South Africa’s Budget for 2024 defied expectations as it prioritised fiscal continuity and consolidation over pre-election populist measures, contrary to widespread forecasts of significant fiscal slippage.

While no tax increases were announced, unfortunate news awaited South African personal income taxpayers with no inflationary adjustments to tax brackets and rebates over the next three fiscal years. However, an agreement to distribute ZAR150bn from the SARB’s Gold and Foreign Exchange Contingency Reserve Account to Treasury led to a decline in the gross borrowing requirement and the projected public debt trajectory. This move, along with a commitment to establish a binding fiscal anchor, reflects the government’s dedication to fiscal stability.

Fiscal Strategy

Prioritising Stability and Consolidation:

The South African government has embraced fiscal discipline, opting for stability and consolidation over populist spending in this budget. Utilising funds from the gold and foreign exchange contingency reserve account (GFECRA) aims to reduce borrowing requirements and signal a commitment to fiscal consolidation.

GFECRA Utilisation and Legislative Framework:

The government plans to draw down R150bn from the GFECRA balance between 2024/25 and 2026/27, subject to a proposed settlement agreement with the National Treasury and the Reserve Bank. However, disappointingly, only guiding principles are provided at this stage, pending formalisation through legislation.

Revenue and Debt Projections:

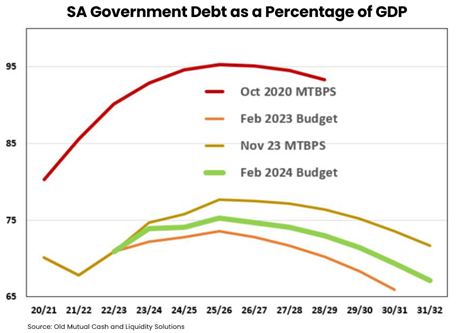

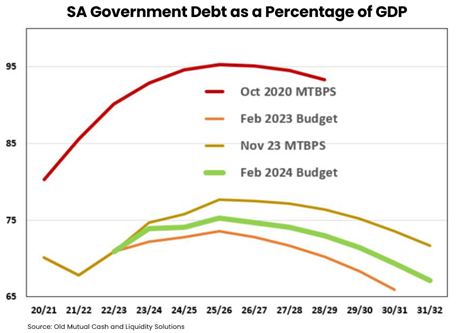

Despite forecast risks, the government aims to achieve a primary budget surplus by FY23/24, with gross government debt projected to peak at 75.3% of GDP, lower than previous estimates, due to GFECRA utilisation.

National Health Insurance (NHI):

Commitment to NHI Implementation:

The government allocated R1.4bn to the direct NHI grant, demonstrating its commitment to the policy. However, several critical activities, including infrastructure upgrades and workforce management, need further development before the NHI can be scaled up.

The NHI Bill, endorsed by both houses of Parliament, awaits presidential approval. However, concerns linger regarding funding mechanisms, particularly the absence of specified taxes or adjustments in the budget.

Taxation:

Stability in Tax Rates:

Personal income tax rates and brackets remain unchanged, with no adjustments for inflation. Tax proposals aim to generate additional revenue through higher excise duties on alcohol and tobacco products.

Long-Term Reforms:

Long-term tax reforms, including the two-pot retirement system and a global minimum corporate tax, are set to be implemented in 2024/25. These reforms aim to enhance revenue streams and align with international tax standards.

Conclusion:

In conclusion, South Africa’s 2024 budget emphasises fiscal continuity and consolidation, which diverges from earlier predictions. While these measures may be positively received by the bond market, it may be perceived as less favourable for the equity market. Notably, the absence of adjustments for inflation to personal income tax rates effectively results in a tax increase of R18 billion for individuals.

Carrick Wealth is an authorised South African financial services provider specialising in South African and international financial planning and integrated wealth management solutions. Licence Number FSCA45621. Company Registration Number: 2014/127048/07. The Carrick corporate group is also licensed in Zimbabwe, Zambia and Malawi, and holds three global licences in Mauritius. The information contained herein as well as the individual companies and/or securities mentioned should not be construed as investment advice, a recommendation to buy or sell, or an indication of trading intent on behalf of Carrick or any financial product. This communication is intended to be used for information purposes only by its designated recipients and is not an offer, recommendation or solicitation to transact. While it is based on information freely available to the public and from sources believed to be credible and reliable, Carrick Wealth makes no representation that it is accurate or complete or that any returns indicated will be achieved. Investments in securities are generally medium to long term investments. The value of products may go down as well as up and past performance is not necessarily a guide to the future. Carrick Wealth (Pty) Ltd and its affiliates disclaims and assumes no liability for any loss or damage (direct, indirect or consequential) that may be suffered from using or relying on the information contained herein.