U.S. equities saw their third consecutive week of losses, influenced by concerns over Middle East tensions and enduring high U.S. interest rates. Mega-cap technology shares were hit by rising rates, leading to a higher theoretical discount on future earnings. Additionally, the technology sector was impacted by a first-quarter revenue miss from ASML Holdings, reducing optimism regarding AI-related earnings. Despite this, the pullback so far has been contained, with the S&P 500 down about 5.5% from its recent high, following a 25% rally over the past 6 months. The U.S. economy, however, remains robust, supported by strong consumer demand and a healthy labour market, while global economic growth is stabilising.

Robust economic data seemed to increase concerns that the Federal Reserve would delay any interest rate cuts until September, if not until 2025. The Commerce Department reported that retail sales rose 0.7% in March, well above consensus expectations of around 0.3%, while February’s gain was revised upward to 0.9%. Fed Chair Jerome Powell stated at an economic conference that “recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence.” The retail sales data helped push the yield on the benchmark 10-year U.S. Treasury note to its highest intraday level since early November.

In Europe, Central Bank President Christine Lagarde expressed optimism about the region’s economy, suggesting that it is nearing the end of a period of stagnation that lasted over a year. Lagarde highlighted signs of recovery in the output of the 20-nation eurozone, noting particularly strong performance in the employment and job market. Numerous ECB policymakers at the IMF meeting reiterated that June was the likely target date for lowering borrowing costs, barring unexpected economic shocks.

The UK’s unemployment rate unexpectedly rose to 4.2%, compared to the revised 4.0% from the previous month. Meanwhile, UK inflation remained higher than anticipated at 3.2%, showing a slight decrease from the previous reading of 3.4%. Bank of England Governor Andrew Bailey suggested that the UK might consider lowering interest rates before the US, highlighting differing inflation dynamics between the two economies. Bailey noted more “demand-led inflation pressure” in the US compared to the UK, following concerns over strong price data in America the previous week.

Chinese economic indicators presented a mixed picture in March and the first quarter of 2024. While industrial production grew by 4.5% year-on-year, below market expectations, the house price index dropped by 2.2%, and retail sales saw a modest increase of 3.1%, falling short of projections. However, gross domestic product (GDP) expanded by 5.3% year-on-year in the first quarter, surpassing market expectations slightly, despite a slight slowdown from the previous quarter’s growth rate.

The International Monetary Fund (IMF) has made a cautious adjustment to its projections for this year, revising upwards to 3.2% citing the resilience of the US economy and positive developments in emerging markets. Despite this optimistic outlook, lingering worries persist regarding persistent inflationary pressures and geopolitical tensions, serving as a reminder of the delicate balance in the current economic landscape.

