As we bid farewell to June and conclude the second quarter of 2023, it’s essential to reflect on the plethora of news and data that has shaped the past three months. From inflation and interest rates…

Continue readingWeek in Review: Mixed Data as S&P500 Regains Bull Market Status

On Thursday, the S&P500 index experienced a significant development as it entered a bull market. The broad equities benchmark demonstrated a 0.6% increase, concluding the day at 4,292.93 points. This surge represents a notable 20% leap from its lowest point on October 12, 2022, when it stood at 3,577.03 points. Investors reacted favourably to indications from the Central Bank, which suggested that it is nearing the conclusion of its interest rate hiking cycle. Last week, the Federal Reserve hinted that it is likely to abstain from implementing a rate hike during its June 13-14 meeting. This anticipated pause has acted as a catalyst, propelling stock prices to higher levels.

On Thursday, the US Labour Department reported that weekly jobless claims had unexpectedly increased this week to 261,000, well above expectations and the highest level since October 2021.

Economists at the World Bank have revised their global GDP forecast for 2023, increasing it from the earlier projection of 1.7% to 2.1%. This upward adjustment indicates an improvement; however, it also suggests a significant deceleration compared to the 3.1% growth rate observed in 2022. In addition, the World Bank has reduced its growth outlook for 2024 from 2.7% to 2.4%.

While major economies have exhibited more resilience than anticipated in 2023, the economists caution that the impact of higher interest rates and tighter credit conditions will likely dampen growth in 2024. These factors are expected to take a toll on economic expansion going forward.During a meeting at the White House, US President Joe Biden and UK Prime Minister Rishi Sunak reached an agreement to initiate negotiations on a trade pact between their countries. This trade agreement holds the potential to benefit British automakers by allowing them to qualify for electric car subsidies. Furthermore, it could facilitate the joint development of advanced weaponry. The focus of the trade discussions would revolve around critical materials that play a vital role in the production of batteries used in electric vehicles. The proposed trade package aims to foster collaboration and strengthen economic ties between the US and UK.

According to revised GDP data, the Eurozone’s economy experienced a technical recession during the winter period, albeit by a small margin. The data reveals that the economy contracted by 0.1% in both the fourth quarter of 2022 and the first quarter of this year. This weak growth performance is not unexpected, considering the significant impact of the war in Ukraine on European energy markets.

In Japan, revised figures released this week by the Cabinet Office indicates that the economy experienced stronger growth than initially estimated during the first quarter of 2023. Gross domestic product (GDP) expanded at an annualized rate of 2.7% quarter on quarter, surpassing the initial reading of 1.6% and exceeding economists’ forecasts. The upward revision of first-quarter GDP can be largely attributed to robust corporate investment. Despite apprehensions surrounding a slowdown in global growth, particularly in China, businesses in Japan demonstrated increased spending as sentiment remained resilient.

Saudi Arabia has announced its intention to implement an additional reduction of 1 million barrels per day in oil supply during July. This decision has been prompted by a decline in crude prices and will bring the country’s production to its lowest level in several years. Despite the potential consequences, this bold step has been taken by Saudi Arabia, which holds significant importance as a member of the OPEC+ coalition, with the aim of stabilizing the market.

However, it is important to note that this move does involve some concessions to key allies. Russia, a prominent member of the coalition, has not committed to further output cuts. Additionally, the United Arab Emirates (UAE) has negotiated a higher production quota for the year 2024. Despite these compromises, Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, has expressed a strong commitment to taking whatever measures are necessary to restore stability to the market. Brent Crude Oil closed the week lower, down 1.65% to $74,94 bbl.

Chinese equities ended the week on a mixed note, following the release of the latest inflation data, which has increased concerns surrounding the post-pandemic recovery, China’s CPI rose 0.2% in May. The recent release of weak export and import data has fuelled expectations for increased economic stimulus in China. The data indicates that both domestic and international demand remain subdued. In May, exports experienced a significant decline of 7.5% compared to the previous year, surpassing initial forecasts for a weaker performance. Additionally, imports fell by 4.5% compared to the same period last year. Notably, China’s share of US goods imports in April reached its lowest level since 2006, as reported by The Wall Street Journal. Analysts are concerned that exports may further decline, despite their current elevation compared to pre-COVID levels.

The Shanghai Composite index posted a modest gain of 0.04% for the week, while Hong Kong’s Hang Seng Index extended the previous week’s gains, posting a strong 2.32% week-on-week return.

