Headline inflation in the Eurozone cooled significantly in November from the peak levels of 10.6% in October 2022. Annual consumer price growth came in at 2.4%, down from 2.9% in October and below expectations for a reading of 2.7%. Core inflation, which excludes food and energy costs, also dropped more than expected to 3.6% from 4.2% in the previous month. ECB officials continued to stress that it is too early to declare victory over price rises in the 20-member euro zone bloc, as they monitor potential pressures from wage increases and energy markets.

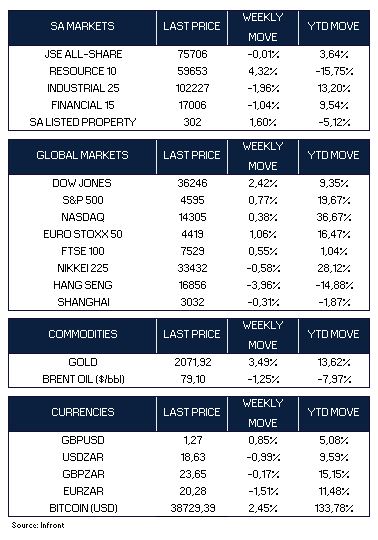

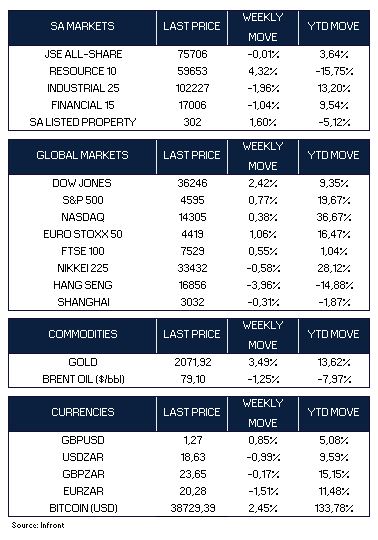

The pan-European STOXX Europe 50 Index ended 1.06% higher, as the lower inflation print and falling bond yields lifted investor sentiment. The UK’s FTSE 100 Index was also stronger on the week, gaining 0.55%.

On Thursday, the Commerce Department reported that the Federal Reserve’s preferred inflation gauge, the core (less food and energy) personal consumption expenditures (PCE) price index, rose 0.2% in October, a slowdown from September. This brought its year-over-year increase down to 3.5%, its lowest level since April 2021.

Major U.S. indices ended stronger on the week, after strong monthly gains for the month of November. November’s gains snapped a three-month losing streak for the major indices. Moderating inflation, decelerating economic growth and signs that the US economy may achieve a goldilocks soft landing buoyed investor sentiment. For the week the broad-based S&P 500 gained 0.77%, while the Dow rallied 2.4%. The tech-heavy Nasdaq advanced 0.38%.

The yield on the US 10-year Treasury note fell more than 13 basis points to end the week at a yield of 4.22% (the yield was 4.77% at the start of November).

In Asia, Japan’s stock markets ended the week weaker, with the benchmark Nikkei 225 Index declining 0.6%. Prime Minister Fumio Kishida reiterated the government’s resolve to pull the economy permanently out of stagnation.

In China, the benchmark Shanghai Composite Index gave up 0.31% for the week. Economic data for October continued to provide a mixed snapshot of the Chinese economy. Retail sales have generally remained lacklustre since the onset of the Covid-19 pandemic in early 2020 as well as falling global demand for Chinese goods and a slump in the real estate market have weighed negatively on the world’s second-largest economy.

The gold price extended to a new seven-month high after the US Federal Reserve Chair Jerome Powell welcomed recently revealed soft inflation data, though stressed core inflation “is still too high.” US interest rate expectations now include nearly 135 basis points of Fed rate cuts by the end of 2024, as indicated by money market futures, providing a tailwind for gold prices.

Market Moves of the Week:

In corporate news, Naspers doubled its profits over the past six months. The multinational internet and tech group released its interim results on Wednesday for the half-year ending 30 September, alongside those of its Amsterdam-based investment arm, Prosus.

Eskom, SA’s power utility has been spending on average R3 billion a month on diesel to keep the lights on. In the past few years, Eskom has been forced to rely increasingly on its open-cycle gas turbines (OCGTs) because of a rising number of breakdowns within its ageing coal-fired power fleet, with both persistent power cuts as well as rail and port constraints continuing to weigh on the local economy.

National Treasury handed state-owned rail and ports firm Transnet a R47 billion ($2.5 billion) lifeline on Friday, which it said would help Transnet meet its immediate debt obligations. The company will be able to access R22.8 billion immediately under a guarantee facility, the Treasury said in a statement. The statement went on to clarify that Transnet will have to meet “strict guarantee conditions” for the rest of the funds.

The JSE all share index ended the week flat, dragged lower by both the industrial and financial sectors. The resource sector had a stronger showing for the week, gaining over 4%. The rand strengthened against the dollar on Friday, ending the week at R18,63 to the greenback.

Chart of the Week:

Eurozone inflation tumbled more than expected for a third straight month in November. Consumer price growth in the 20 nations sharing the euro currency dropped to 2.4% in November from 2.9% in October, well below expectations for 2.7%. Even underlying price pressures eased more quickly than forecast, with inflation excluding food and energy, which is closely scrutinised by the ECB dipping to 3.6% from 4.2% the month before.