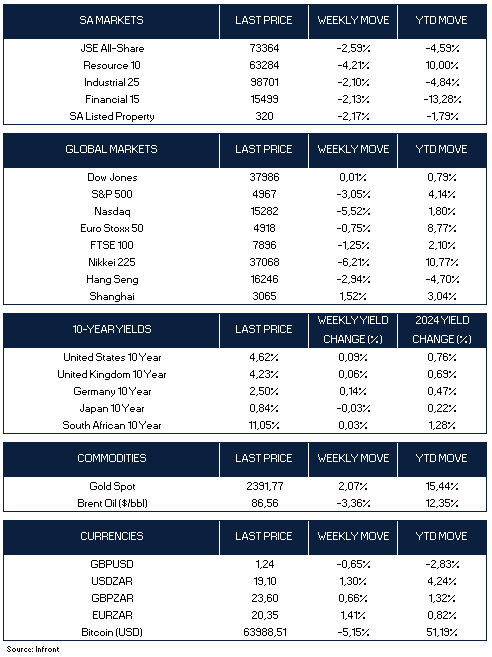

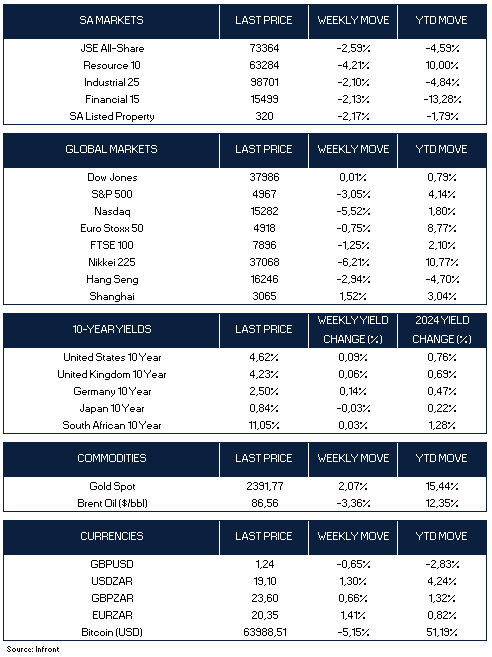

Global stocks closed lower after a volatile week as investors turned risk-averse. U.S. stocks faced challenges, with the Nasdaq (-5.52%) and S&P 500 (-3.05%) seeing significant declines, while the Dow Jones (+0.01%) managed to stay flat. European shares (Euro Stoxx 50) fell by -0.75%, and the FTSE 100 dropped by -1.25%. China’s Shanghai Composite experienced a -2.94% drop, and the Nikkei 225 fell by -6.21%. The standout performer was the China Shanghai Composite Index, which ended the week up +1.52%. Brent oil prices declined by -3.36%, while the gold price, known for its safe-haven status, increased by +2.07%.

Market Moves of the Week

Following a two-month upswing, South African headline inflation softened to 5.3% in March from 5.6% in February. The rate has held its ground between 5% and 6% since September 2023. At the same time, retail sales fell by 3.2% (month-on-month) in February, compared to an increase of 1.2% recorded in the prior month.

Finance Minister Enoch Godongwana revealed plans to manage the country’s debt burden by utilising future drawdowns from the Gold and Foreign Exchange Contingency Reserve Account. However, he ruled out using these funds for Eskom or Transnet, emphasising the need for fiscal consolidation through potential tax adjustments and expenditure cuts in the upcoming budget.

Meanwhile, Governor Lesethsha Kganyago of the South African Reserve Bank indicated that a new inflation target framework might not be finalised before the 29th of May election. On the energy front, Eskom announced a temporary halt to rotational power cuts, marking the longest respite since June 2022, and planned to restore a significant portion of generation capacity by the end of the week.

The JSE (-2.59%) tracked global peers lower this week after a significant selloff across all sectors, including the Resources (-4.21%), Industrials (-2.10%), and Financials (-2.13%) indices, all under pressure. The rand weakened throughout the week, closing at R19.10/$.

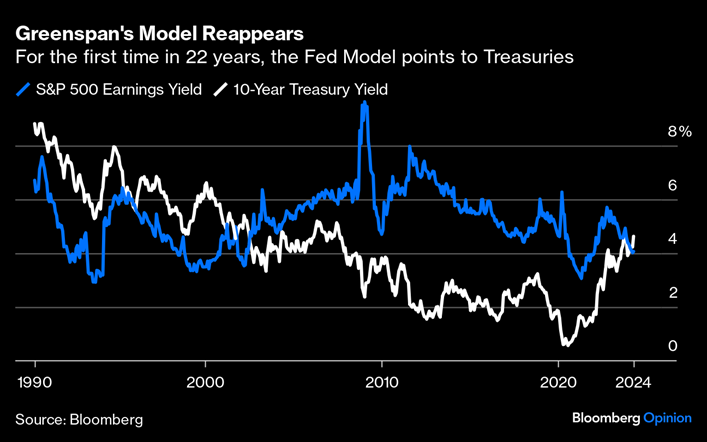

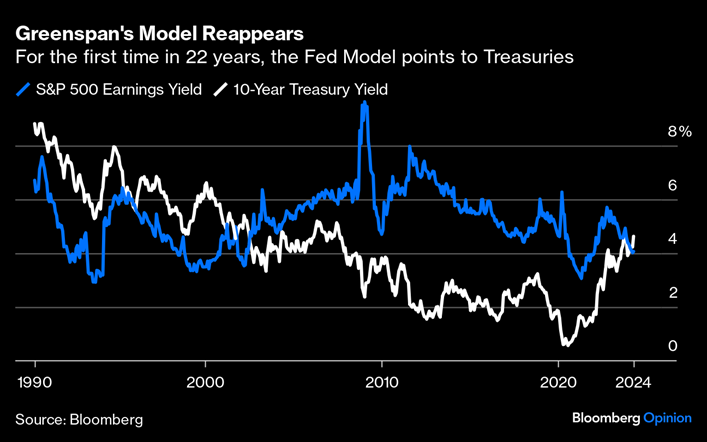

Chart of the Week

In the 1990s, the “Fed Model” gained popularity, correlating bond yields with stock earnings yields. However, its use has declined over the past two decades, coinciding with a period where this correlation broke down due to record low interest rates and central banks’ implementation of quantitative easing measures post the Global Financial Crisis. Recent trends indicate a return to the historical norm, with long Treasuries yielding more than stocks. This was once considered necessary to compensate for bonds’ limited growth potential. While not inherently alarming, this shift complicates asset allocation for a generation accustomed to stocks outperforming bonds.