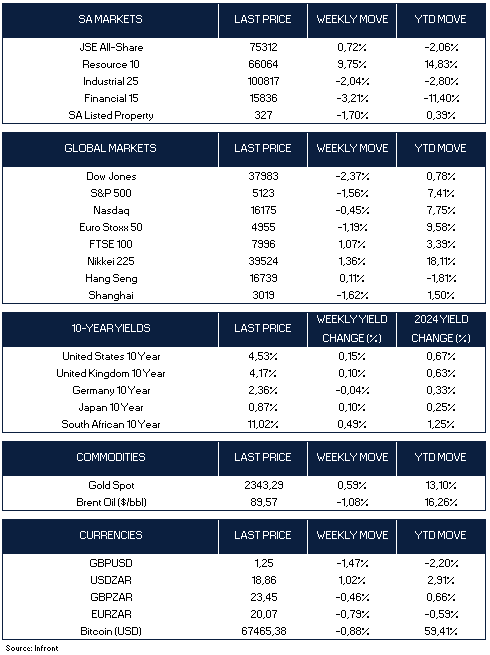

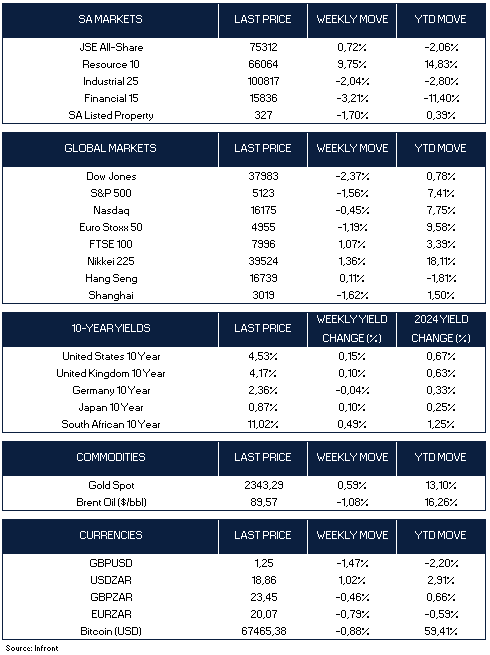

U.S. stock markets saw a decline for the week due to increased concerns about conflict in the Middle East and ongoing inflation worries, leading to higher long-term Treasury yields. Growth stocks performed better than value shares, with interest rate-sensitive sectors like real estate investment trusts (REITs), regional banks, housing, and utilities weighing down on value stocks.

Investors reacted to three consecutive hotter-than-expected CPI readings by revising their expectations for rate cuts by the US Federal Reserve downward. Initially, they anticipated two to three rate cuts before year-end, with the first expected in July. However, following the 0.4% month-on-month increase in both headline and core March CPI, the market is now pricing in only one to two cuts, with the first not fully priced in until September.

Following the CPI data, US 10-year Treasury note yields spiked over 20 basis points and remain elevated at 4.53%. Despite this, Fed officials emphasised that the central bank is not rushing to adjust policy and prefers to wait for more data. The next crucial inflation data point is core PCE on 26 April.

Geopolitical tensions are on the rise as the USA warns of an imminent attack on Israel by Iran or its proxies. In response, the US Embassy in Jerusalem has issued a security alert and imposed travel restrictions on US government employees and their families within Israel, restricting travel beyond their respective cities. The USA vows unwavering support for Tel Aviv’s defence in the face of these threats.

All major U.S. equity markets ended the week lower. The Dow Jones Industrial Average down 2.37%, followed by the S&P 500 down 1.56%. The tech heavy NASDAQ composite faired best, still in negative territory, down 0.45%.

In February, UK GDP growth increased by 0.1% month-on-month, aligning with consensus expectations. January’s growth rate was also revised upward to 0.3%. Goldman Sachs forecasts Q1 GDP growth at 0.4%, with an annual growth projection for 2024 at 0.6%, surpassing consensus estimates of 0.3% and the Bank of England’s forecast of 0.2%. In other news, former Federal Reserve Chair Ben Bernanke conducted a review of the Bank of England’s economic model, identifying significant shortcomings such as outdated software and makeshift solutions that hindered the bank’s ability to generate alternative scenarios quickly. The BOE’s failure, along with other central banks, to predict inflationary pressures from pandemic-era economic disruptions and the Ukraine conflict prompted the review.

At its meeting on Thursday, the European Central Bank (ECB) maintained its interest rates unchanged. However, ECB President Christine Lagarde acknowledged that some members of the Governing Council were ready to reduce interest rates at this week’s meeting, although a majority preferred to wait until June for more data. Lagarde emphasised that the decision to lower rates is not contingent on actions taken by the Federal Reserve. European natural gas futures surged on Thursday to their highest level in over two weeks following renewed attacks by Russia on Ukrainian energy facilities. Benchmark futures spiked by as much as 7.1%, reversing the losses from the previous two days.

The FTSE 100 closed the week in positive territory, up 1.07% while the Euro Stoxx 50 closed the week lower, down 1.19%.

Japan’s stock markets saw gains throughout the week, with the Nikkei 225 Index rising by 1.36% and the broader TOPIX climbing 2.1%. Investors closely monitored the Japanese yen, which remained near a 34-year low, anticipating potential interventions by the country’s authorities to bolster the currency. In March, Japan’s domestic Corporate Goods Price Index (CGPI) saw a slight increase of +0.2% month-on-month. Year-on-year, the index also rose gradually by +0.8%.

