Ahead of Wednesday’s press conference following the latest Federal Open Market Committee (FOMC) meeting, markets anticipated a hawkish response due to recent higher-than-expected inflation figures. However, Fed Chair Jerome Powell surprised by stating that a rate hike is “unlikely” and that rate cuts remain the Fed’s primary scenario, albeit delayed. Amidst a plethora of data indicating persistent price pressures, Fed officials unanimously opted to maintain the target federal funds rate at 5.25% to 5.5%, a level it has held since July. Additionally, the FOMC voted to reduce the pace of quantitative tightening starting in June, allowing $25 billion a month of Treasuries to roll off the balance sheet, below the expected $30 billion. Powell also expressed confidence in inflation moderation throughout the year, although less certain than before.

The main driver behind this week’s market gains appeared to be Friday’s U.S. nonfarm payrolls report, showing the addition of 175,000 jobs in April, below expectations and the lowest since November. The print signalled a labour market cooldown, potentially easing inflationary pressures. Investors were also likely pleased by the unexpected slowdown in monthly wage growth. Additionally, the year-over-year wage gain decreased to 3.9%, the slowest in almost two years. Friday’s report also showed the unemployment rate rising to 3.9% from 3.8% in March amid increasing labour supply.

The Eurozone emerged from a recession in Q1 2024. Eurozone gross domestic product unexpectedly expanded by 0.3% in the first quarter, rebounding from a 0.1% contraction in the final three months of 2023. Inflation in the region remained unchanged as expected in April, but a key indicator of underlying price pressures decelerated, further strengthening the argument for the European Central Bank to implement interest rate cuts in June. Annual consumer price growth remained at 2.4%, but core inflation – which excludes energy and food prices – slowed to 2.7% from 2.9%.

The Bank of Japan intervened this week to counter the yen’s decline, which hit a 34-year low against the U.S. dollar on Monday (USDJPY 160.17). By purchasing nearly $60 billion worth of yen, authorities managed to boost the currency to 152.35 by week’s end, aided by news of slowed U.S. payroll growth on Friday. To address interest rate differentials, Japanese authorities are considering tax incentives for repatriating Japanese corporate profits held abroad, aiming to stimulate yen purchases and capital inflows. However, selling U.S. dollar-denominated reserves could widen the interest rate gap, presenting a challenge for Japan in stabilizing the yen without adjusting monetary policy to narrow the U.S.-Japan rate differential.

Chinese stocks climbed during a shortened trading week, buoyed by expectations of increased economic stimulus. The Shanghai Composite Index rose by +0.52%, while in Hong Kong, the benchmark Hang Seng Index surged by +4.45%. In April, China’s manufacturing sector showed slight improvement for the second consecutive month, but service sector growth slowed down. A private survey also indicated ongoing expansion in manufacturing. However, industrial profits declined in March and grew at a slower pace in the first quarter of 2024, suggesting ongoing economic challenges.

As approximately 80% of S&P 500 companies have reported their Q1 2024 earnings, blended earnings per share, combining reported data with estimates for those yet to report, indicates a modest increase of approximately 4.9% compared to the same quarter last year. Sales growth stands at 4.1% year over year. Bloomberg reports that roughly 80% of companies have exceeded earnings estimates.

