally, as part of its strategy to reduce its balance sheet, the ECB confirmed the cessation of reinvestments from its asset purchase program starting in July.

China’s economy encountered challenges in May as industrial output and retail sales growth fell short of expectations, further raising concerns about the stability of the post-pandemic recovery. The slowdown in economic momentum during the second quarter has prompted China’s central bank to implement its first key interest rate cuts in almost a year, indicating the need for additional measures to support the economy. Industrial output grew by 3.5% in May, slower than the previous month and below analysts’ expectations, reflecting manufacturers’ struggles with weak domestic and international demand. Similarly, retail sales, a crucial indicator of consumer confidence, rose by 12.7%, missing forecasts and decelerating compared to April’s growth rate of 18.4%.

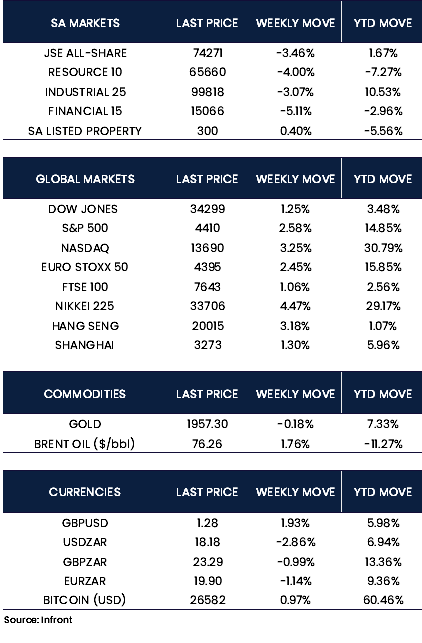

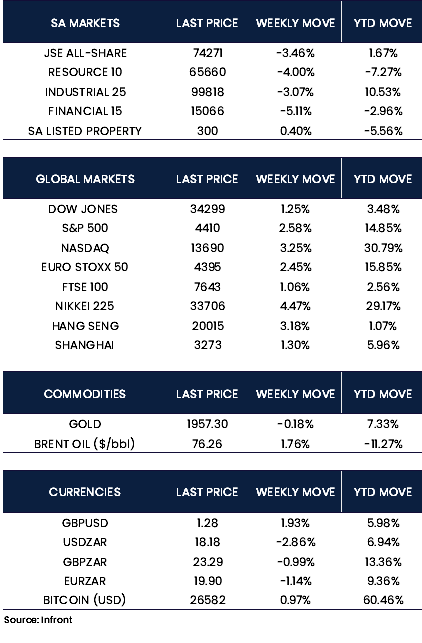

US stocks displayed a robust performance during the week, with the S&P 500 Index achieving its longest stretch of daily gains since November 2021 and its strongest weekly performance since the end of March. The tech-heavy Nasdaq surged by +3.25% over the week, while the S&P 500 and the Dow Jones also exhibited significant gains of 2.58% and 1.25% respectively. In Europe, both the Euro Stoxx 50 and FTSE 100 closed the week positively, registering gains of +2.45% and +1.06% respectively. Chinese stocks followed suit, driven by expectations of additional stimulus measures to support industries experiencing a slowdown in the wake of the waning post-pandemic recovery. The Shanghai Composite Index climbed by +1.30%, and the Hang Seng Index saw a notable increase of +3.18%. Meanwhile, Japan’s Nikkei 225 concluded the week on a higher note, recording a weekly market movement of +4.47%. The markets’ upward trajectory, reaching their highest levels in over three decades, was reinforced by the Bank of Japan’s (BoJ’s) decision to maintain its accommodative monetary policy, a widely anticipated move.

Market Moves of the Week:

According to recent data released by Statistics South Africa (Stats SA), retail trade-in April 2023 contracted by 1.6% compared to the same period last year. This decline follows a downwardly revised 1.5% fall in March and marks the fifth consecutive month of declining retail activity, showing the swiftest pace of contraction since June 2022. The figures also exceeded market expectations of a 1.4% decrease. Stats SA highlighted that out of the seven retail categories included in the index, five experienced a year-on-year decline. Raquel Floris, the deputy director for distributive trade statistics at Stats SA, noted that the decline was primarily driven by a decrease in general dealers and retailers in the food and non-alcoholic beverages sector.

The National Assembly of South Africa has passed new legislation that paves the way for the implementation of universal health insurance, despite concerns raised by its opponents regarding its financial sustainability and effective implementation. The National Health Insurance (NHI) Bill aims to ensure equitable access to high-quality healthcare services for all South Africans. It establishes a fund that will cover most medical treatments provided by accredited healthcare providers, with pricing determined by the government. Private insurers will only be able to cover services not included in the fund’s coverage. The funding for the new fund will be derived from general tax revenue, payroll taxes, surcharges on personal income tax, and the reallocation of funds currently allocated to tax credits for private insurers, as outlined in the bill. Nicholas Crisp, the head of the health department, addressed concerns by stating that around 8.5% of the country’s gross domestic product (GDP) is already allocated to healthcare spending, and by eliminating duplication and inefficiencies, the funding gap is not as substantial as critics of the NHI anticipated.

During the week, the JSE all-share index experienced a decline of -3.46%, primarily driven by losses in the financial sector (-5.11%), followed by the resources sector (-4.00%) and the industrial sector (-3.07%). However, the overall impact of these losses was partly mitigated by a modest increase in the property sector (+0.40%). Additionally, the rand demonstrated a slight appreciation, concluding the week at a rate of R18.18 to the dollar.

Chart of the Week:

Fed maintains interest rates amid economic developments. Rate projections hint at potential future hikes.

