President Joe Biden, House Speaker Kevin McCarthy and their negotiators reached a tentative agreement to raise the debt ceiling on Saturday evening, ending a months-long stalemate. President Joe Biden described the agreement as a “compromise”, while House Speaker Kevin McCarthy said it “has historic reductions in spending”. Republicans have been seeking spending cuts in areas such as education and other social programs in exchange for raising the $31.4tn (£25tn) debt limit, a law that caps how much debt the US government can accrue. Recent U.S. market performance has been closely linked to the development of the talks, with signs of renewed momentum in the talks spurring a market rally on Friday.

The core personal consumption expenditures price index, the U.S. Federal Reserve’s (the Fed) preferred inflation measure, rose 4.7% y/y in April, up from March’s 4.6% y/y reading. The print signals that inflation remains sticky and that insufficient progress has been made in bringing down core inflation. Personal income experienced a strong increase of 0.8%, while personal spending surpassed expectations with a rise of 0.5%. These figures indicate that the U.S. economy still remains resilient. Markets are currently pricing in one more interest rate hike from the Fed over the next two meetings and less than one rate cut by year end.

The Fed’s May meeting’s minutes were released during the week, revealing that Federal Reserve officials were divided over whether further rate hikes would be necessary to lower inflation, given the high uncertainty surrounding the impact of banking-sector stresses on the economy. Some participants commented that “based on their expectations that progress in returning inflation to 2% could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings.”

April’s inflation figure in the United Kingdom came in above expectations, with a year-over-year rate of 8.7% compared to the previous month’s 10.1% y/y rise. Consensus had anticipated a decrease to 8.2% in the Consumer Price Index (CPI). Meanwhile, core inflation rose to 6.8% y/y, reaching a new peak within the current cycle. Following the release of this data, investors adjusted their expectations and priced in an additional half-point increase in rates by the Bank of England.

According to a survey conducted by S&P Global, business output in the eurozone continued to grow for the fifth consecutive month in May. However, the rate of growth moderated slightly due to manufacturing weakness, which offset another robust month of activity in the services sector.

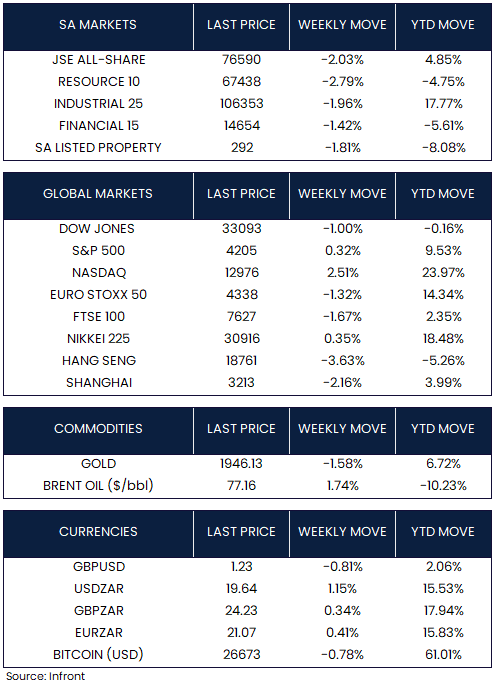

On the market front, global indices ended the week mixed. The S&P 500 Index climbed +0.32%, while the Dow Jones slipped -1.00%. The technology-heavy Nasdaq Composite outperformed and ended the week up +2.51% as a rush for artificial intelligence–focused stocks sparked a U.S. rally late in the week. Notably, shares of chipmaker NVIDIA surged +24% on Thursday after the company beat consensus first-quarter earnings expectations by a wide margin and raised its profit outlook. Shares in Europe fell -1.32% (Euro Stoxx 50) over the week while the FTSE 100 declined -1.67%.

Chinese equities fell over the week following a series of discouraging indicators in recent weeks that indicated a slowdown in their economic recovery. The Shanghai index ended the week down -2.16% as a result. In Japan, the Nikkei 225 gained +0.35%. Gold dipped -1.58% while Brent Oil rose +1.74% over the week.

Market Moves of the Week:

Inflation in South Africa cooled in April, with headline inflation easing to 6.8% y/y (expectations: 7% y/y) from 7.1% y/y in March. This was the lowest headline inflation print since May last year. Core inflation edged higher (from 5.2% y/y to 5.3%) in April. Despite a slight decrease in food prices, which slowed to 13.9% in April, the food and non-alcoholic beverages category continued to be the primary contributor to inflation for the month. Transport experienced its ninth consecutive month of disinflation (7.6% y/y), with fuel prices easing to 5% – the lowest reading since March 2021. Although consensus is for inflation growth to start declining going forward, the weakening rand as well as load shedding may keep inflation risks elevated.

Following Wednesday’s inflation print, the South African Reserve Bank (SARB) rose rates to the highest level since 2009 on Thursday, saying the restrictive policy is necessary to curb inflation. The repo rate rose to 8.25% after a 50 basis point hike was declared by governor Lesetja Kganyago. The decision will further burden an economy already facing unprecedented electricity shortages, with growth projected to be a mere 0.3% this year. Markets are suggesting that the SARB’s hiking cycle is now complete, however, risks continue to be tilted toward further tightening on account of continued rand depreciation.

The rand sank to a record low against the U.S. dollar ($/R 19.51) on Thursday after the hawkish statement by the SARB’s Monetary Policy Committee and subsequent comments by the Governor painted a gloomy outlook for the currency. The rand fell sharply by over 2% in response to the decision. The local currency is significantly oversold at these levels, but negative sentiment might keep it that way for some time.

President Cyril Ramaphosa insisted this week that South Africa (SA) will remain non-aligned towards Russia or Ukraine. The country has faced pressures from some of its main trading partners to change course, however, the president remains persistent that SA won’t be taking sides in the conflict.

The JSE (-2.03%) fell over the week as negative sentiment took hold. All sectors ended in the red, with Resources (-2.79%) and Industrials (-1.96%) taking the biggest hits. The rand depreciated against the U.S. dollar over the week, rising to R19.64/$ from last week’s R19.42/$ level.

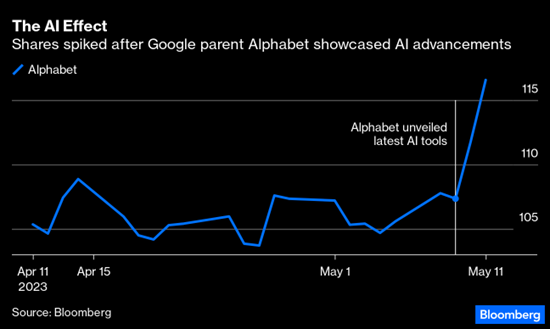

Chart of the Week:

Google parent Alphabet Inc. on May 10 unveiled a slew of AI-related projects and touched on $122 billion in a few trading hours. The AI phenomenon, which executives around the world have variously likened to the emergence of the internet and the iPhone, has administered what now looks like a historic shock to markets that even rivals the scenes when the pandemic hit three years ago.

Source: Bloomberg