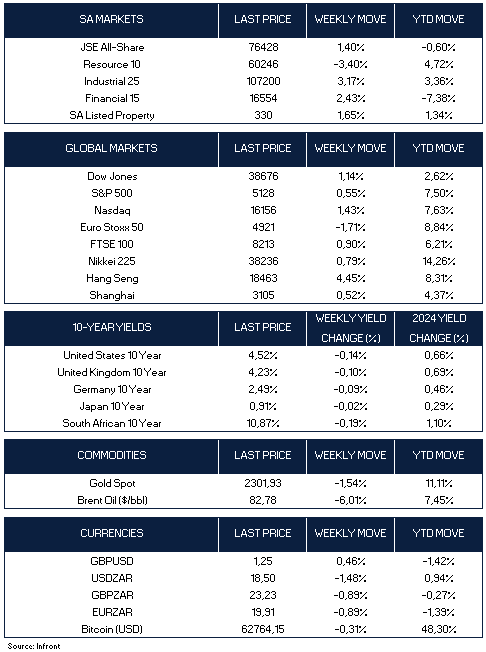

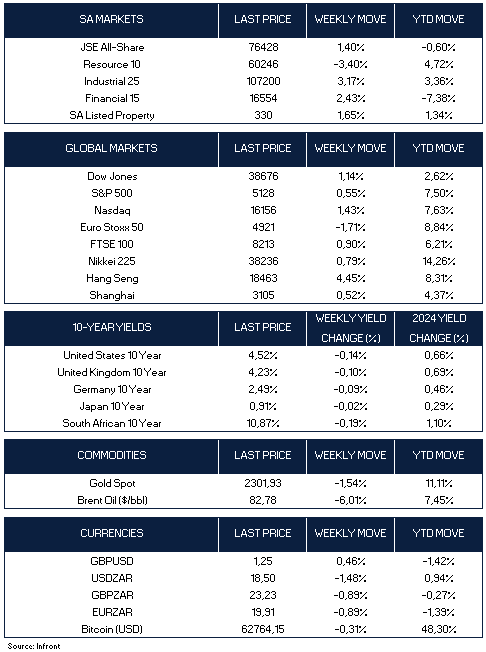

All major U.S. benchmarks ended the week higher, following positive economic and earnings data. The S&P 500 index rose by +0.55%, the Dow Jones increased by +1.14% while the Nasdaq Composite gained +1.43%. The yield on the U.S. 10-year benchmark fell 14 basis points over the week.

In Europe, the Euro Stoxx 50 index declined by -1.71%, whilst the UK’s FTSE 100 index rose +0.90%, driven to a fresh high by strength in mining and energy stocks. Japan’s stock market rose, with the Nikkei 225 gaining +0.79%. Oil prices (Brent) fell -6.01% while Gold moved -1.54% lower.

Market Moves of the Week

Ahead of Wednesday’s press conference following the latest Federal Open Market Committee (FOMC) meeting, markets anticipated a hawkish response due to recent higher-than-expected inflation figures. However, Fed Chair Jerome Powell surprised by stating that a rate hike is “unlikely” and that rate cuts remain the Fed’s primary scenario, albeit delayed. Amidst a plethora of data indicating persistent price pressures, Fed officials unanimously opted to maintain the target federal funds rate at 5.25% to 5.5%, a level it has held since July. Additionally, the FOMC voted to reduce the pace of quantitative tightening starting in June, allowing $25 billion a month of Treasuries to roll off the balance sheet, below the expected $30 billion. Powell also expressed confidence in inflation moderation throughout the year, although less certain than before.

The main driver behind this week’s market gains appeared to be Friday’s U.S. nonfarm payrolls report, showing the addition of 175,000 jobs in April, below expectations and the lowest since November. The print signalled a labour market cooldown, potentially easing inflationary pressures. Investors were also likely pleased by the unexpected slowdown in monthly wage growth. Additionally, the year-over-year wage gain decreased to 3.9%, the slowest in almost two years. Friday’s report also showed the unemployment rate rising to 3.9% from 3.8% in March amid increasing labour supply.

The Eurozone emerged from a recession in Q1 2024. Eurozone gross domestic product unexpectedly expanded by 0.3% in the first quarter, rebounding from a 0.1% contraction in the final three months of 2023. Inflation in the region remained unchanged as expected in April, but a key indicator of underlying price pressures decelerated, further strengthening the argument for the European Central Bank to implement interest rate cuts in June. Annual consumer price growth remained at 2.4%, but core inflation – which excludes energy and food prices – slowed to 2.7% from 2.9%.