China’s headline Consumer Price Index (CPI) inflation decreased, while Producer Price Index (PPI) deflation widened slightly in year-over-year terms. The decline in headline CPI inflation was driven by moderation in food prices and tourism-related services prices, likely due to reduced demand after the Lunar New Year. The widening of PPI deflation was primarily attributed to weak upstream sector prices. With soft Q2 inflation data, full-year 2024 forecasts for headline PPI inflation have been revised down to -1.1% year-on-year (previously -0.3% year-on-year), while the headline CPI inflation forecast remains at 0.4%, below consensus. China’s March trade growth surprised to the downside, the trade surplus in March was $58.6bn below consensus. Chinese stocks experienced a retreat, as weak inflation data highlighted the subdued demand prevailing in China’s economy. The Shanghai Composite closed the week lower down -1.62%, while Hong Kong’s Hang Seng Composite ended marginally higher, up 0.11%.

Market Moves of the Week

In local political news, the Social Research Foundation’s latest poll indicates a significant shift in support, with Jacob Zuma’s MK party gaining up to 13% of the vote while the ANC’s support slips to just 37%. Analysts suggest that such an outcome could compel the ANC to form a coalition with a larger party to maintain control of the country’s economy, potentially leading to policy concessions and changes in appointments. There’s also speculation that a poor election performance could prompt the ruling party to remove President Cyril Ramaphosa from office before the end of his term, causing concern among investors. The Independent Electoral Commission (IEC) has taken steps to challenge Jacob Zuma’s candidacy in the elections, potentially sparking public unrest if a negative ruling ensues.

These political developments have led to volatility in the currency and bond market, with the South African Rand depreciating by 1.02% against the US Dollar, closing the week at R18.86/$. The SA 10-year bond yields spiked 0.49% this week, a major move, pushing yields up to 11.02%. Investors are grappling with the implications of these events for local assets prices and forward-looking economic policy.

In share specific news, Transaction Capital (TCP) recently unbundled and listed their used-car business, We Buy Cars Holdings Ltd (WBC), on the JSE on 11 April 2024. WBC, the first new listing on the JSE for the year, debuted at R20 per share, surpassing its initial public offering price of R18.75 per share. This resulted in a total market capitalisation of R8.34 billion ($444 million) at the opening. The JSE anticipates approximately ten listings in 2024, including companies like cannabis firm Cilo Cybin Holdings and the highly anticipated Coca-Cola Beverages Africa. These listings could provide a much-needed boost to the JSE, which has faced challenges in attracting listings in recent years.

On the local equity front, the Resource sector caught a major bid pushing the JSE ALSI into positive territory for the week, up 0.72%. Resources ended the week up 9.75%. Both Industrials and Financials were lower, down 2.04% and 3.21% respectively. The SA Listed Property sector also ended the week down 1.70%.

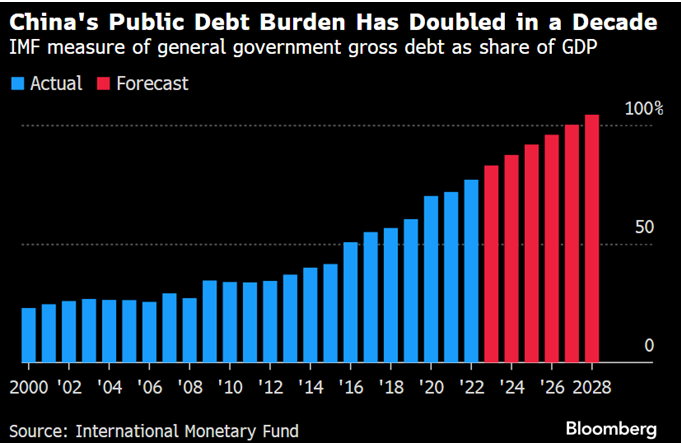

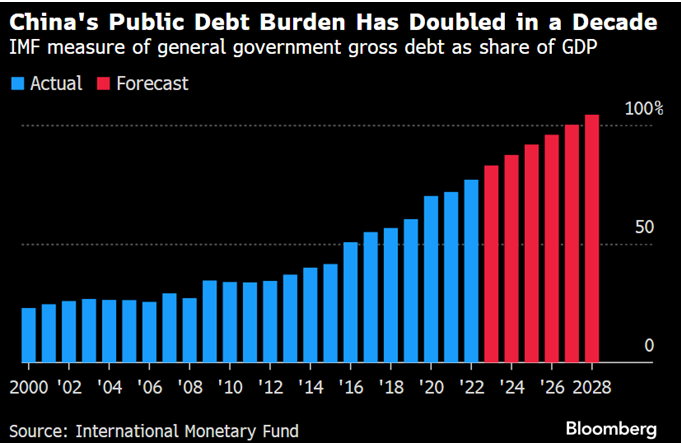

Chart of the Week

The International Monetary Fund notes a steady increase in China’s public debt-to-GDP ratio over the last decade. Projections anticipate a further rise as China aims to stimulate the economy amid a slowdown driven by the real estate sector. This growing debt has sparked concerns among rating agencies, with Fitch Ratings revising China’s outlook from stable to negative. Source: International Monetary Fund & Bloomberg.