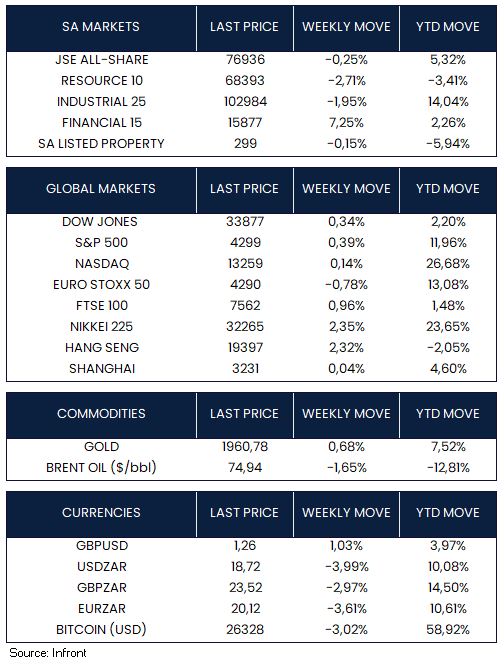

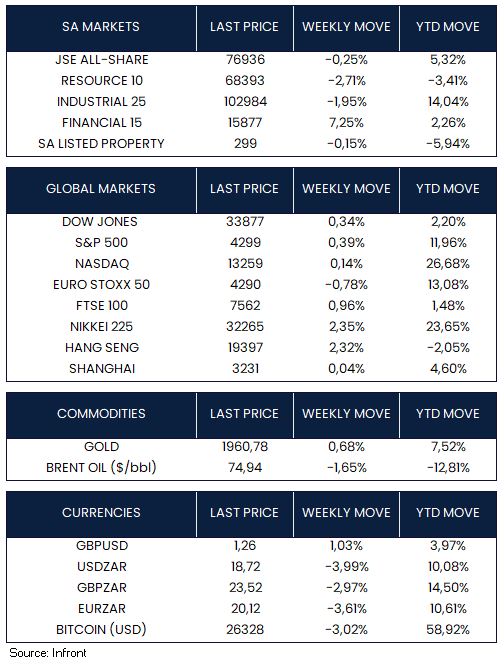

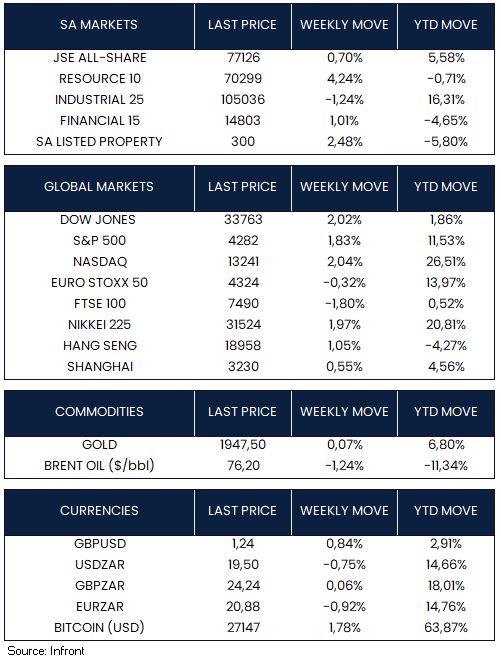

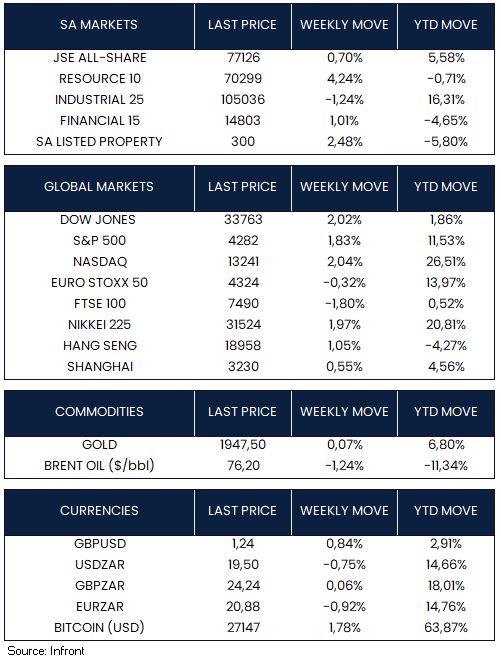

US stocks ended the week slightly higher, with the S&P 500 up 0.39%, the Dow Jones Industrial Average up 0.34%, and the tech heavy Nasdaq Composite rising slightly 0.14%. The Euro Stoxx 50 ended the weak lower (-0.78%), while the FTSE 100 (0.96%) closed the week in positive territory. Japan’s Nikkei 225 index gained 2.35% this week, continuing its positive trend for the year (23.65% YTD).