Week in Review: Mixed Data as S&P500 Regains Bull Market Status

On Thursday, the S&P500 index experienced a significant development as it entered a bull market. The broad equities benchmark demonstrated a 0.6% increase, concluding the day at 4,292.93 points. This surge represents a notable 20% leap from its lowest point on October 12, 2022, when it stood at 3,577.03 points. Investors reacted favourably to indications from the Central Bank, which suggested that it is nearing the conclusion of its interest rate hiking cycle. Last week, the Federal Reserve hinted that it is likely to abstain from implementing a rate hike during its June 13-14 meeting. This anticipated pause has acted as a catalyst, propelling stock prices to higher levels.

On Thursday, the US Labour Department reported that weekly jobless claims had unexpectedly increased this week to 261,000, well above expectations and the highest level since October 2021.

Economists at the World Bank have revised their global GDP forecast for 2023, increasing it from the earlier projection of 1.7% to 2.1%. This upward adjustment indicates an improvement; however, it also suggests a significant deceleration compared to the 3.1% growth rate observed in 2022. In addition, the World Bank has reduced its growth outlook for 2024 from 2.7% to 2.4%.

While major economies have exhibited more resilience than anticipated in 2023, the economists caution that the impact of higher interest rates and tighter credit conditions will likely dampen growth in 2024. These factors are expected to take a toll on economic expansion going forward.During a meeting at the White House, US President Joe Biden and UK Prime Minister Rishi Sunak reached an agreement to initiate negotiations on a trade pact between their countries. This trade agreement holds the potential to benefit British automakers by allowing them to qualify for electric car subsidies. Furthermore, it could facilitate the joint development of advanced weaponry. The focus of the trade discussions would revolve around critical materials that play a vital role in the production of batteries used in electric vehicles. The proposed trade package aims to foster collaboration and strengthen economic ties between the US and UK.

According to revised GDP data, the Eurozone’s economy experienced a technical recession during the winter period, albeit by a small margin. The data reveals that the economy contracted by 0.1% in both the fourth quarter of 2022 and the first quarter of this year. This weak growth performance is not unexpected, considering the significant impact of the war in Ukraine on European energy markets.

In Japan, revised figures released this week by the Cabinet Office indicates that the economy experienced stronger growth than initially estimated during the first quarter of 2023. Gross domestic product (GDP) expanded at an annualized rate of 2.7% quarter on quarter, surpassing the initial reading of 1.6% and exceeding economists’ forecasts. The upward revision of first-quarter GDP can be largely attributed to robust corporate investment. Despite apprehensions surrounding a slowdown in global growth, particularly in China, businesses in Japan demonstrated increased spending as sentiment remained resilient.

Saudi Arabia has announced its intention to implement an additional reduction of 1 million barrels per day in oil supply during July. This decision has been prompted by a decline in crude prices and will bring the country’s production to its lowest level in several years. Despite the potential consequences, this bold step has been taken by Saudi Arabia, which holds significant importance as a member of the OPEC+ coalition, with the aim of stabilizing the market.

However, it is important to note that this move does involve some concessions to key allies. Russia, a prominent member of the coalition, has not committed to further output cuts. Additionally, the United Arab Emirates (UAE) has negotiated a higher production quota for the year 2024. Despite these compromises, Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, has expressed a strong commitment to taking whatever measures are necessary to restore stability to the market. Brent Crude Oil closed the week lower, down 1.65% to $74,94 bbl.

Chinese equities ended the week on a mixed note, following the release of the latest inflation data, which has increased concerns surrounding the post-pandemic recovery, China’s CPI rose 0.2% in May. The recent release of weak export and import data has fuelled expectations for increased economic stimulus in China. The data indicates that both domestic and international demand remain subdued. In May, exports experienced a significant decline of 7.5% compared to the previous year, surpassing initial forecasts for a weaker performance. Additionally, imports fell by 4.5% compared to the same period last year. Notably, China’s share of US goods imports in April reached its lowest level since 2006, as reported by The Wall Street Journal. Analysts are concerned that exports may further decline, despite their current elevation compared to pre-COVID levels.

The Shanghai Composite index posted a modest gain of 0.04% for the week, while Hong Kong’s Hang Seng Index extended the previous week’s gains, posting a strong 2.32% week-on-week return.

