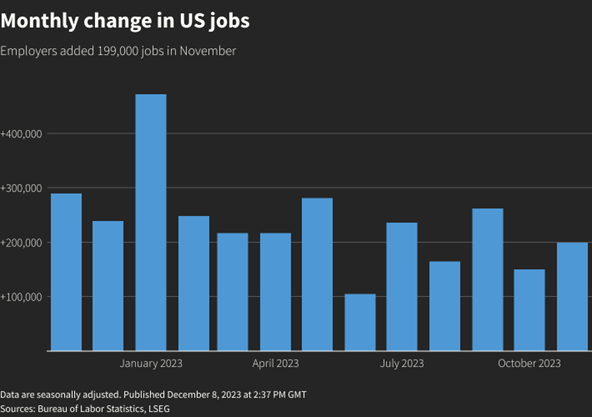

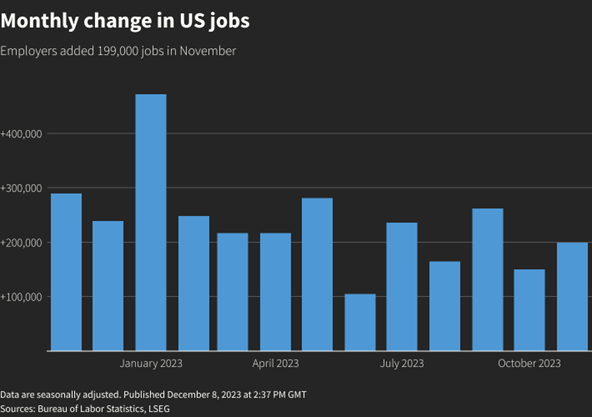

In November, U.S. job growth gained momentum while the unemployment rate declined, indicating a robust underlying labor market. According to the Labor Department’s report on Friday, employers added 199,000 jobs last month, while the unemployment rate dropped to 3.7 percent, from 3.9 percent. This increase in employment includes the return of tens of thousands of autoworkers and actors to their jobs post-strikes, along with other workers in related industries previously affected by these walkouts. Additionally, average hourly earnings saw a 0.4% uptick for the month, maintaining a steady 4% increase year-over-year. This positive data has helped cool speculations about the Federal Reserve’s potential rate cuts in the first half of next year.

Meanwhile, the U.S. services sector exhibited growth driven by increased business activity. According to the Institute for Supply Management (ISM) report released on Tuesday, the non-manufacturing Purchasing Managers’ Index (PMI) climbed to 52.7 in November from a 5-month low of 51.8. A PMI reading above 50 indicates expansion in the services sector, a pivotal component accounting for over two-thirds of the economy.

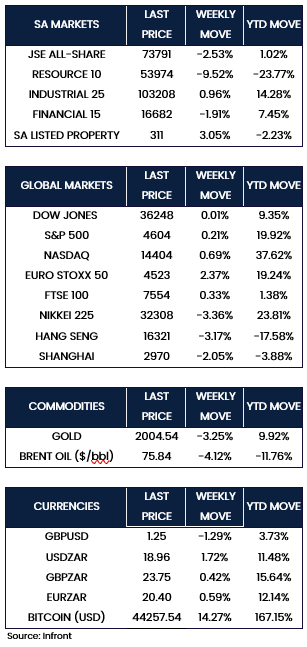

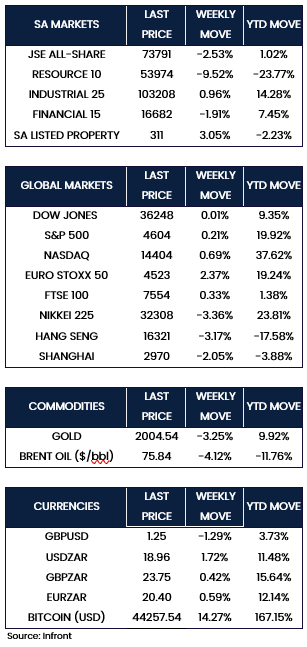

A late rally helped the major U.S indices end flat to modestly higher for the week. The S&P 500 saw a modest increase of +0.21%, while the Nasdaq Composite closed higher, up by +0.69%. Conversely, the Dow Jones Industrial Average ended the week almost flat, showing a minimal increase of +0.01%.