Market Moves of the Week:

On the domestic front, recent economic data indicates a notable resilience, as the South African economy narrowly averted a recession during the first quarter. According to the latest data released on Tuesday, the economy expanded by 0.4%, effectively returning to pre-COVID levels. Out of the ten industries monitored by Stats SA, eight experienced growth in Q1, with manufacturing and finance, real estate, and business services making the most significant positive contributions.

Furthermore, South Africa’s current account deficit exhibited a substantial narrowing, declining from 2.3% of GDP in Q4 2022 to 1.0% of GDP in Q1 2023, contrary to the consensus forecast of a widening deficit. The primary catalyst for this improvement was the balance of trade in goods and services, which shifted from a deficit of 0.8% of GDP in Q4 to a surplus of 0.6% of GDP in Q1.

Adding to the positive developments, there has been some relief from Stage 6 national loadshedding, and a constructive meeting between government officials and business leaders on Wednesday, which has reignited optimism that a potential solution could be identified to mitigate the persistent power outages.

Although there were some positive developments on the news and economic front, the JSE ALSI posted a modest decline for the week (-0.25%), the only positive sector contributor was Financials up 7.25%. Both Industrials (-1.95%) and Resources (-2.71%) were down for the week. The Rand made a strong recovery, receding below the R19/$ mark. The currency was trading at R18.72/$ by Friday close, appreciating 3.99% against the Dollar. The SA listed property sector continues to face headwinds, the sector closed the week marginally lower -0.15%.

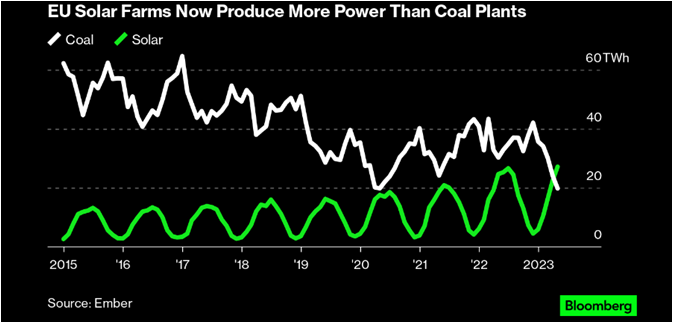

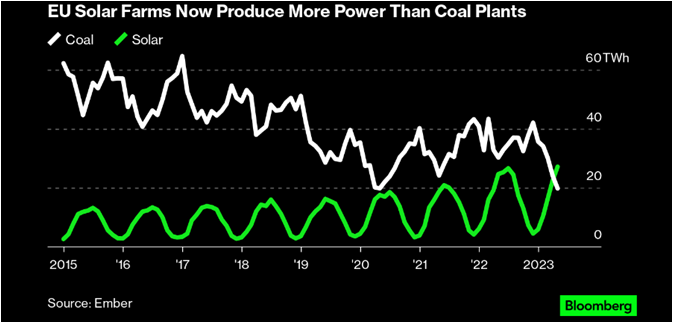

Chart of the Week:

In May 2023, the European Union’s transition to clean energy reached a remarkable milestone. Solar panel generation exceeded the bloc’s coal power plants for the first time, production should be further boosted over the summer months. Power prices turned negative during some of May’s sunniest days as grid operators struggled to handle the surge. Source: Ember & Bloomberg.

Week in Review: Fed Rate Hike Pause on the Cards

This week marked the end of May, with the S&P 500 reaching its highest level since mid-August 2022 and the Nasdaq Composite hitting its best level since mid-April 2022. The agreement reached between the White House and Republican congressional leaders to raise the federal debt limit and avoid a default did not significantly impact investor sentiment, as indications of a deal had already emerged. Economic data took centre stage, with U.S. employment data in the spotlight.