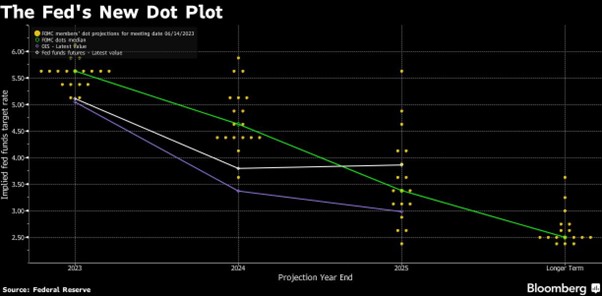

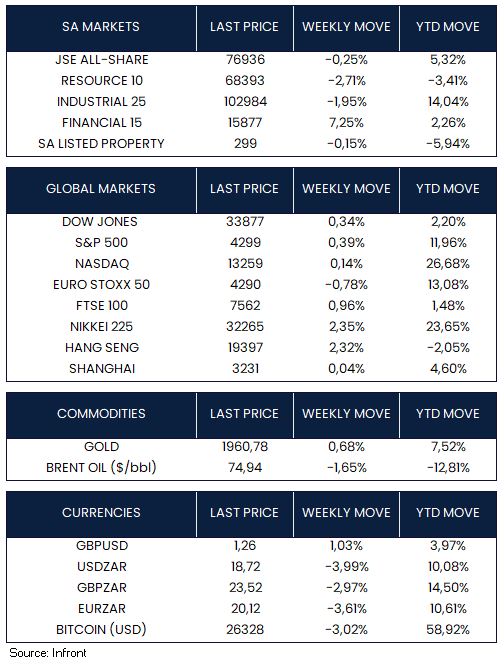

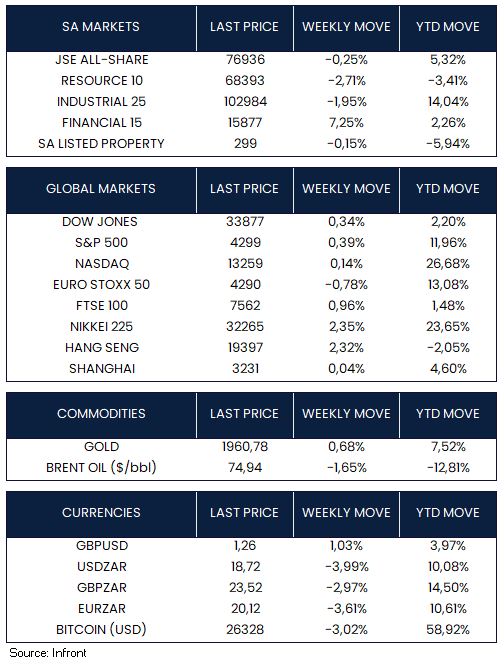

US stocks ended the week slightly higher, with the S&P 500 up 0.39%, the Dow Jones Industrial Average up 0.34%, and the tech heavy Nasdaq Composite rising slightly 0.14%. The Euro Stoxx 50 ended the weak lower (-0.78%), while the FTSE 100 (0.96%) closed the week in positive territory. Japan’s Nikkei 225 index gained 2.35% this week, continuing its positive trend for the year (23.65% YTD).

Market Moves of the Week:

On the domestic front, recent economic data indicates a notable resilience, as the South African economy narrowly averted a recession during the first quarter. According to the latest data released on Tuesday, the economy expanded by 0.4%, effectively returning to pre-COVID levels. Out of the ten industries monitored by Stats SA, eight experienced growth in Q1, with manufacturing and finance, real estate, and business services making the most significant positive contributions.

Furthermore, South Africa’s current account deficit exhibited a substantial narrowing, declining from 2.3% of GDP in Q4 2022 to 1.0% of GDP in Q1 2023, contrary to the consensus forecast of a widening deficit. The primary catalyst for this improvement was the balance of trade in goods and services, which shifted from a deficit of 0.8% of GDP in Q4 to a surplus of 0.6% of GDP in Q1.

Adding to the positive developments, there has been some relief from Stage 6 national loadshedding, and a constructive meeting between government officials and business leaders on Wednesday, which has reignited optimism that a potential solution could be identified to mitigate the persistent power outages.

Although there were some positive developments on the news and economic front, the JSE ALSI posted a modest decline for the week (-0.25%), the only positive sector contributor was Financials up 7.25%. Both Industrials (-1.95%) and Resources (-2.71%) were down for the week. The Rand made a strong recovery, receding below the R19/$ mark. The currency was trading at R18.72/$ by Friday close, appreciating 3.99% against the Dollar. The SA listed property sector continues to face headwinds, the sector closed the week marginally lower -0.15%.

Chart of the Week:

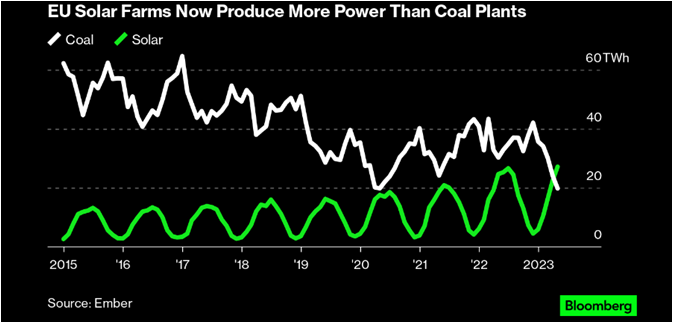

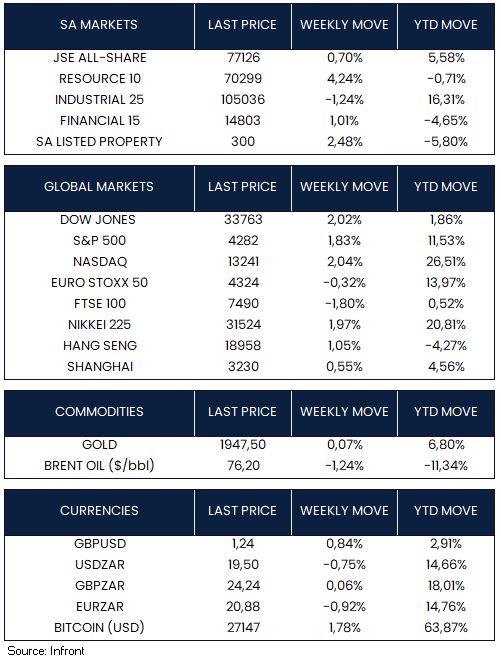

In May 2023, the European Union’s transition to clean energy reached a remarkable milestone. Solar panel generation exceeded the bloc’s coal power plants for the first time, production should be further boosted over the summer months. Power prices turned negative during some of May’s sunniest days as grid operators struggled to handle the surge. Source: Ember & Bloomberg.

Week in Review: Fed Rate Hike Pause on the Cards

This week marked the end of May, with the S&P 500 reaching its highest level since mid-August 2022 and the Nasdaq Composite hitting its best level since mid-April 2022. The agreement reached between the White House and Republican congressional leaders to raise the federal debt limit and avoid a default did not significantly impact investor sentiment, as indications of a deal had already emerged. Economic data took centre stage, with U.S. employment data in the spotlight.

The Senate passed legislation to suspend the U.S. debt ceiling and impose restraints on government spending through the 2024 election. President Joe Biden is set to formally end the month-long debt-limit crisis this weekend.