In November, both the Eurozone and the United Kingdom observed increases in their composite purchasing managers’ indices. The eurozone’s composite rose from 46.5 in October to 47.6, while an upturn in the UK services sector elevated the country’s composite from 48.7 to 50.7.

The pan-European Stoxx Europe 50 Index emerged as a notable performer, experiencing a significant surge of +2.37% in the week. Stocks seemed to benefit from anticipations of potential interest rate cuts by central banks next year, driven by concerns over slowing inflation and indications of economic slowdown across European nations. Meanwhile, the FTSE 100 recorded a modest rise of +0.33% for the week.

On Tuesday, Moody’s shifted China’s credit rating outlook from stable to negative, citing concerns over prolonged lower medium-term economic growth and ongoing issues in its property sector. This adjustment doesn’t guarantee an immediate credit rating downgrade, but it increases the likelihood. Moody’s specifically emphasized concerns regarding the potential financial strain on the national government due to supporting debt-burdened regional and local governments, as well as state-owned enterprises. In response, China’s Finance Ministry expressed disappointment, asserting confidence in an economic rebound and claiming control over the property crisis and concerns about local government debt.

In November, China experienced an uptick in services business activity, according to a private-sector survey released on Tuesday. The Caixin/S&P Global services purchasing managers’ index (PMI), which assesses China’s private sector services activity, increased to a three-month high of 51.5, rising from October’s 50.4. The gauge remained above the 50 threshold, indicating expansion for the 11th straight month, and recorded its highest increase since August.

Chinese equities experienced a decline following a credit downgrade of China’s sovereign debt by Moody’s, intensifying concerns regarding the country’s economic prospects. The Shanghai Composite Index dropped by -2.05%. In Hong Kong, the benchmark Hang Seng Index also witnessed a decrease, declining by -3.17%. Similarly, Japan’s stocks faced losses during the week, with the Nikkei 225 Index falling by -3.36%.

Market Moves of the Week:

According to Statistics South Africa (Stats SA), South Africa experienced a 0.2% contraction in its real gross domestic product (GDP) during the third quarter of 2023, following two consecutive quarters of growth. Significant declines in output were observed in key sectors such as agriculture, manufacturing, and construction. South Africa’s stagnant growth and subsequent contraction are attributed to several factors. These include severe power shortages worsened by ongoing issues at Transnet, along with elevated interest rates.

The National Health Insurance (NHI) Bill has been passed by the National Council of Provinces (NCOP) despite facing significant criticism from health professionals, business sectors, and opposition groups. This contentious legislation is now set to be reviewed by President Cyril Ramaphosa, who holds the decision-making power on its fate. As per the Constitution, the bill, previously endorsed by the National Assembly in June, will be referred to President Cyril Ramaphosa. He retains the option to either approve it as law or call for amendments by lawmakers.

During the week, the JSE All-Share Index experienced a notable decline of -2.53%, primarily influenced by a considerable sell-off in the resources sector, plummeting by -9.52%. Additionally, the financial sector faced a weekly loss of -1.91%. Conversely, the industrial sector saw relatively modest gains, rising by +0.96% throughout the week. Meanwhile, the property sector exhibited robust weekly gains, climbing by +3.05%. By Friday’s close, the rand was trading at R18.96 against the U.S. Dollar, marking a weekly depreciation of -1.72%.

Chart of the Week:

Job growth surged as nonfarm payrolls added 199,000 jobs last month, surpassing initial forecasts, according to the Labor Department’s Bureau of Labor Statistics. October’s figure remained unrevised at 150,000.