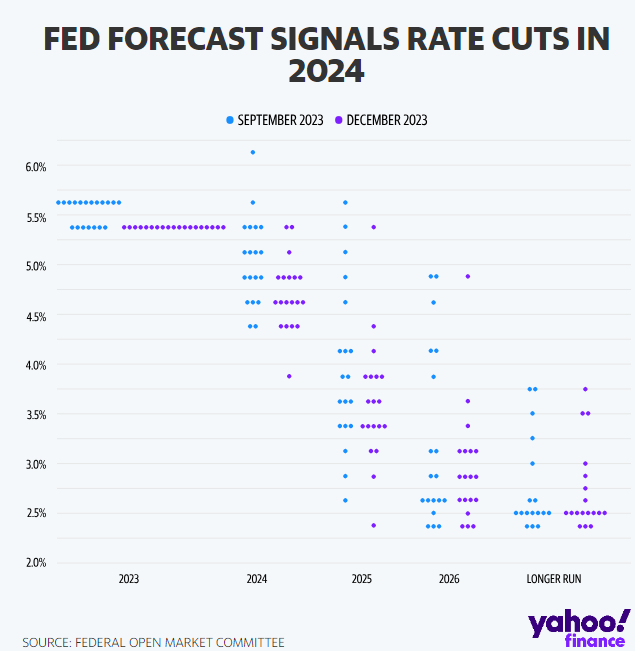

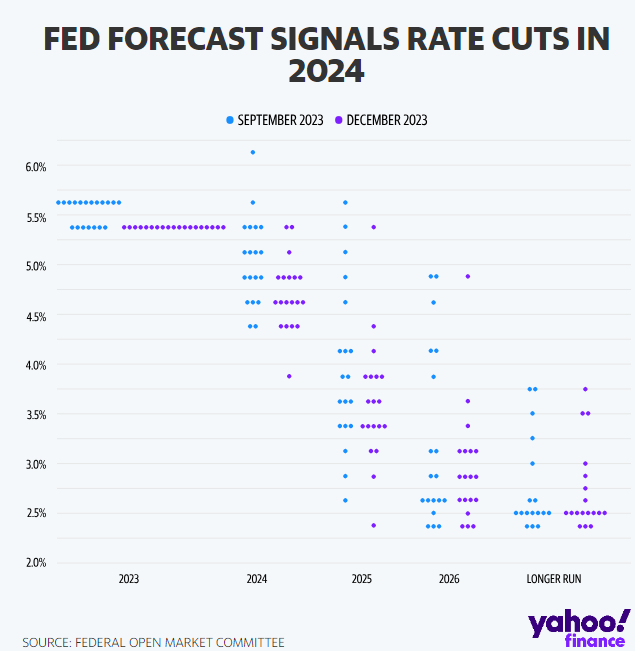

The Federal Reserve held its final policy meeting of the year this week. As anticipated, officials kept rates unchanged. However, the quarterly “dot plot,” which outlines individual policymakers’ rate expectations, revealed a shift in projections. The median forecast now suggests 75 basis points of rate cuts in 2024, up from the previous 50 basis points. Jerome Powell emphasized the committee’s awareness of the dangers associated with maintaining rates at elevated levels for an extended period. To avoid an inflation overshoot to the downside, Powell said the Fed would cut rates well before it reached its 2% target. Traders factored in a potential of seven rate cuts by January 2025, an increase from the previous projection of five before the meeting. Equities, bonds and commodities all surged in response to the unexpected dovish remarks.

U.S. inflation rose 3.14% y/y in November, down from October’s 3.24% level, which supported the Fed’s dovish narrative, while core prices held steady at 4% y/y. The producer price inflation report, released Wednesday, revealed a slight downside surprise, showing core inflation at 2.0% for the year, slightly below forecasts and marking its lowest point since January 2021.

Following the Fed’s meeting, the European Central Bank (ECB) and the Bank of England (BOE) convened on Thursday, opting to maintain their rates unchanged. However, they exhibited notably more cautious stances in their subsequent commentary. Differing from the Fed’s approach, ECB President Christine Lagarde stated that the Monetary Policy Committee did not deliberate on a rate cut while the bank called for inflation to slow to just below its 2% target by 2026, a move widely seen as paving the way for a reduction of interest rates. On the same hawkish tone, BOE policymakers restated their readiness to raise borrowing costs once again should there be indications of more sustained inflation.

In December, Eurozone business activity contracted, per S&P Global. The initial Purchasing Managers’ Index (PMI) estimate, combining manufacturing and services sectors, dropped to 47.0 from November’s 47.6, marking a two-month low and the seventh consecutive month below the contraction threshold of 50. Similarly, the U.K. economy shrank in October by 0.3% sequentially, after rising 0.2% in September.

China’s November economic performance data showed a mixed picture. Industrial production exceeded expectations, growing by 6.6% y/y. Conversely, retail sales fell significantly short of forecasts, increasing by 10.1%. Residential property sales declined by 4.3% compared to the previous year, and new home prices continued their downward trend for the sixth consecutive month, dropping by 0.37% in November. Meanwhile, China’s producer price index dropped a bigger-than-expected 3% from a year ago, marking the 14th monthly decline.

