Crude oil surged above the $90 per barrel mark for the first time since November 2022. Concerns around supply shortfalls heading into the last quarter of 2023 saw the commodity catch a strong bid, at Friday’s close Brent Crude was up 4.16% week-on-week, to close at $94.20 ($/bbl). Rising oil prices resulted in mixed market performance across the major US indexes. Value outperformed growth, the Dow Jones Industrial Average closed the week in positive territory, outperforming both the S&P 500 and Nasdaq Composite.

Treasury Secretary Janet Yellen expressed growing confidence in the US economy’s ability to manage inflation without harming employment levels. Yellen cited encouraging data showing a steady deceleration in inflation and an increase in job seekers. She reiterated her positive outlook on the US avoiding a recession while keeping consumer-price gains in check.

The Federal Reserve faces a challenging situation as August’s core Consumer Price Index (CPI) rose by 0.28%, surpassing consensus expectations. However, the year-on-year inflation rate dropped to 4.3%, prompting questions about the necessity of another interest rate hike to combat rising prices. Producer price index (PPI) data, released on Thursday, revealed that headline producer prices surged above expectations. Meanwhile, core PPI met anticipated levels. This indicates potential inflationary pressures within the producer sector.

In share specific new, Arm Holdings, the chip designer owned by SoftBank, has successfully pricing its initial public offering (IPO) at the upper end of its range, raising an impressive $4.87 billion. This remarkable IPO now stands as the world’s largest in 2023, surpassing Johnson & Johnson’s Kenvue, which raised $4.37 billion. Arm issued 95.5 million American depositary shares (ADS) at $51 per ADS. Many tech startups and companies in the US have faced obstacles due to a prolonged and challenging listing environment, making Arm’s successful IPO a potential catalyst for others in a similar position.

The U.K. experienced an economic setback in July, with a contraction of 0.5% in monthly GDP, which was worse than expected. All major sectors, including services, production, and construction, reported declines. Goldman Sachs downgraded their 2023 annual growth forecast to +0.3%, aligning with consensus expectations but falling below the Bank of England’s latest projection of +0.5%. Bond yields in the U.K. have weakened as a result of the significant and unexpected decline in monthly gross domestic product (GDP) during July.

The European Central Bank (ECB) made a significant move by increasing key policy rates by 25 basis points. The ECB justified the decision by stating that these rates had reached levels that, if maintained long enough, would contribute substantially to bringing inflation back to its target. Despite this hike, the ECB’s formal guidance continues to pledge that rates will be “set at” sufficiently restrictive levels, with the Governing Council remaining data dependent. In July, industrial production in the Eurozone dropped by 1.1%, above consensus expectations, primarily driven by sharp declines in durable consumer and capital goods output. The European Commission has revised down its 2023 GDP growth forecast for the Eurozone to 0.8% from 1.1%, reflecting increased economic uncertainty.

China’s economic performance in August exceeded expectations and improved from the previous month. Industrial production growth increased, driven primarily by higher output in computers, chemicals, and automobiles. Year-on-year growth in retail sales and the Services Industry Output Index also saw improvements, mainly due to stronger sales in the automotive and gasoline sectors, although restaurant sales growth slowed. Additionally, fixed asset investment growth rose in August, particularly in manufacturing and infrastructure sectors, although the magnitude of improvement slightly missed expectations, partially due to ongoing challenges in the property investment sector. Despite these economic dynamics, property-related activity remained sluggish, with a sequential decline in property prices in the primary market observed in August.

North Korean leader Kim Jong Un’s visit to Russia ahead of a summit with President Vladimir Putin drew global attention. The summit is expected to focus on Moscow’s supply of weapons for the ongoing conflict in Ukraine. Meanwhile, Ukraine’s military intelligence service reported regaining control of critical Black Sea drilling platforms that Russia had used for helicopter stations and radar activity. Ukraine has also sought substantial financial aid from the US, ranging from $12 billion to $14 billion, as it continues to grapple with high budget spending due to Russia’s ongoing invasion.

US stocks ended the week mixed, with the S&P 500 down 0.16%, the more value orientated Dow Jones Industrial Average up 0.12%, and the tech heavy Nasdaq Composite closing in the red, down 0.39%.

