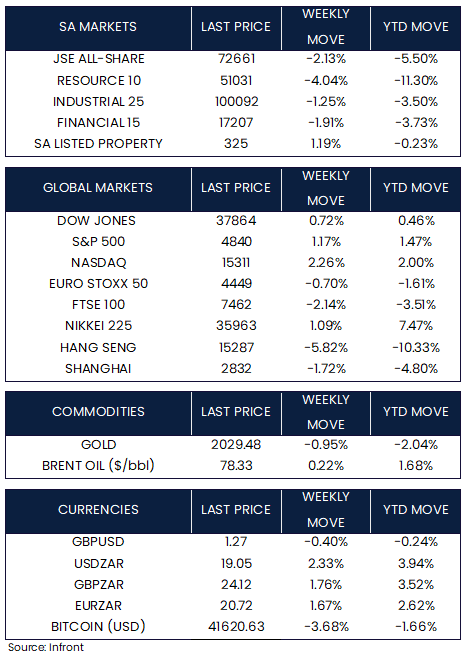

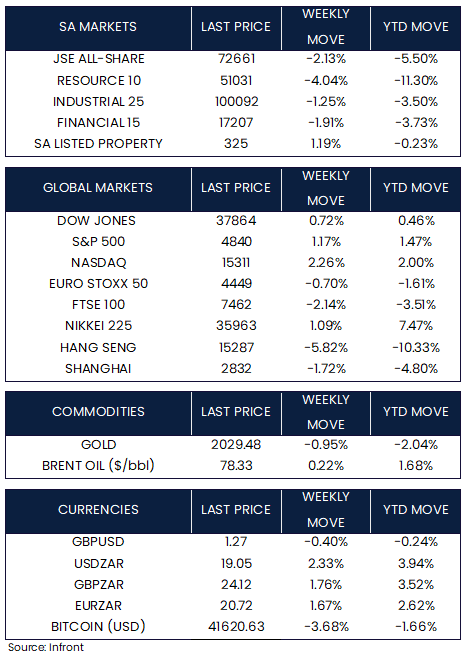

Despite experiencing upward momentum last week, the markets in 2024 have been characterised as restrained and somewhat uneven. This subdued trend is not entirely unexpected, especially following a robust rally in the final weeks of 2023. During the holiday-shortened week, U.S. stocks concluded on a positive note. The broad-based S&P 500 recorded a gain of 1.17%, while the Dow Jones saw a more modest advance of 0.72%. Notably, information technology stocks outperformed, benefiting from a rally in semiconductor shares, thereby contributing to the Nasdaq’s robust gain of 2.26%.

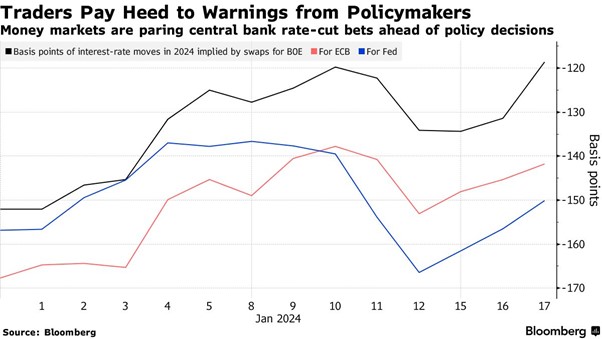

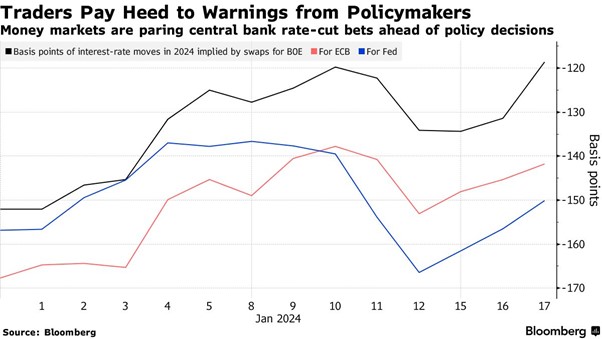

Expectations for rate cuts in 2024 experienced a significant decline over the week. The likelihood of a rate cut in March dropped notably from 81.0% to 47.4%. This shift appears to be influenced, by comments made on Tuesday by Fed Governor Christopher Waller. During a virtual conference, Waller expressed the view that there was no compelling reason to expedite or cut rates swiftly, citing the healthy state of the economy. The yield on the benchmark US 10-year note increased by 16 basis points to reach 4.17%, driven by the market adjusting and scaling back aggressive rate cut expectations.