The Senate passed legislation to suspend the U.S. debt ceiling and impose restraints on government spending through the 2024 election. President Joe Biden is set to formally end the month-long debt-limit crisis this weekend.

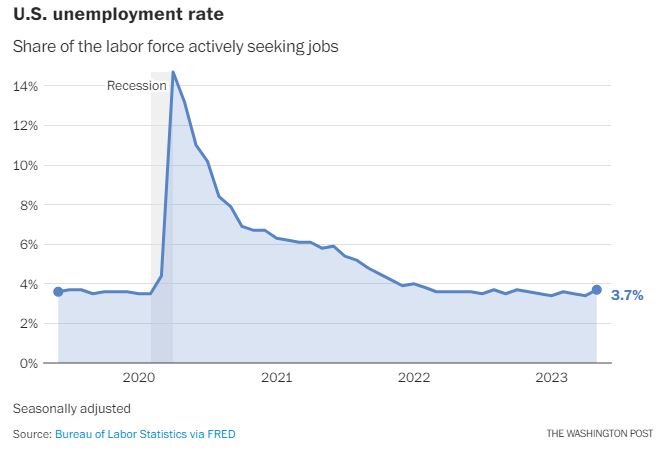

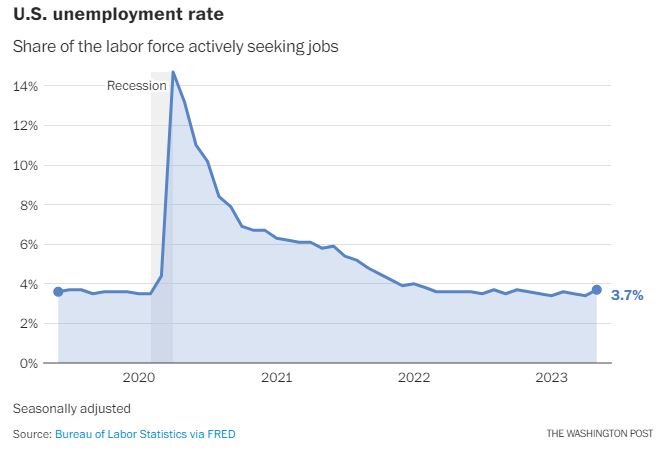

Employment data released during the week was mixed. A report on Wednesday showed that job openings rebounded much more than expected in April and hit their highest level (10.1 million) since January. However, Friday’s release showed that U.S. unemployment unexpectedly rose from 3.4% to 3.7%. The Labor Department also highlighted an increase in the number of people losing jobs or completing temporary positions, reaching the highest level since February 2022. Overall, these findings suggest a more challenging job market for workers. The Federal Reserve is signalling that they plan to keep interest rates steady in June while retaining the option to hike further in coming months. Friday’s unemployment data reinforces this possibility.

Another encouraging sign regarding interest rates was the release of U.S. manufacturing data for May. Data showed a seventh straight monthly contraction in factory activity, as expected. Encouragingly, prices paid for supplies and other inputs by manufacturers contracted at the fastest pace since December, defying expectations for a modest increase.

Eurozone inflation decreased more than expected in May, increasing by 6.1%, also down from a 7.0% increase in the previous month. The unemployment rate decreased to 6.5% in April, in line with market expectations, following a revised rate of 6.6% in March. Manufacturing PMI in the eurozone declined to 44.80 in May, down from 45.80 in the previous month.

UK house prices experienced a marginal decrease of 0.1% on a monthly basis in May, following a revised increase of 0.4% in the previous month. Market expectations had anticipated a 0.5% decline. This decline in house prices reflects wider concerns in the UK property market. Moody’s recently downgraded the debt of Canary Wharf, a prominent symbol of the global real estate downturn. The east London financial district, saw its debt rating lowered from Ba1 to Ba3.

In China, the official manufacturing Purchasing Managers’ Index (PMI) dropped unexpectedly to 48.80 in May, indicating a contraction for the second consecutive month. This suggests that the post-Covid recovery in China’s economy is facing challenges. However, the services PMI rose to 54.5, albeit below expectations, but still indicating expansion.

On the other hand, the private Caixin manufacturing PMI index surprisingly increased to 50.90 in May, contradicting the official data and showing a slight expansion in manufacturing activity. The Caixin index mainly covers smaller and export-oriented businesses.