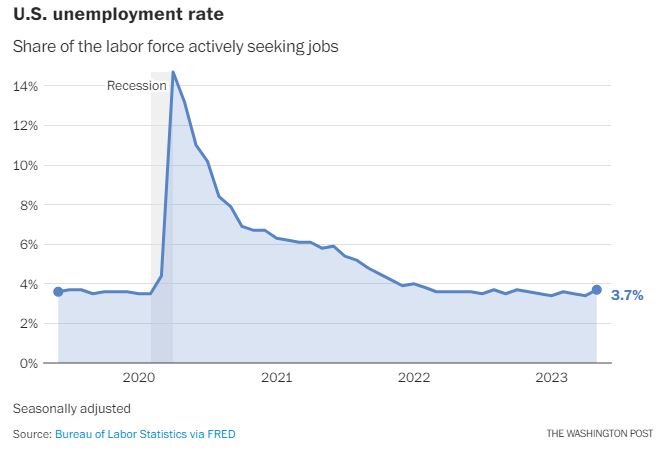

Employment data released during the week was mixed. A report on Wednesday showed that job openings rebounded much more than expected in April and hit their highest level (10.1 million) since January. However, Friday’s release showed that U.S. unemployment unexpectedly rose from 3.4% to 3.7%. The Labor Department also highlighted an increase in the number of people losing jobs or completing temporary positions, reaching the highest level since February 2022. Overall, these findings suggest a more challenging job market for workers. The Federal Reserve is signalling that they plan to keep interest rates steady in June while retaining the option to hike further in coming months. Friday’s unemployment data reinforces this possibility.

Another encouraging sign regarding interest rates was the release of U.S. manufacturing data for May. Data showed a seventh straight monthly contraction in factory activity, as expected. Encouragingly, prices paid for supplies and other inputs by manufacturers contracted at the fastest pace since December, defying expectations for a modest increase.

Eurozone inflation decreased more than expected in May, increasing by 6.1%, also down from a 7.0% increase in the previous month. The unemployment rate decreased to 6.5% in April, in line with market expectations, following a revised rate of 6.6% in March. Manufacturing PMI in the eurozone declined to 44.80 in May, down from 45.80 in the previous month.

UK house prices experienced a marginal decrease of 0.1% on a monthly basis in May, following a revised increase of 0.4% in the previous month. Market expectations had anticipated a 0.5% decline. This decline in house prices reflects wider concerns in the UK property market. Moody’s recently downgraded the debt of Canary Wharf, a prominent symbol of the global real estate downturn. The east London financial district, saw its debt rating lowered from Ba1 to Ba3.

In China, the official manufacturing Purchasing Managers’ Index (PMI) dropped unexpectedly to 48.80 in May, indicating a contraction for the second consecutive month. This suggests that the post-Covid recovery in China’s economy is facing challenges. However, the services PMI rose to 54.5, albeit below expectations, but still indicating expansion.

On the other hand, the private Caixin manufacturing PMI index surprisingly increased to 50.90 in May, contradicting the official data and showing a slight expansion in manufacturing activity. The Caixin index mainly covers smaller and export-oriented businesses.

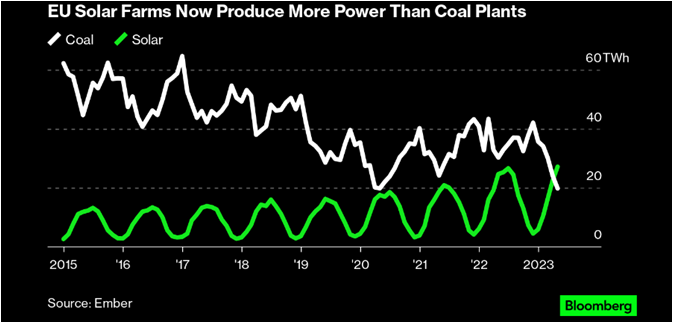

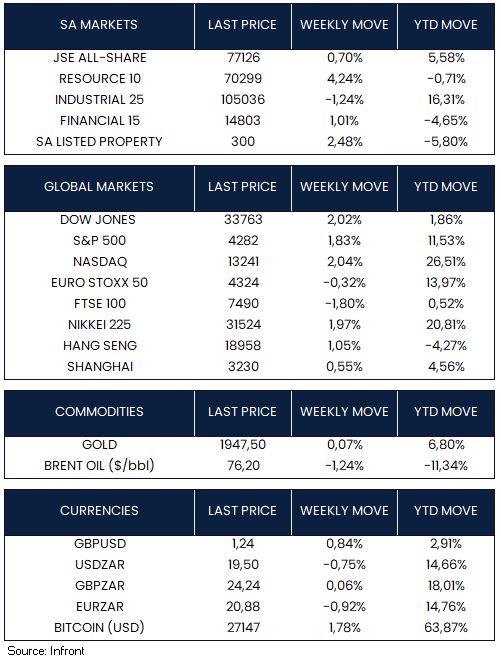

U.S. and Asian markets were stronger this week, whilst European markets ended in negative territory. In the U.S., the Dow Jones (+2.02%), S&P 500 (+1.83%) and Nasdaq (+2.04%) all ended the week higher. Similarly, the Nikkei 225 (+1.97%), Hang Seng (+1.05%) and Shanghai Composite Index (+0.55%) also ended the week higher, whilst the Euro Stoxx 50 (-0.32%) and FTSE 100 (-1.80%) were negative.

Market Moves of the Week:

Earlier this week, the foreign ministers of Brazil, Russia, India, China, and South Africa met in Cape Town. The BRICS nations have requested guidance from their dedicated bank regarding the potential implementation of a shared currency, aiming to shield member countries from the impact of sanctions like those imposed on Russia.