The Bank of Japan intervened this week to counter the yen’s decline, which hit a 34-year low against the U.S. dollar on Monday (USDJPY 160.17). By purchasing nearly $60 billion worth of yen, authorities managed to boost the currency to 152.35 by week’s end, aided by news of slowed U.S. payroll growth on Friday. To address interest rate differentials, Japanese authorities are considering tax incentives for repatriating Japanese corporate profits held abroad, aiming to stimulate yen purchases and capital inflows. However, selling U.S. dollar-denominated reserves could widen the interest rate gap, presenting a challenge for Japan in stabilizing the yen without adjusting monetary policy to narrow the U.S.-Japan rate differential.

Chinese stocks climbed during a shortened trading week, buoyed by expectations of increased economic stimulus. The Shanghai Composite Index rose by +0.52%, while in Hong Kong, the benchmark Hang Seng Index surged by +4.45%. In April, China’s manufacturing sector showed slight improvement for the second consecutive month, but service sector growth slowed down. A private survey also indicated ongoing expansion in manufacturing. However, industrial profits declined in March and grew at a slower pace in the first quarter of 2024, suggesting ongoing economic challenges.

As approximately 80% of S&P 500 companies have reported their Q1 2024 earnings, blended earnings per share, combining reported data with estimates for those yet to report, indicates a modest increase of approximately 4.9% compared to the same quarter last year. Sales growth stands at 4.1% year over year. Bloomberg reports that roughly 80% of companies have exceeded earnings estimates.

All major U.S. benchmarks ended the week higher, following positive economic and earnings data. The S&P 500 index rose by +0.55%, the Dow Jones increased by +1.14% while the Nasdaq Composite gained +1.43%. The yield on the U.S. 10-year benchmark fell 14 basis points over the week.

In Europe, the Euro Stoxx 50 index declined by -1.71%, whilst the UK’s FTSE 100 index rose +0.90%, driven to a fresh high by strength in mining and energy stocks. Japan’s stock market rose, with the Nikkei 225 gaining +0.79%. Oil prices (Brent) fell -6.01% while Gold moved -1.54% lower.

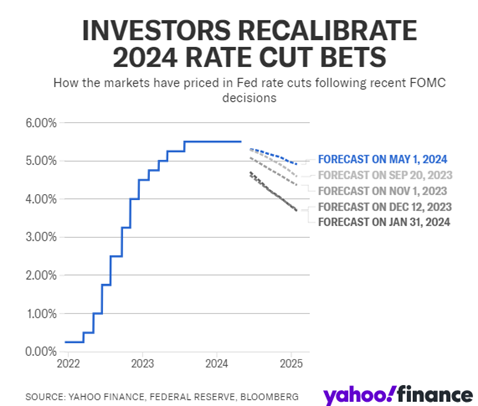

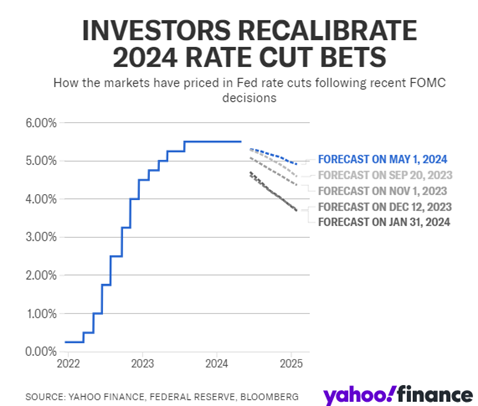

Chart of the Week

Market rate cut expectations have been declining after each of the past 5 FOMC meetings. Post Wednesday’s meeting there was only 1 rate cut priced in from the Fed for 2024, as we end the week, there are now two cuts priced in post the release of Friday’s payroll data, with no chance of a rate hike for this year expected. About 70 percent of bets implied that rates would be lower after the Fed’s September meeting. Source: Financial Times, Yahoo!finance.