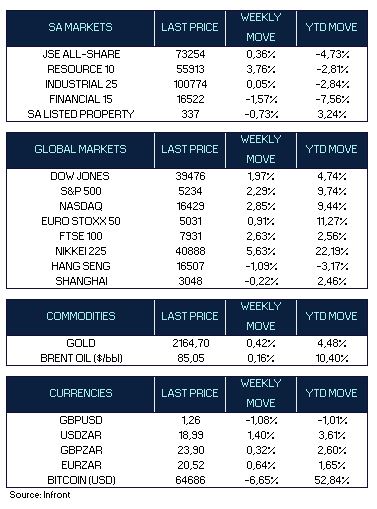

All three major U.S. indices moved higher last week, with the S&P 500 gaining 2.3%. The Dow was also up 1.97% for its best week since December. The Nasdaq was the outperformer of the three, gaining 2.85%.

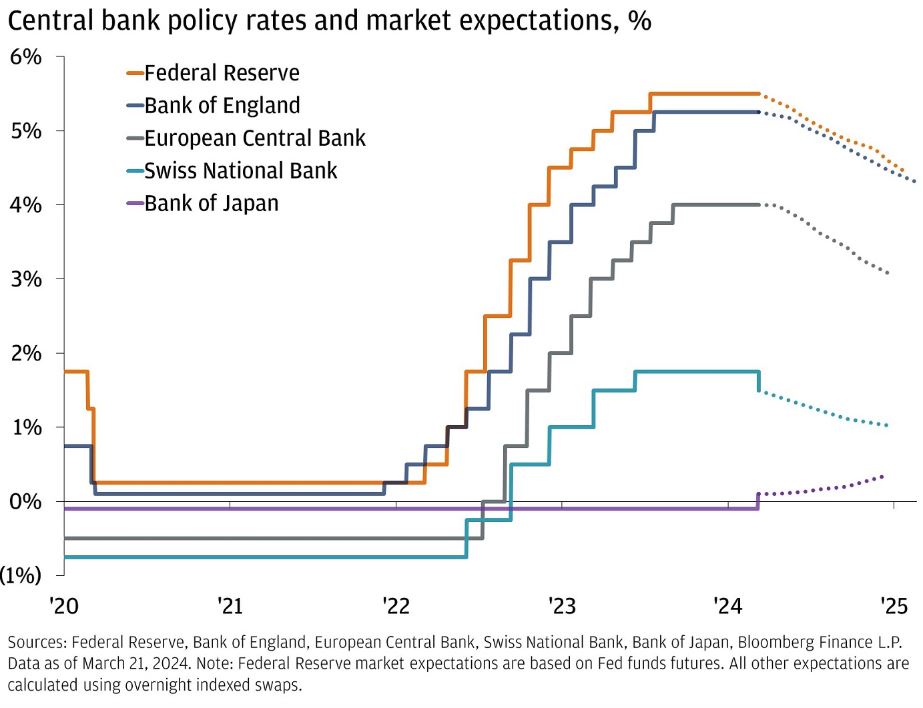

The main driver of positive investor sentiment for markets was the conclusion of the Federal Reserve’s (Fed) policy meeting on Wednesday. As expected, policymakers left the federal funds rate unchanged in the range of 5.25% to 5.50%. However, the updated dot plot signalled that policymakers still remain on track to cut rates three times this year (75 basis points). Fed officials also boosted their forecast for 2024’s underlying inflation to 2.6% from 2.4%, while raising the growth forecast to 2.1% from 1.4%. The news from the Fed helped drive a decline in longer-term Treasury yields over last week.

The Euro Stoxx 50 Index gained 0.91% for last week. Dovish signals from central banks boosted risk-on sentiment, as well as a surprise reduction in Swiss interest rates.

The Bank of England (BoE) took another step toward cutting interest rates in the coming months after two of its most ardent hawks dropped their demands for hikes in borrowing costs. The BoE kept its key interest rate unchanged at 5.25% for a fifth consecutive time, striking a more dovish tone at its policy meeting. The UK’s FTSE 100 gained 2.70% for last week buoyed by the BoE’s greater optimism about the economy.

In other central bank news, the Swiss National Bank (SNB) unexpectedly reduced borrowing costs by a quarter of a percentage point to 1.5%—the first cut in nine years. Meanwhile, Norway’s central bank kept its policy rate unchanged at 4.5%.

Earlier in the week the Bank of Japan (BoJ) made a much-anticipated policy shift, exiting its negative interest rate policy. The central bank delivered its first hike since 2007, scrapping the world’s last remaining negative interest rate.

On the economic front, Japanese inflation accelerated to 2.8% in February, data showed Friday, staying above the Bank of Japan’s 2% target. The year-on-year rise in prices excluding volatile fresh food was in line with market expectations and followed an increase of 2% in January.

Chinese equities were softer on last week, as concerns about the property sector continued to offset optimism about better-than-expected economic data. The Shanghai Composite Index ended last week 0.22% lower.

Central banks in emerging markets, Brazil and Mexico both cut rates last week. Brazil’s central bank reduced its benchmark interest rate by 50 basis points to 10.75% on Wednesday, in line with market expectations. While the Bank of Mexico trimmed its key interest rate by 25 basis points to 11%—the first reduction since it started tightening monetary policy in 2021.

Market Moves of the Week

South Africa’s inflation rate climbed to 5.6% in February from a year earlier, compared with 5.3% the prior month, Pretoria-based Statistics South Africa said on Wednesday. The increase moved the inflation rate further away from the 4.5% midpoint of the South African Reserve Bank’s target range, likely supporting the central bank’s resolve to keep borrowing costs steady at a 15-year-high of 8.25% for a fifth straight meeting when they announce their policy decision this week on March 27.

February’s price-growth was largely driven by higher transport costs, housing & utilities and food and non-alcoholic beverages.

Stats SA also released retail sales data later in last week, showing that retail sales measured in real terms dropped by 2.1% year-on-year in January 2024. The largest contributors to the decrease were retailers in textiles, clothing, footwear and leather goods as well as retailers in pharmaceuticals and medical goods, cosmetics and toiletries.

For last week, the broader all-share index ended 0.36% higher, largely driven by gains in the resource sector (+3.76%). The rand weakened on Friday in line with other emerging market currencies as the U.S. dollar gained on global risk sentiment. The rand ended last week at 18.99 against the dollar, 1.4% weaker than the previous weeks close.

Chart of the Week

The chart above illustrates current and expected interest rate paths for major developed markets. The Swiss National Bank (SNB) made history last week as the first developed market central bank to deliver a rate cut this cycle, while the Fed confirmed that it still plans to cut rates three times this year, even with stronger growth and stickier inflation in mind. The Bank of England laid the groundwork for a potential cut as soon as June while in contrast the Bank of Japan hiked rates for the first time in 17 years to officially put an end to its negative interest rate policy.