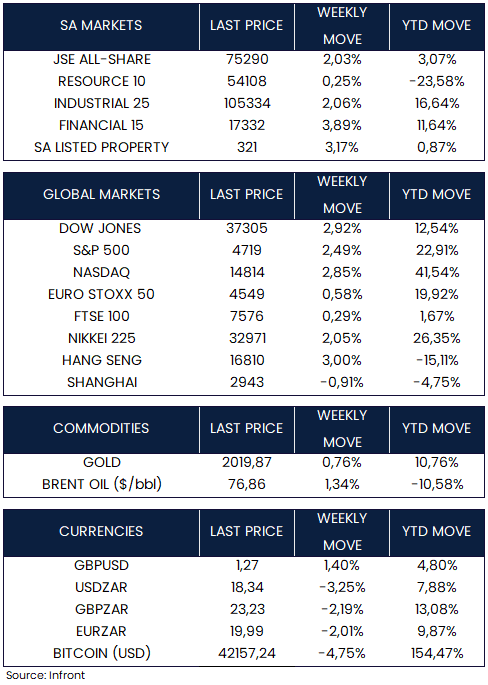

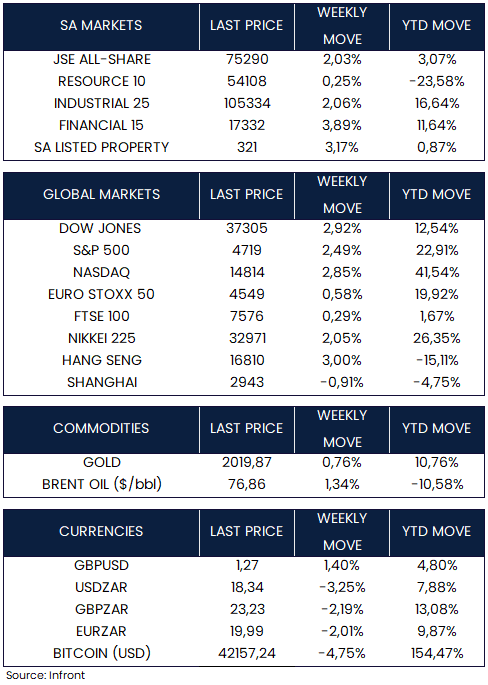

On the market front, major global indices ended the week higher. In the U.S., the S&P 500 Index (+2.49%), Nasdaq Composite (+2.85%), and Dow Jones Industrial Average (+2.92%) recorded their seventh consecutive week of gains – the longest streak for the S&P 500 since 2017. The Dow Jones hit an all time high while the two reaming indices reached 52-week highs. The yield on the U.S. 10-year Treasury note dropped from 4.22% last Friday to as low as 3.89% after the Fed signalled it has begun to contemplate rate cuts in 2024.

Shares in Europe (Euro Stoxx 50) and the UK ( FTSE 100) rose by +0.58% and 0.29% respectively. Chinese shares declined with the Shanghai index dropping -0.91%, while in Hong Kong, the benchmark Hang Seng Index managed a 3% gain. In Japan, the Nikkei 225 rallied +2.05%. Gold rose by +0.76% while Brent Oil gained +1.34% over the week.

Market Moves of the Week

Several key economic data points were released in South Africa (SA) this week. Headline inflation fell from 5.9% y/y in October to 5.5% y/y in November, coming in slightly above expectations of 5.4%, while core inflation increased from 4.4% y/y to 4.5%. Most notably, annual food-price inflation quickened to a four-month high of 9% y/y, mainly driven by chicken-portion prices, which rose 7.3% as an outbreak of avian flu continued to disrupt the country’s poultry market. Likewise, egg prices climbed 10.6% m/m.

SA retail sales fell -2.5% y/y in October after increasing by 1% in September. The move was the steepest decrease in retail activity since May, mainly due to reduced sales at general dealers. On a more positive note, SA’s business confidence rose to 111.5 in November from 108.6 in October as tourism and merchandise import volumes improved in month-on-month terms. 11 out of 14 sub-indices either showed positive changes or remained practically unchanged.

On the mining and manufacturing front, production in both sectors rose by more than expected in October. Mining production increased by 3.9% y/y (expectations: 1.2%) in October after September’s 1.9% drop. Mining output is down -1.3% YTD vs the -7.1% decline in 2022. Manufacturing, which holds more than twice the economic significance of mining in South Africa, witnessed a 2.1% y/y increase in October, surpassing the anticipated 1.7% gain. Manufacturing is now up 0.2% YTD.

Thursday’s release of third-quarter employment data revealed a net increase of 31,000 employees between June and September, compared to the second quarter of 2023. Although this overall employment growth was positive for SA, Stats SA noted a decrease in the number of individuals hired on a full-term basis, including those engaged in community services.

The JSE (+2.03%) ended the week in the green, following global markets higher. Sectors were mixed with Financials (+3.89%) leading and Resources (+0.25%) lagging. The local currency strengthened against the U.S. dollar over the week, rising to R18.34/$ from last week’s R18.96/$ level.

Chart of the Week

The dot plot shows Fed policymakers’ estimates for interest rates at the end of the next several years and over the longer run. December’s plot shows that seventeen officials predict a rate cut next year, with five officials seeing a decrease of more than 0.75% while just two see no cut – a major shift from September’s chart. No officials see rates ticking higher in 2024.

Source: Yahoo Finance