U.S. and Asian markets were stronger this week, whilst European markets ended in negative territory. In the U.S., the Dow Jones (+2.02%), S&P 500 (+1.83%) and Nasdaq (+2.04%) all ended the week higher. Similarly, the Nikkei 225 (+1.97%), Hang Seng (+1.05%) and Shanghai Composite Index (+0.55%) also ended the week higher, whilst the Euro Stoxx 50 (-0.32%) and FTSE 100 (-1.80%) were negative.

Market Moves of the Week:

Earlier this week, the foreign ministers of Brazil, Russia, India, China, and South Africa met in Cape Town. The BRICS nations have requested guidance from their dedicated bank regarding the potential implementation of a shared currency, aiming to shield member countries from the impact of sanctions like those imposed on Russia.

Despite a 9.61% tariff increase and a bailout of R21.9 billion from the Treasury, Eskom reported a loss before tax of R21.2 billion for the 2024 financial year, surpassing the projected loss of R13.6 billion. The company’s revenue fell short of expectations, while its expenses, particularly on diesel, amounted to R21.36 billion, more than double the previous year. Additionally, the Treasury informed legislators that the total invoiced municipal arrear debt rose to R58.5 billion.

South Africa’s trade surplus contracted to R3.54bn, lower than expectations, while the Absa Purchasing Managers Index (PMI) declined in May, indicating a contraction in manufacturing output for the second quarter following a modest rebound in the first quarter.

The JSE All-Share Index (+0.70%) ended the week in positive territory, driven higher by the resource (+4.24%) and financial (+1.01%) sectors, whilst industrial shares (-1.24%) were negative. By Friday close, the rand was trading at R19.50 to the U.S. Dollar, appreciating by +0.75% for the week.

Chart of the Week:

The U.S. unemployment rate rose in May to 3.7% from 3.4%, one of the fastest increases since early in the pandemic, according to Bureau of Labor Statistics data released Friday. About 440,000 more workers reported that they are unemployed; and most of those were from temporary jobs ending or layoffs, according to the data.

Source: Bureau of Labor Statistics via FRED, Washington Post.

Week in Review: Agreement in Principle

President Joe Biden, House Speaker Kevin McCarthy and their negotiators reached a tentative agreement to raise the debt ceiling on Saturday evening, ending a months-long stalemate. President Joe Biden described the agreement as a “compromise”, while House Speaker Kevin McCarthy said it “has historic reductions in spending”. Republicans have been seeking spending cuts in areas such as education and other social programs in exchange for raising the $31.4tn (£25tn) debt limit, a law that caps how much debt the US government can accrue. Recent U.S. market performance has been closely linked to the development of the talks, with signs of renewed momentum in the talks spurring a market rally on Friday.

The core personal consumption expenditures price index, the U.S. Federal Reserve’s (the Fed) preferred inflation measure, rose 4.7% y/y in April, up from March’s 4.6% y/y reading. The print signals that inflation remains sticky and that insufficient progress has been made in bringing down core inflation. Personal income experienced a strong increase of 0.8%, while personal spending surpassed expectations with a rise of 0.5%. These figures indicate that the U.S. economy still remains resilient. Markets are currently pricing in one more interest rate hike from the Fed over the next two meetings and less than one rate cut by year end.

The Fed’s May meeting’s minutes were released during the week, revealing that Federal Reserve officials were divided over whether further rate hikes would be necessary to lower inflation, given the high uncertainty surrounding the impact of banking-sector stresses on the economy. Some participants commented that “based on their expectations that progress in returning inflation to 2% could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings.”

April’s inflation figure in the United Kingdom came in above expectations, with a year-over-year rate of 8.7% compared to the previous month’s 10.1% y/y rise. Consensus had anticipated a decrease to 8.2% in the Consumer Price Index (CPI). Meanwhile, core inflation rose to 6.8% y/y, reaching a new peak within the current cycle. Following the release of this data, investors adjusted their expectations and priced in an additional half-point increase in rates by the Bank of England.

According to a survey conducted by S&P Global, business output in the eurozone continued to grow for the fifth consecutive month in May. However, the rate of growth moderated slightly due to manufacturing weakness, which offset another robust month of activity in the services sector.