Outside the US, other global markets ended the week in the green. Euro Stoxx 50 ended the week higher, up 1.34%, the FTSE 100 had a strong week, ending the week up 3.12%. Japan’s Nikkei 225 index gained 2.83% this week. Chinese equities ended the week in positive territory, although with modest gains, the Hang Seng Composite up 0.13% and Shanghai Composite up 0.03%.

Market Moves of the Week:

SA’s economy showed some resilience, with GDP increasing from +0.4% QoQ in Q1 to +0.6% QoQ in Q2. Growth exceeded consensus and SARB forecasts, fuelled by a significant increase in private sector fixed investment, despite a drop in household consumption. At the same time, SA’s current account deficit increased from 0.9% of GDP in Q1 2023 to 2.3% in Q2, less severe than expected.

Nevertheless, National Treasury faces significant challenges amid shrinking tax revenue and mounting debt. SA’s budget deficit reached R143.8 billion in July, the largest since 2004, with the debt-to-GDP ratio at 73% and potentially reaching 80% by end-2024. Finance Minister Enoch Godongwana has subsequently hinted at potential tax increases to address revenue shortfalls but acknowledged limitations due to ongoing tax collection underperformance. Budget cuts were also highlighted as an option, but less likely in an election year.

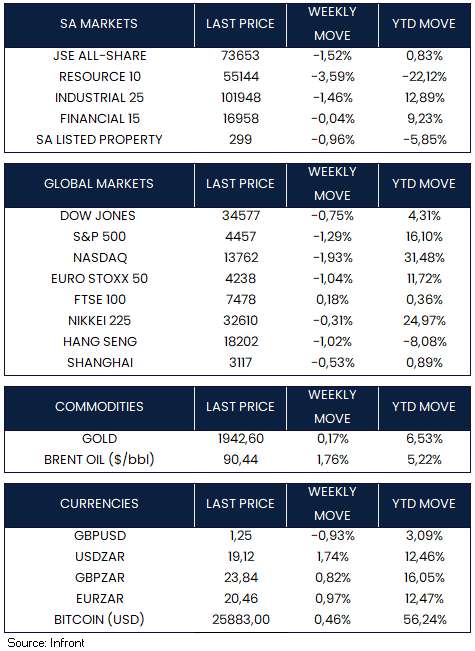

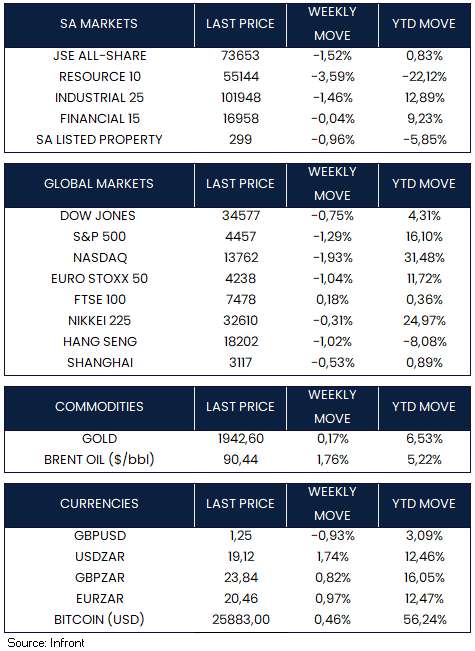

The JSE All-Share Index (-1.52%) was negative this week. Weaker performances came from the resource (-3.59%) and industrial (-1.46%) sectors, while the financial sector (-0.04%) was largely unchanged. By Friday close, the rand was trading at R19.12 to the U.S. Dollar, depreciating by -1.74% for the week.

Chart of the Week:

Amid ongoing negative developments in China, the world’s second-largest economy faces an uncertain future. The $18 trillion economy is slowing down, with low consumer sentiment, export challenges, price deflation, and a youth unemployment rate exceeding 20%. Bloomberg Economics predicts that China may not surpass the U.S. in gross domestic product until the mid-2040s. This represents a significant departure from pre-pandemic expectations, where China was anticipated to secure and maintain the top spot as early as the beginning of the next decade.

Source: Bloomberg