Despite a 9.61% tariff increase and a bailout of R21.9 billion from the Treasury, Eskom reported a loss before tax of R21.2 billion for the 2024 financial year, surpassing the projected loss of R13.6 billion. The company’s revenue fell short of expectations, while its expenses, particularly on diesel, amounted to R21.36 billion, more than double the previous year. Additionally, the Treasury informed legislators that the total invoiced municipal arrear debt rose to R58.5 billion.

South Africa’s trade surplus contracted to R3.54bn, lower than expectations, while the Absa Purchasing Managers Index (PMI) declined in May, indicating a contraction in manufacturing output for the second quarter following a modest rebound in the first quarter.

The JSE All-Share Index (+0.70%) ended the week in positive territory, driven higher by the resource (+4.24%) and financial (+1.01%) sectors, whilst industrial shares (-1.24%) were negative. By Friday close, the rand was trading at R19.50 to the U.S. Dollar, appreciating by +0.75% for the week.

Chart of the Week:

The U.S. unemployment rate rose in May to 3.7% from 3.4%, one of the fastest increases since early in the pandemic, according to Bureau of Labor Statistics data released Friday. About 440,000 more workers reported that they are unemployed; and most of those were from temporary jobs ending or layoffs, according to the data.

Source: Bureau of Labor Statistics via FRED, Washington Post.

Week in Review: Agreement in Principle

President Joe Biden, House Speaker Kevin McCarthy and their negotiators reached a tentative agreement to raise the debt ceiling on Saturday evening, ending a months-long stalemate. President Joe Biden described the agreement as a “compromise”, while House Speaker Kevin McCarthy said it “has historic reductions in spending”. Republicans have been seeking spending cuts in areas such as education and other social programs in exchange for raising the $31.4tn (£25tn) debt limit, a law that caps how much debt the US government can accrue. Recent U.S. market performance has been closely linked to the development of the talks, with signs of renewed momentum in the talks spurring a market rally on Friday.

The core personal consumption expenditures price index, the U.S. Federal Reserve’s (the Fed) preferred inflation measure, rose 4.7% y/y in April, up from March’s 4.6% y/y reading. The print signals that inflation remains sticky and that insufficient progress has been made in bringing down core inflation. Personal income experienced a strong increase of 0.8%, while personal spending surpassed expectations with a rise of 0.5%. These figures indicate that the U.S. economy still remains resilient. Markets are currently pricing in one more interest rate hike from the Fed over the next two meetings and less than one rate cut by year end.

The Fed’s May meeting’s minutes were released during the week, revealing that Federal Reserve officials were divided over whether further rate hikes would be necessary to lower inflation, given the high uncertainty surrounding the impact of banking-sector stresses on the economy. Some participants commented that “based on their expectations that progress in returning inflation to 2% could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings.”

April’s inflation figure in the United Kingdom came in above expectations, with a year-over-year rate of 8.7% compared to the previous month’s 10.1% y/y rise. Consensus had anticipated a decrease to 8.2% in the Consumer Price Index (CPI). Meanwhile, core inflation rose to 6.8% y/y, reaching a new peak within the current cycle. Following the release of this data, investors adjusted their expectations and priced in an additional half-point increase in rates by the Bank of England.

According to a survey conducted by S&P Global, business output in the eurozone continued to grow for the fifth consecutive month in May. However, the rate of growth moderated slightly due to manufacturing weakness, which offset another robust month of activity in the services sector.