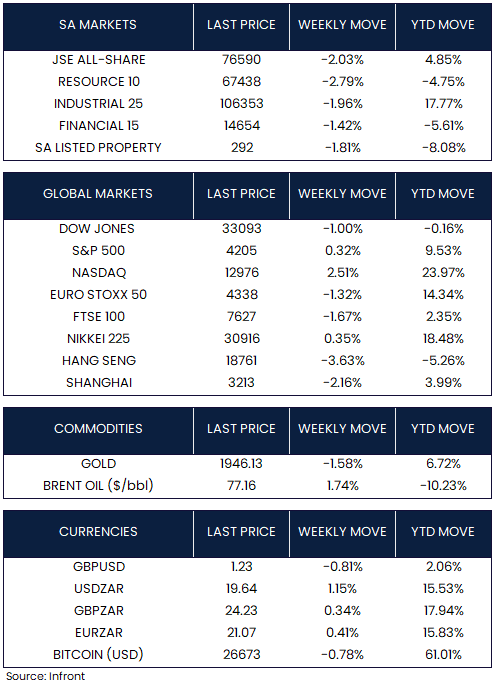

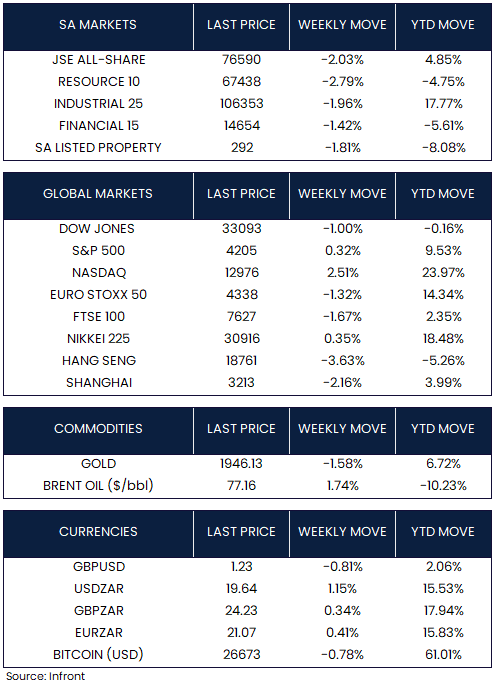

On the market front, global indices ended the week mixed. The S&P 500 Index climbed +0.32%, while the Dow Jones slipped -1.00%. The technology-heavy Nasdaq Composite outperformed and ended the week up +2.51% as a rush for artificial intelligence–focused stocks sparked a U.S. rally late in the week. Notably, shares of chipmaker NVIDIA surged +24% on Thursday after the company beat consensus first-quarter earnings expectations by a wide margin and raised its profit outlook. Shares in Europe fell -1.32% (Euro Stoxx 50) over the week while the FTSE 100 declined -1.67%.

Chinese equities fell over the week following a series of discouraging indicators in recent weeks that indicated a slowdown in their economic recovery. The Shanghai index ended the week down -2.16% as a result. In Japan, the Nikkei 225 gained +0.35%. Gold dipped -1.58% while Brent Oil rose +1.74% over the week.

Market Moves of the Week:

Inflation in South Africa cooled in April, with headline inflation easing to 6.8% y/y (expectations: 7% y/y) from 7.1% y/y in March. This was the lowest headline inflation print since May last year. Core inflation edged higher (from 5.2% y/y to 5.3%) in April. Despite a slight decrease in food prices, which slowed to 13.9% in April, the food and non-alcoholic beverages category continued to be the primary contributor to inflation for the month. Transport experienced its ninth consecutive month of disinflation (7.6% y/y), with fuel prices easing to 5% – the lowest reading since March 2021. Although consensus is for inflation growth to start declining going forward, the weakening rand as well as load shedding may keep inflation risks elevated.

Following Wednesday’s inflation print, the South African Reserve Bank (SARB) rose rates to the highest level since 2009 on Thursday, saying the restrictive policy is necessary to curb inflation. The repo rate rose to 8.25% after a 50 basis point hike was declared by governor Lesetja Kganyago. The decision will further burden an economy already facing unprecedented electricity shortages, with growth projected to be a mere 0.3% this year. Markets are suggesting that the SARB’s hiking cycle is now complete, however, risks continue to be tilted toward further tightening on account of continued rand depreciation.

The rand sank to a record low against the U.S. dollar ($/R 19.51) on Thursday after the hawkish statement by the SARB’s Monetary Policy Committee and subsequent comments by the Governor painted a gloomy outlook for the currency. The rand fell sharply by over 2% in response to the decision. The local currency is significantly oversold at these levels, but negative sentiment might keep it that way for some time.

