In the past year, concerns about inflation, rising interest rates, and political instability have persisted, even as markets have shown improvement. However, recent tragic events in the Middle East have introduced new worries for investors, as they evaluate how military conflicts might impact financial markets. While acknowledging the human tragedy, the market’s primary focus has shifted to potential effects on oil prices, interest rates, and the strength of the dollar, as these factors have a more direct influence on market performance.

Major indexes concluded the week with mixed results as investors weighed up inflation data against dovish signals from Federal Reserve officials. Leading banks such as Citigroup, Wells Fargo, and JPMorgan Chase initiated the unofficial start of the third-quarter earnings reporting season on a positive note, benefiting from higher interest rates.

The release of minutes from the Fed’s September policy meeting on Wednesday suggested that policymakers agree that they need to maintain restrictive interest rates for some time, while being mindful of balancing the risk of overtightening with the goal of curbing inflation towards the 2% target. In September, CPI rose by 0.4% month-on-month, surpassing market expectations, signalling ongoing inflationary pressures. The Fed’s core CPI, which excludes food and energy costs, also increased by 0.3% in September.

In Europe, the ECB’s minutes revealed that the majority of policymakers voted to raise the key deposit rate to a record high of 4.0%. Meanwhile, the German government lowered its 2023 economic growth outlook from 0.4% growth to a 0.4% contraction due to higher energy costs and reduced demand from major markets like China.

UK retail sales growth slowed to 2.7% year-on-year in September, marking the second weakest month of the year, while GDP rose by 0.2% month-on-month in August, after contracting 0.6% in July.

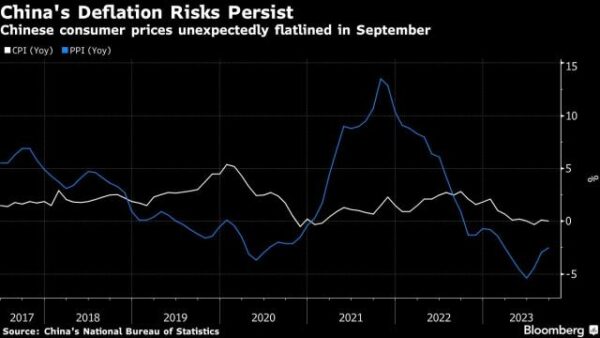

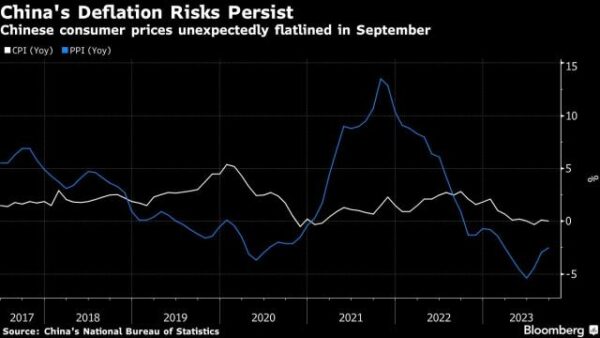

In China, inflation remained subdued with CPI for September remaining unchanged from a year earlier. Meanwhile, producer prices fell by a higher-than-expected 2.5% compared to the previous year. At the same time, Chinese developer Country Garden Holdings faces its first-ever potential default and restructuring due to difficulties in meeting offshore payment obligations on U.S. dollar bonds, highlighting China’s property debt crisis.

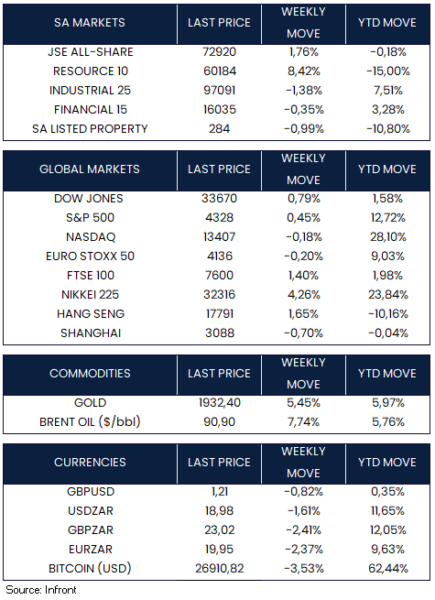

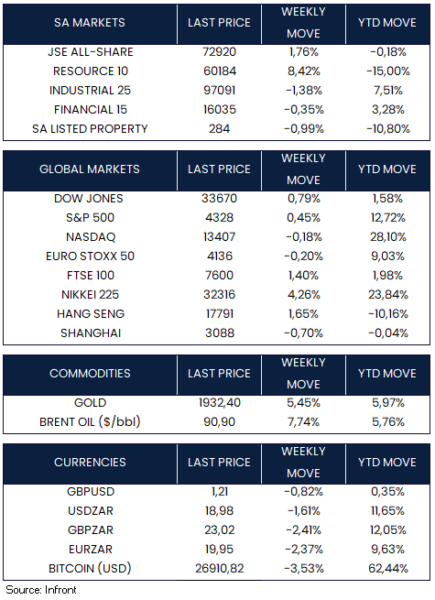

Global equity markets concluded the week with mixed results. In the U.S., the Dow Jones (+0.79%) and S&P 500 (+0.45%) were positive whilst the Nasdaq (-0.18%) was mildly negative. Similarly, European and Asian markets, including the Euro Stoxx 50 (-0.20%), FTSE 100 (+1.40%), Nikkei 225 (+4.26%), Hang Seng (+1.65%) and Shanghai Composite Index (-0.70%) were mixed.

Market Moves of the Week:

South Africa’s latest census data reveals a substantial population growth, with the country’s population reaching 62 million in 2022, up from 51.8 million in 2011. The census also highlights the presence of over 2.4 million migrants, primarily from neighbouring countries like Zimbabwe, Mozambique, and Lesotho. Notably, this census is only the fourth since 1994 and the first in over a decade.

On the economic front, South Africa is expected to experience a slight growth upturn in the coming year, primarily due to improved energy supply – this according to a Reuters poll. GDP is anticipated to expand by 1.2% in 2024, exceeding previous estimates and surpassing 2023 projections. Additionally, a decline in inflation is expected to offer some relief to consumers, with inflation projected to decrease to 4.8% in 2024, down from the estimated 5.8% in 2023.

The JSE All-Share Index (+1.76%) was positive this week, driven higher by the resource (+8.42%) sector. Weaker performances came from industrial (-1.38%), and financial (-0.35%) sectors. By Friday close, the rand was trading at R18.98 to the U.S. Dollar.

Chart of the Week:

China’s consumer inflation rate unexpectedly flatlined in September while factory-gate deflation persisted, suggesting the economy’s path to growth is still fragile and in need of additional support. According to the National Bureau of Statistics, the consumer price index for the past month remained unchanged from the previous year, falling short of expectations for a slight increase, and approaching the deflationary level observed in July.

Source: Bloomberg