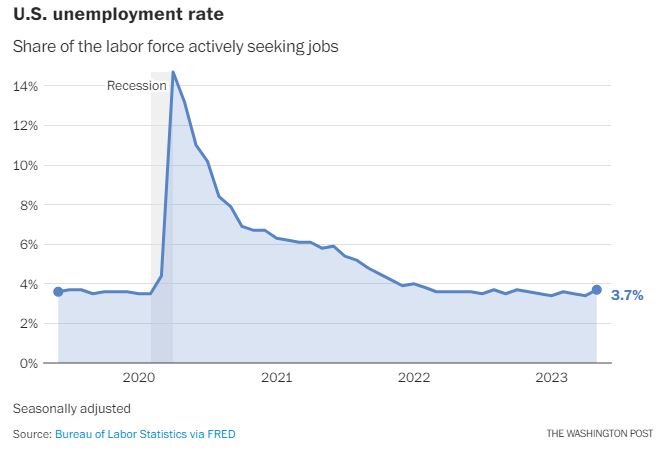

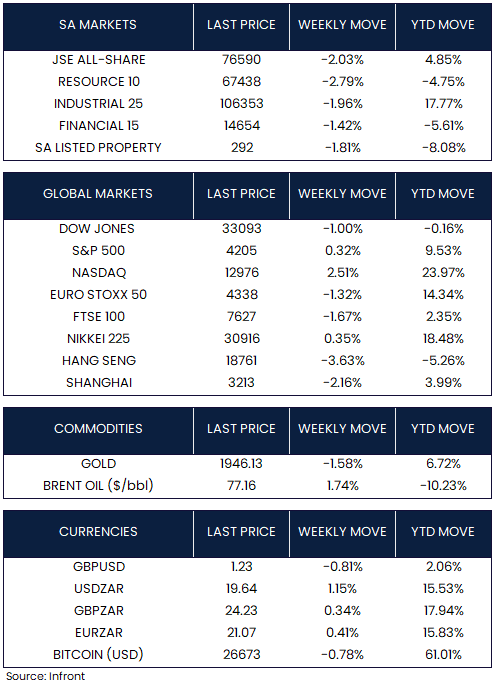

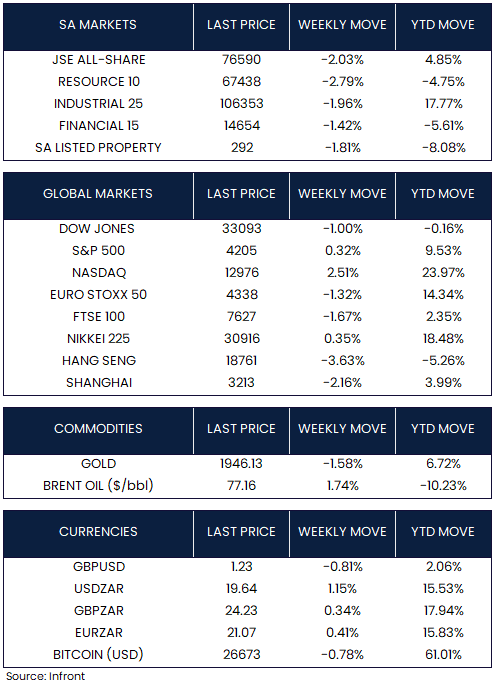

On the market front, global indices ended the week mixed. The S&P 500 Index climbed +0.32%, while the Dow Jones slipped -1.00%. The technology-heavy Nasdaq Composite outperformed and ended the week up +2.51% as a rush for artificial intelligence–focused stocks sparked a U.S. rally late in the week. Notably, shares of chipmaker NVIDIA surged +24% on Thursday after the company beat consensus first-quarter earnings expectations by a wide margin and raised its profit outlook. Shares in Europe fell -1.32% (Euro Stoxx 50) over the week while the FTSE 100 declined -1.67%.

Chinese equities fell over the week following a series of discouraging indicators in recent weeks that indicated a slowdown in their economic recovery. The Shanghai index ended the week down -2.16% as a result. In Japan, the Nikkei 225 gained +0.35%. Gold dipped -1.58% while Brent Oil rose +1.74% over the week.

Market Moves of the Week:

Inflation in South Africa cooled in April, with headline inflation easing to 6.8% y/y (expectations: 7% y/y) from 7.1% y/y in March. This was the lowest headline inflation print since May last year. Core inflation edged higher (from 5.2% y/y to 5.3%) in April. Despite a slight decrease in food prices, which slowed to 13.9% in April, the food and non-alcoholic beverages category continued to be the primary contributor to inflation for the month. Transport experienced its ninth consecutive month of disinflation (7.6% y/y), with fuel prices easing to 5% – the lowest reading since March 2021. Although consensus is for inflation growth to start declining going forward, the weakening rand as well as load shedding may keep inflation risks elevated.

Following Wednesday’s inflation print, the South African Reserve Bank (SARB) rose rates to the highest level since 2009 on Thursday, saying the restrictive policy is necessary to curb inflation. The repo rate rose to 8.25% after a 50 basis point hike was declared by governor Lesetja Kganyago. The decision will further burden an economy already facing unprecedented electricity shortages, with growth projected to be a mere 0.3% this year. Markets are suggesting that the SARB’s hiking cycle is now complete, however, risks continue to be tilted toward further tightening on account of continued rand depreciation.

The rand sank to a record low against the U.S. dollar ($/R 19.51) on Thursday after the hawkish statement by the SARB’s Monetary Policy Committee and subsequent comments by the Governor painted a gloomy outlook for the currency. The rand fell sharply by over 2% in response to the decision. The local currency is significantly oversold at these levels, but negative sentiment might keep it that way for some time.

President Cyril Ramaphosa insisted this week that South Africa (SA) will remain non-aligned towards Russia or Ukraine. The country has faced pressures from some of its main trading partners to change course, however, the president remains persistent that SA won’t be taking sides in the conflict.

The JSE (-2.03%) fell over the week as negative sentiment took hold. All sectors ended in the red, with Resources (-2.79%) and Industrials (-1.96%) taking the biggest hits. The rand depreciated against the U.S. dollar over the week, rising to R19.64/$ from last week’s R19.42/$ level.

Chart of the Week:

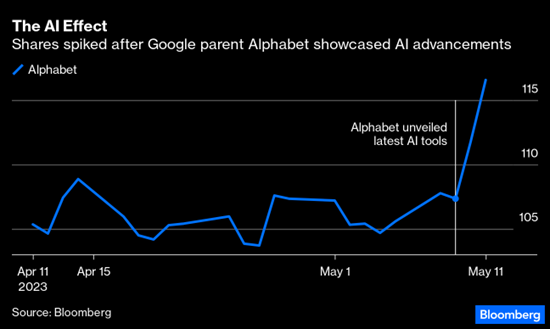

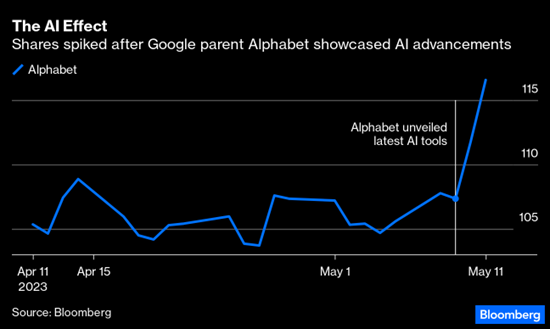

Google parent Alphabet Inc. on May 10 unveiled a slew of AI-related projects and touched on $122 billion in a few trading hours. The AI phenomenon, which executives around the world have variously likened to the emergence of the internet and the iPhone, has administered what now looks like a historic shock to markets that even rivals the scenes when the pandemic hit three years ago.

Source: Bloomberg

Week in Review: Debt Ceiling Talks Stall

Market concern eased late in the week, with investors less worried that the U.S. Department of the Treasury will default on its debt in early June. On Thursday, investors were buoyed by comments from Speaker of the House of Representatives Kevin McCarthy, who said he hopes to have legislation raising the debt cap on the House floor in the week ahead. Then on Friday morning the high stakes talks over raising the debt limit appeared to stall before resuming in the Capitol on Friday evening. One of the toughest sticking points in the talks has been the question of spending caps, a key Republican demand but a red line for a significant bloc of Democrats.