President Cyril Ramaphosa insisted this week that South Africa (SA) will remain non-aligned towards Russia or Ukraine. The country has faced pressures from some of its main trading partners to change course, however, the president remains persistent that SA won’t be taking sides in the conflict.

The JSE (-2.03%) fell over the week as negative sentiment took hold. All sectors ended in the red, with Resources (-2.79%) and Industrials (-1.96%) taking the biggest hits. The rand depreciated against the U.S. dollar over the week, rising to R19.64/$ from last week’s R19.42/$ level.

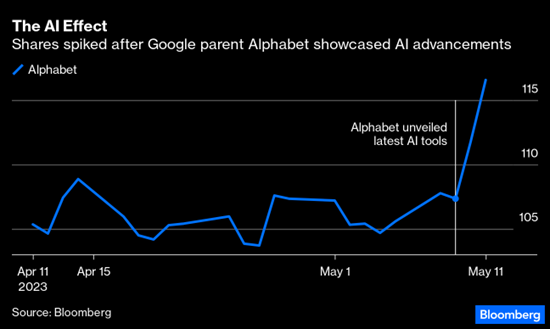

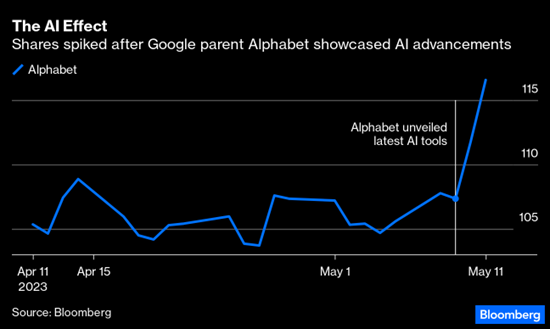

Chart of the Week:

Google parent Alphabet Inc. on May 10 unveiled a slew of AI-related projects and touched on $122 billion in a few trading hours. The AI phenomenon, which executives around the world have variously likened to the emergence of the internet and the iPhone, has administered what now looks like a historic shock to markets that even rivals the scenes when the pandemic hit three years ago.

Source: Bloomberg

Understanding UK Property Tax

The rules around tax are intricate enough when you’re buying property in your own country; when you take that process offshore, you quickly understand the value of consulting a qualified professional.

UK property as a long-term investment can yield high returns and is an effective means of hard currency exposure. Considering the impact and cost of taxes on your overall investment, it’s essential to ensure that you have (or at least your advisor has) a sound understanding of all the taxes that come with owning property in the UK.

Understanding the complete ins and outs of buying, holding and disposing of UK property assets can be complex and is often overlooked.

Transparency is the key word we stand by when assisting our clients in buying property overseas, and we work hand in hand with one of the UK’s top-rated accounting firms, HWFisher, to ensure our clients are fully informed

Our latest tax guide, in partnership with HWFisher, is available to download for everything you need to know about tax when looking at UK property as an investment for your 2023 portfolio.

Week in Review: Hawkish Fed and Bank Jitters

Hawkish testimony from US Federal Reserve Chair Jerome Powell earlier in the week and strong job openings in the U.S. saw major global indices retreat over the week.

Federal Reserve Chair Jerome Powell testified before a House Financial Services hearing indicating that interest rates may need to go higher and remain in a restrictive territory for an extended period. The higher for longer approach saw expectations of the feds fund rate increase with the peak or terminal rate now close to 5,75%.

Friday’s job report which showed an increase of 311,000 nonfarm jobs in February, well above consensus expectations of around 200,000, added to the Fed’s higher for longer interest rate path. The unemployment rate rose unexpectedly, however, from a January five-decade low of 3.4% to 3.6%. There also was some good news on the inflation side, as average hourly earnings rose 4.6% from a year ago, below the estimate for 4.8%. Leisure and hospitality, retail and government led job creation by sector. January’s nonfarm payrolls gain of 517,000 was revised down to 504,000, while December’s total was also revised down to 239,000, a decrease of 21,000 from the previous estimate.

All eyes will now be on next Tuesdays U.S. consumer price data, ahead of the Fed’s 22 March rate-setting meeting, to see whether there is enough evidence of easing inflation pressures to convince the Fed to raise rates by 0.25% rather than 0.5%.

