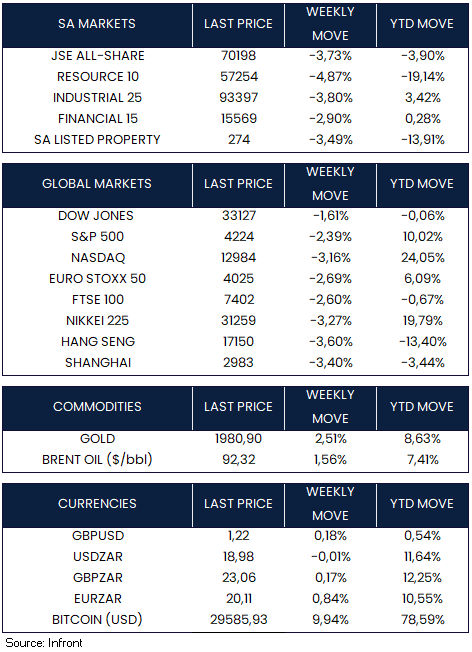

Hightened geopolitical tensions and a surge in long-term bond yields to their highest level in 16 years had a negative impact on investor sentiment this week. The S&P 500 Index experienced its most significant weekly decline in a month. Among major U.S stock indices, the Nasdaq Composite Index was hit the hardest and came close to entering bear market territory, finishing the week down by 19.91% from its early 2022 peak. In connection with these developments, growth stocks underperformed value stocks.

Federal Reserve Chair Jerome Powell indicated that the U.S. central bank is leaning towards keeping interest rates stable at its upcoming meeting, while remaining open to the possibility of raising rates in the future if the economy continues to show strength. This aligns with market expectations that the Fed will likely skip a rate increase for the second consecutive meeting scheduled for October 31 and November 1.

In the United States, the latest economic data looks positive. Retail sales for September exceeded expectations with a strong 0.7% increase, and core retail sales also rose by 0.6%. Industrial production and manufacturing production both outperformed expectations, with increases of 0.3% and 0.4% respectively in September. Business inventories for August also did better than expected.

However, in the housing market, housing starts saw a 7.0% increase, slightly below what was anticipated, and the growth rate for August was revised downward. Building permits, on the other hand, experienced a 4.4% decrease in September, surpassing expectations.

There were geopolitical tensions in the Middle East during President Joe Biden’s visit to Israel, following an explosion at a Gaza hospital. This incident led to the cancellation of a summit with leaders from Jordan, Egypt, and the Palestinian Authority, who blamed Israel for the explosion. Anti-Israel protests erupted in various cities in the region. The Middle East uncertainty pushed oil prices higher, Brent Crude Oil was up 1.56%, and closed the week at $92.32 bbl.

In the United Kingdom, September’s inflation figures exceeded consensus expectations, with increases in services, core, and headline inflation. Core inflation rebounded to 0.41% on a monthly basis, up from last month’s 0.12%. The rise in services inflation, driven in part by volatile factors, raised concerns about inflation’s persistence. Despite this, the data, along with wage information and anticipated unemployment rates, suggest that the Bank of England (BoE) will likely maintain its current monetary policy at its November meeting.

Various European Central Bank (ECB) officials, including ECB President Christine Lagarde, Robert Holzmann from Austria, and Yannis Stournaras from Greece, have drawn attention to the inflationary risks arising from the increase in oil prices due to Middle East conflicts. Additionally, ECB Chief Economist Philip Lane mentioned in an interview with a Dutch newspaper that the central bank might need to wait until spring to have confidence that inflation is moving toward the 2% target. European government bond yields have generally risen as investors consider the possibility that interest rates might stay elevated for an extended period because of persistent inflation pressures.

In the third quarter, China’s economy showed resilience thanks to increased government support and rising consumer spending. Gross domestic product (GDP) grew by 4.9% year-on-year, surpassing expectations and improving from the previous quarter. In September, retail sales surged by 5.5%, the highest reading since May, thanks to government stimulus measures and stronger consumer spending.

However, the property market remained a drag on the overall performance. China’s housing market faced its steepest decline in nearly a year, raising concerns about the effectiveness of Beijing’s efforts to revive the sector. In September, new-home prices in 70 cities dropped by 0.3%, slightly sharper than the decline in August. This was the most significant month-on-month decline since October 2022. To support the economy, China injected a record amount of liquidity into its financial system through short-term monetary tools, signalling the government’s commitment to keeping funding costs low.

Concerns about China’s property market outweighed the stronger GDP figures, resulting in a sharp decline across Chinese equity markets. The Hang Seng Composite Index declined 3.60%, while the Shanghai Composite faired marginally better, but still declined 3.40% this week.

Meanwhile, Japan’s exports showed a year-on-year increase for the first time in three months, while imports continued to decline sharply. This resulted in a modest trade surplus of ¥62.4 billion. Importantly, export volume turned slightly positive for the first time since February 2022, indicating a potential bottoming out of Japan’s exports. Inflation in Japan fell below 3% for the first time in over a year, aligning with the Bank of Japan’s view that upward pressure on prices is peaking, which may impact expectations of near-term changes in negative interest rates. Japan’s Nikkei 225 closed the week lower, down 3.27%.

Risk off sentiment filtered through developed market equity markets this week, resulting in a sea of red. US stocks end lower, with the S&P 500 down 2.39%, the Dow Jones Industrial Average was the most resilient, but still closed the week down 1.61%. Growth stocks took the most pain, with the tech heavy Nasdaq Composite closing, down 3.16%. Euro Stoxx 50 ended the week lower, down 2.69%, the FTSE 100 also down this week, 2.60%.

Market Moves of the Week:

In South Africa, the latest economic data shows that headline inflation increased from 4.8% year-on-year in August to 5.4% year-on-year in September, which was in line with what experts had predicted. On the other hand, core inflation, which excludes volatile factors, decreased from 4.8% year-on-year to 4.5% year-on-year, surpassing the consensus forecast of 4.7%. The primary reason behind the rise in headline inflation was increased petrol prices, while food inflation remained relatively stable on an annual basis.

In other news, South African lawmakers have approved the nomination of Kholeka Gcaleka as the new Public Protector, a position previously held by Busiswe Mkhwebane. Mkhwebane was suspended a year ago and impeached last month.

The local equity market took direction from global peers, with the JSE ALSI ending the week down 3.73%. All sectors were weaker, with Resources leading the market lower, down 4.87%. Surprisingly the Rand was relatively flat this week against the US Dollar, although intra-week volatility was high. USD/ZAR closed the week at R18.98/$.

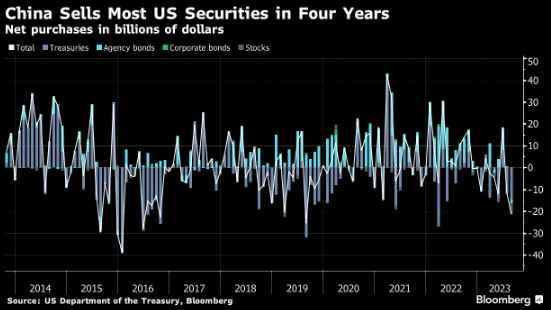

Chart of the Week:

Chinese investors made their largest sale of US bonds and stocks in four years, raising speculation that Chinese authorities might be taking this action to safeguard the weakening Yuan. Most of the $21.2 billion in sales included US Treasuries and equities, with Chinese funds also reducing their holdings of agency debt. This substantial divestment highlights the complexity of China’s economic and financial strategies and their potential effects on global markets.

Source: US Department of Treasury, Bloomberg.