US retail sales rose 0.4% in April, after falling by 0.7% the prior month and below consensus expectations at its slowest year-over-year pace (1.6%) since early in the pandemic. Core sales, which strip out sales of autos, gasoline, building supplies and food services, rose 0.7%, beating expectations for a 0.3% rise while industrial production rose 0.5% in April, well above expectations, driven in part by increased auto manufacturing.

Shares in Europe advanced amid optimism that interest rates could be close to peaking and that the U.S. would avoid a debt default. In local currency terms, the pan-European STOXX Europe 50 Index ended the week 1.79% higher while the UK’s FTSE 100 Index was flat on the week.

The European Commission raised its forecasts for eurozone economic growth this year and next, while predicting that inflation would remain stubbornly high. The latest projection calls for gross domestic product (GDP) to expand 1.1% this year and 1.6% in 2024, up from the previous forecast for growth of 0.9% and 1.5%, respectively.

The UK’s unemployment rate crept up to 3.9% in the three months through March, from 3.8% in the three months through February, the national statistics office said. However, wage growth showed little signs of easing over the period. Average weekly pay excluding bonuses rose to 6.7% compared with a year earlier, from 6.6%.

Ukrainian President Volodymyr Zelenskyy arrived Saturday in Japan for diplomatic talks with leaders of the world’s most powerful democracies participating in the Group of Seven (G-7). The G-7 have so far decided against imposing a near-outright ban on exports to Russia and will instead look to widen existing sanctions and restrictions on key Russian sectors, such as manufacturing, construction, transportation and business services.

According to the final presidential election results announced by the Supreme Election Court, the incumbent President Recep Tayyip Erdogan received 49.5% of the vote in the first round of voting in Turkey’s presidential election last Sunday versus 44.9% for his main opponent, Kemal Kilicdaroglu. The voter participation rate was high, as expected, with about 88%, or over 56 million voters, casting ballots. Erdogan is expected to defeat opposition leader Kemal Kilicdaroglu in the runoff between the two on Sunday, 28 May.

U.S. equities were higher this week, with the S&P 500 Index gaining 1.65%, and the Nasdaq Composite gaining 3.04%. It was the best weekly performance since March for both indexes, while the Dow added 0.38%.

Japanese equities reached their highest levels this week since its equity market burst in 1989. Improved corporate governance, solid domestic earnings and renewed interest on the part of foreign investors have bolstered share prices so far in 2023 while Q1 GDP growth of 1.6% doubled economists’ forecasts. The benchmark Nikkei 225 Index gained 4.8% for the week.

In China, official data showed industrial output, retail sales, and fixed asset investment grew at a weaker-than-expected pace in April from a year earlier. Nevertheless, the Shanghai Stock Exchange Index managed a gain of 0.34% for the week while in Hong Kong, the benchmark Hang Seng Index declined 0.90%.

Market Moves of the Week:

In South Africa (SA), Eskom’s warning on Thursday to brace for the grim prospect of having to slash as much as 8,000 megawatts from the grid to prevent a complete blackout will put further pressure on SA’s already fragile economic growth prospects this year. Loadshedding (rotational power cuts) has been estimated by the South African Reserve Bank to slash as much as two percentage points from economic growth.

South Africa’s unemployment rate in the first quarter of 2023 was recorded at 32,9 %, among the highest in the world. According to the Quarterly Labour Force Survey (QLFS), this is an increase of 0,2 of a percentage point compared to the fourth quarter of 2022. The youth remained vulnerable in the labour market, with the first quarter of 2023 results showing that the total number of unemployed youth (15-34 years) increased by 241 000 to 4.9 million, while there was an increase of 28 000 in the number of employed youth to 5.6 million during the same period.

S&P Global Ratings has given SA the benefit of the doubt by keeping the outlook on the country’s rating at stable, after a surprise drop in early March when it moved it from positive. S&P did not issue a report with the announcement, which came late on Friday.

The announcement of Eskom’s winter plan, which showed that rotational power cuts could be ramped up to Stage 8 as well as last weeks accusations of SA selling weapons and ammunition to Russia, continued to weigh on sentiment towards the rand with the currency touching a fresh low on Friday, before closing at R19.42 against the US dollar.

The JSE all-share index was marginally down on the week (-0.2%), with all the major sectors softer, apart from rand hedge counters that are benefiting from the weaker rand.

In the week ahead, the SA Reserve Bank (SARB) is also expected to announce yet another interest rate hike of between 25 and 50 basis points. A 50-basis point hike has become more likely given the recent sell-off in the rand as well as consumer inflation that remains stubbornly above the SARB’s target range of 3%-6%.

Chart of the Week:

The debt ceiling, set by Congress, caps how much the U.S. can borrow to pay for its remaining bills. As per the chart above the national debt has grown significantly since the early 1980s under both Republican and Democratic administrations. The largest percentage increases to the debt occurred under Presidents Ronald Reagan and George W. Bush, both of whom enacted tax cuts that led to large deficits. Flashpoints that greatly contributed to the debt over the past 50 years include the wars in Iraq and Afghanistan, the 2008 financial crisis and the more recent 2020 COVID-19 pandemic.

Week in Review: U.S. Inflation Moderates

Following a report released by the Labor Department on Wednesday, the U.S. consumer price index (CPI), a widely recognized measure of inflation that assesses the cost of a diverse range of goods and services, showed a monthly increase of 0.4%. This figure aligns with the estimated value provided by Dow Jones. On an annual basis, the increase amounted to 4.9%, slightly lower than the projected 5% and marking the slowest pace since April 2021. In comparison, the annual rate in March stood at 5%. Additionally, core CPI, which excludes the volatile food and energy categories, saw a monthly increase of 0.4% and a 5.5% increase from the previous year, in line with expectations.