In December, U.S. retail sales exceeded expectations, with a 0.6% increase driven by motor vehicle and online transactions. Year-over-year, retail sales saw a notable 5.6% rise, outpacing the 3.4% annual inflation rate. However, U.S. factory production experienced minimal growth of 0.1%, hampered by declines in machinery and electrical equipment output. Excluding motor vehicles, manufacturing output decreased by 0.1%. The manufacturing sector, constituting 10.3% of the U.S. economy, faces challenges attributed to a cumulative 525 basis points increase in interest rates by the U.S. central bank since March 2022.

U.K. inflation unexpectedly rose to 4% year-on-year in December, defying market expectations for an early Bank of England rate cut. This increase was influenced by higher alcohol and tobacco prices, marking the first increase in the annual consumer price index since February 2023. Month-on-month, the headline CPI rose by 0.4%, above a consensus forecast of 0.2% and up from -0.2% in November. Meanwhile, core inflation, excluding volatile energy and food prices, remained steady at 5.1%.

Additional data presented mixed signals for policymakers in the UK. Wages, excluding bonuses, experienced a slowdown to their weakest pace in almost a year, showing a 6.6% increase from year-ago levels during the three months through November. Conversely, retail sales volumes in December were notably weaker than anticipated, witnessing a sequential decline of 3.2%, marking their most significant month-over-month drop since January 2021.

European Central Bank (ECB) President Christine Lagarde stated that while the ECB is working towards its 2% inflation target, definitive success has not been achieved. Lagarde indicated a likelihood of interest rate cuts in the summer, deviating from the market’s anticipation of a spring adjustment. In response to Bloomberg’s inquiry at the World Economic Forum in Davos about Governing Council members’ expectations for a midyear rate cut, Lagarde cautiously agreed, emphasising that crucial wage-related information would influence policy decisions by late spring.

The pan-European STOXX Europe 50 Index concluded the week with a 0.70% decline, influenced by remarks from central bank policymakers that led financial markets to reduce expectations for an early reduction in interest rates. Similarly, the UK’s FTSE 100 Index also concluded the week lower, experiencing a decline of 2.14%.

In 2023, China’s economy achieved a growth of 5.2%, meeting the government’s official target. Despite this positive development, apprehensions persist surrounding the sustainability of growth momentum, exacerbated by a prolonged property crisis, sluggish consumer and business confidence, and a backdrop of global economic weakness. The National Bureau of Statistics in China reported a corresponding 5.2% increase in the gross domestic product (GDP) during the final three months of 2023, with a quarterly growth rate of 1.0%, demonstrating an improvement from the third quarter’s 0.8% expansion.

In December, retail sales registered a lower-than-expected growth of 7.4% compared to the previous year, reflecting a decline from the 10.1% increase observed in November. Concurrently, year-on-year industrial production for December exhibited robust growth, reaching 6.8%, surpassing both consensus estimates and November’s 6.6%. Notably, this marked the sharpest increase since February 2022.

Meanwhile, property prices in 70 major Chinese cities decreased by 0.4% in December, maintaining a pace of decline not seen since 2015, according to data released on Wednesday and analysis conducted using Wind Information. The real estate sector, constituting well over 20% of China’s economy, has faced increased regulatory scrutiny due to developers’ heightened dependence on debt for growth. In 2023, investment in real estate witnessed a notable decline of 9.6%, whereas investments in infrastructure and manufacturing rose by 5.9% and 6.5%, respectively.

Stocks in China experienced a decline as recent indicators highlighted a subdued economic outlook. The Shanghai Composite Index fell by 1.72%, marking its eighth consecutive weekly drop. In Hong Kong, the benchmark Hang Seng Index saw a more substantial decline, plunging by 5.82%. In contrast, Japan’s stock markets demonstrated an upward trend for the week, with the Nikkei 225 Index gaining 1.09%, reaching a 34-year high.

Market Moves of the Week

According to the most recent data from Statistics South Africa (Stats SA), retail sales in South Africa have continued to experience a decline. Stats SA reported a year-on-year decrease of 0.9% in retail trade sales for November 2023. The primary contributors to this downturn were retailers in the hardware, paint, and glass sectors, as well as those in textiles, clothing, footwear, and leather goods. Additionally, retail trade sales saw a 0.7% decline in the three months ending November 2023 compared to the corresponding period in the previous year.

During the week, the JSE All-Share Index registered a decline of 2.13%, driven by losses in the resource sector at -4.04%, followed by financials at -1.91%, and the industrial sector at -1.25%. The only positive performer for the week was the property sector, which concluded with a weekly gain of +1.19%. Additionally, the South African rand depreciated during the week, closing at R19.05 against the US dollar.

Chart of the Week

Investors in the world’s largest bond markets are paying attention to cautionary signals from central banks and are reducing their expectations for significant interest-rate cuts this year. Those who were once nearly certain that the Federal Reserve would start an easing cycle in March now view the probability as no better than a coin toss.

Source: Bloomberg