Financials led the declines within the S&P 500 with concerns growing throughout the week about the health of SVB Financial, or Silicon Valley Bank, with customers withdrawing $42 billion of deposits by the end of Thursday. The collapse started on Wednesday when the technology-oriented regional bank was forced to sell and realize losses in securities held on its balance sheet in order to meet capital requirements. Within 48 hours a run-on deposits caused SVB to be shuttered by regulators, with trading in SVB stock halted on Friday. SVB is the largest banking failure in U.S. since the 2008 financial crisis and the second largest ever. The U.S. banking system, following a prolonged period of stringent oversight in the aftermath of the Global Financial Crisis, appears to be significantly better capitalized than it was in past crises, including 2008, but nevertheless the failure sent ripples through the global financial system on growing concerns that the aggressive Fed tightening cycle may be beginning to have undesirable economic side effects.

Major U.S. indices ended the week sharply lower with the benchmark S&P 500 Index down 4.5%, the Dow Jones off 4.4% and the Nasdaq off 4.7% as risk off sentiment took hold.

In the U.K. the economy grew by 0.3% in January, official figures showed on Friday, exceeding expectations as it continues to fend off an inevitable recession. The U.K. remains the only country in the G-7 (Group of Seven) major economies that has yet to fully recover its lost output during the Covid-19 pandemic. On the inflation front, U.K. inflation slowed to an annual 10.1% in January, continuing to shrink after hitting a 41-year high of 11.1% in October but staying well above the Bank of England’s 2% target. The UK’s FTSE 100 Index lost 2.50% for the week.

In Europe, shares tracked global markets lower amid concerns of risks in the banking system, the pan-European STOXX Europe 50 Index ended the week 1.5% lower.

Earlier in the week Beijing set an economic growth target of around 5% this year at the National People Congress (NPC). On Friday Chinese leader Xi Jinping gained an unprecedented third term as president as was widely expected, delegates also formally reappointed Xi as chairman of the Central Military Commission. Signs of weakening demand and a lower than expected growth outlook saw the Shanghai Stock Exchange Index decline by 2.95%, the worst weekly loss in more than two months.

Japan’s stock markets registered modest gains for the week, with the Nikkei 225 Index rising 0.78%, as the Bank of Japan made no changes to its monetary policy at the final meeting chaired by outgoing Governor Haruhiko Kuroda.

Bitcoin fell below $20,000 on Friday hitting a near-two month low after a sell-off in risk assets and the collapse of Silvergate, a crypto-focused bank, which announced it would wind down operations due to the fallout from the implosion of FTX, also weighing on crypto prices.

Market Moves of the Week:

On Monday night South African President Cyril Ramaphosa announced his much anticipated cabinet reshuffle. Paul Mashatile, newly elected deputy president of the ANC was installed as deputy president of South Africa, as was widely expected. A new minister of electricity was announced, Kgosientso Ramokgopa, the former mayor of Tshwane. Ramokgopa has been tasked with ending rolling blackouts by overseeing the fix on Eskom and bringing new energy to the grid. South Africa suffered its worst power cuts in 2022, and 2023 is so far looking even darker.

The South African economy contracted more than expected in the last quarter of 2022, as an escalation in rolling power cuts contributed to most sectors from agriculture to mining shrinking. Figures from Statistics South Africa showed gross domestic product contracted 1.3% in the fourth quarter compared to the previous three months in seasonally-adjusted terms. Analysts had predicted a 0.4% contraction in the October-December period. GDP growth increased by 2.0% in 2022.

Rating agency, S&P Global on Wednesday downgraded its outlook on South Africa to “stable” from “positive”, citing infrastructure constraints and the severe power crisis. It also revised down its real GDP growth forecast for 2023 to 1% from 1,5% previously.

The JSE All-Share Index tracked global markets lower for the week. Resources (-4.05%) were sharply lower, followed by financials (-1.89%) and industrials (-1.57%). The rand gained the most in more than a month on Friday after the US dollar weakened as US jobs data came in stronger-than-expected but lower than in January, ending the week approximately 1% stronger at R18.33/$.

Chart of the Week:

Following testimony from Fed Chair Jerome Powell the predicted feds fund rate moved higher, pointing to a higher terminal rate (using the Bloomberg World Interest Rate Probabilities function). This implied policy rate contrasts sharply with Powell’s last press conference on Feb. 1st .