In a separate report this week, the Labor Department revealed that the producer price index (PPI), a metric that measures prices for final demand goods and services, experienced a 0.2% increase, slightly below the Dow Jones estimate of 0.3%, following a 0.4% decline in March. Excluding food and energy, the core PPI also rose by 0.2%, aligning with expectations. On an annual basis, the headline PPI increased by 2.3%, down from 2.7% in March and representing the lowest reading since January 2021. However, despite the PPI rise being less than expected, the services index displayed a notable increase of 0.3%, the biggest move since November 2022, according to the report from the Bureau of Labor Statistics.

The Bank of England raised interest rates by 0.25% to reach 4.5% in response to persistent inflationary pressures, indicating the need for further policy tightening. Alongside this decision, the bank expressed confidence in the United Kingdom’s ability to avoid a recession this year. This marks the 12th consecutive increase in borrowing costs by the monetary policy committee (MPC), representing the bank’s most assertive rate-hiking cycle since the 1980s, driven by the goal of curbing double-digit inflation in the UK. Despite a slight decrease in March that fell below expectations, the inflation rate has remained stubbornly high at 10.1%, the highest among G7 nations. The Bank of England has adjusted its inflation forecast, now projecting it to surpass 5% by year-end, compared to the below 4% estimate made in February. This adjustment is attributed to elevated food prices, experiencing their fastest annual growth since 1977, and a resilient job market. Currently, market expectations point to the Bank of England’s terminal rate ranging from 4.75% to 5%.

China experienced its slowest consumer inflation growth in over two years in April, with the consumer price index (CPI) rising by 0.1 percent year-on-year, according to the National Bureau of Statistics (NBS). This reading represents the lowest rate since February 2021. In March, China’s inflation rate eased to 0.7 percent after reaching a recent peak of 2.8 percent in September. Core inflation, which excludes food and energy, remained unchanged at 0.7 percent year-on-year and 0.1 percent month-on-month. On the other hand, the producer price index (PPI), which indicates the prices charged by factories to wholesalers, experienced its most significant decline since May 2020. It fell for the seventh consecutive month, missing expectations, with a year-on-year decrease of 3.6 percent in April, compared to a 2.5 percent drop in March.

The performance of major indexes was mixed for the week, coinciding with the conclusion of first-quarter earnings reports. The Nasdaq Composite, which has a heavy focus on technology stocks, outperformed its counterparts, recording an increase of +0.4%. This was largely attributed to Google’s parent company, Alphabet, which announced a new artificial intelligence-based search platform. On the other hand, the Dow Jones Industrial Average, which is more narrowly focused, struggled and was weighed down by Disney’s disappointing report of a decline in subscribers to its streaming platform, Disney+. As a result, the index declined by -1.1%. Similarly, the S&P 500 experienced a decrease of -0.29% over the week. In Europe, the Euro Stoxx 50 and FTSE 100 indexes also ended the week with negative movements of -0.52% and -0.31% respectively. Across Asian-Pacific markets, there was a mixed trend. Hong Kong’s Hang Seng Index experienced the most significant decline with a weekly movement of -2.12%, followed by mainland China’s Shanghai Composite, which fell by 1.86%. In contrast, Japan’s Nikkei index recorded positive gains of 0.79% for the week.

Market Moves of the Week:

According to Stats SA, South Africa’s manufacturing production declined by 1.1% year-on-year in March 2023, following a revised 5.6% drop in February. However, there was a positive development in the month-on-month figures, with a 4.0% increase in seasonally adjusted manufacturing production for March 2023. In comparison, February 2023 experienced a month-on-month change of -1.3%, while January 2023 saw a modest increase of 0.3%. Additionally, mining production also contracted, shrinking by 2.6% year on year in March, following a revised 7.6% dip in February. This marked the 14th consecutive month of contraction in mining activity, although it was milder than market estimates of a 7.3% decline. The decline in mining was primarily attributed to electricity supply constraints and logistical bottlenecks.

The United States has accused South Africa of engaging in a covert naval operation to supply arms to Russia, which has intensified a foreign policy crisis for President Cyril Ramaphosa. This accusation raises concerns about South Africa’s connections with the Kremlin and its stance on the Ukraine war. Reuben Brigety, the U.S. ambassador to South Africa, stated in an interview with local media on Thursday that the U.S. had reason to believe that weapons and ammunition were loaded onto the Lady R, a Russian vessel under sanctions, during its docking at the Simon’s Town naval dockyard near Cape Town in December. As a result of these allegations, there was a sell-off in the South African rand and bonds, with the rand reaching a record low on Friday at R19.51 to the U.S. dollar, surpassing its previous low of R19.35 in April 2020. In response, the presidential spokesman, Vincent Magwenya, acknowledged that a Russian vessel had indeed docked at Simon’s Town last year but emphasised that there was currently no evidence to suggest that it departed with South African weapons. However, U.S. ambassador Reuben Brigety has offered an unreserved apology after admitting to crossing the line during a briefing held on Thursday, as expressed by the Department of International Relations and Cooperation (Dirco) in a diplomatic démarche on Friday.

During the week, the JSE all-share index experienced a modest gain of +0.25%, primarily driven by notable gains in the industrial sector (+2.67%). However, this positive performance was counterbalanced by declines in the property, financial, and resource industries, which saw drops of -3.12%, -2.93%, and -1.50% respectively. Meanwhile, the South African rand showed signs of recovery from its weakest level ever, but still reached a record closing low of R19.33. It experienced a significant decline of 4.98% this week, marking the largest weekly drop in nine months.

Chart of the Week:

Persistent Deceleration in Consumer Prices: Year-on-Year Growth Slows to 4.9% for the 10th Consecutive Month, Reflecting the Impact of the Federal Reserve’s Rate Tightening Measures