After a strong performance in the first half of 2023, markets experienced a slight setback in the first week of the third quarter. The catalyst behind this week’s pullback was the release of the Fed’s minutes and stronger-than-expected U.S. services data, increasing expectations for an extended period of higher interest rates.

Minutes from the Federal Reserve’s meeting last month revealed that although the decision to keep rates unchanged in June was unanimous, some members expressed a preference for a rate hike, reinforcing the belief that interest rates would remain at elevated levels for an extended period.

The ISM Services Index surpassed expectations, registering a reading of 53.9 for June (a value above 50 represents an expansion). This positive performance was observed across 15 out of the 18 services sectors, showcasing robust growth and sustained demand for services. The strength of the U.S. services industry stands in contrast to the manufacturing sector, which showed signs of weakness. The ISM manufacturing component recorded a reading of 46.0, falling below expectations and remaining in contraction territory for the eighth consecutive month.

On the other hand, the latest job data from Friday indicates a potential slowdown in the U.S. labour market. The Labor Department reported that employers added 209,000 nonfarm jobs in June, slightly below expectations and marking the lowest figure since December 2020. Additionally, the previously reported job gains for the past two months were revised downward by a total of 110,000 jobs. Although the unemployment rate decreased from 3.7% in May to 3.6% in June, the report revealed a significant increase of approximately 11% in the number of individuals employed part-time due to economic reasons. This increase can be attributed, in part, to a rise in people experiencing reduced working hours.

European inflation expectations decreased in May, with survey participants expecting inflation to be at 3.9% in the next 12 months, down from 4.1% in April. However, European Central Bank President Christine Lagarde, maintained a hawkish stance, emphasising the need to address inflation projected to be above the 2% target in 2024 and 2025. At the same time, ECB Governing Council member Joachim Nagel stated that interest rates would need to remain restrictive for an extended period to control inflation.

The UK housing market is being affected by the ongoing increase in mortgage rates. According to Halifax, a home loan provider, house prices have experienced a year-over-year decline of 2.6%. This represents the most significant decrease since 2011.

Chinese manufacturing activity slowed to its lowest level since January. The private Caixin/S&P Global survey of manufacturing activity eased to 50.5 in June from May’s 50.9 as expansion of manufacturing output and new orders softened. The reading was in line with the official Manufacturing Purchasing Managers’ Index, which contracted in June for a third consecutive month. Premier Li Qiang, China’s second-highest ranking official, has pledged to “spare no time” in implementing a batch of targeted policies to strengthen China’s post-pandemic recovery.

In oil-related news, Saudi Arabia announced significant price increases for its crude oil. State-owned Saudi Aramco raised the prices of all grades to the U.S., northwest Europe, and the Mediterranean for the upcoming month. It also unexpectedly increased the price of its flagship Arab Light oil in the crucial Asian market, contrary to expectations.

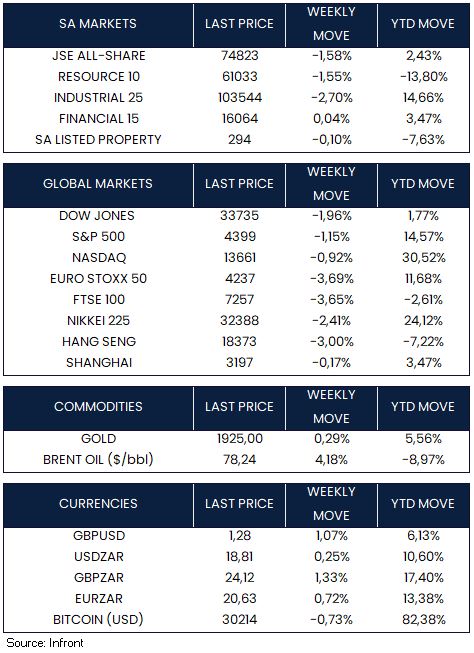

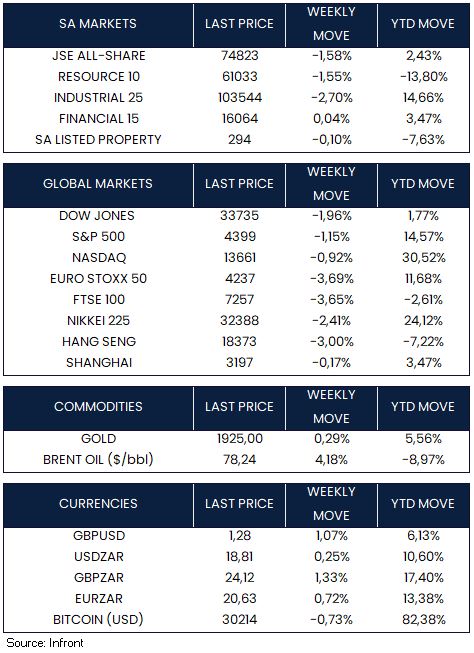

Global equity markets ended the week lower. In the U.S., the Dow Jones (-1.96%), S&P 500 (-1.15%) and Nasdaq (-0.92%) all ended the week in negative territory. Similarly, European and Asian markets including the Euro Stoxx 50 (-3.69%); FTSE 100 (-3.65%), Nikkei 225 (-2.41%), Hang Seng (-3.00%) and Shanghai Composite Index (-0.17%) were all weaker.

Market Moves of the Week:

In South Africa, Reserve Bank Governor, Lesetja Kganyago stated that inflation has begun to decline, emphasising the need for it to fall within the 3 to 6 percent target range. Critics have argued that the South African Reserve Bank’s hawkish stance overlooks the import-driven nature of inflation and the challenges faced by debt-ridden individuals and businesses seeking credit.

Meanwhile, private-sector credit reached a three-month low due to easing lending growth in both households and corporations. Household credit growth decreased to a one-year low of 6.7% in May, with home loans and vehicle finance seeing downward pressure due to weaker household finances, higher interest rates, and declining consumer confidence.

Electricity production in South Africa fell by 9% in May, reflecting the ongoing struggle with load shedding. Additionally, environmental activists have appealed against a decision allowing Eskom to bypass pollution reduction equipment while repairing one of its major coal-fired power plants.

The JSE All-Share Index (-1.58%) was negative this week. Weaker performances came from the resources (-1.55%) and industrial (-2.70%) sectors, whilst the financial sector (+0.04%) was flat. By Friday close, the rand was trading at R18.76 to the U.S. Dollar, depreciating by -0.25% for the week.

Chart of the Week:

Expansion in China’s services industry slowed in June, indicating a weakening of the country’s post-Covid recovery. According to the Caixin China services purchasing managers’ index, the sector declined to 53.9 from 57.1 in May, the lowest level since January and below economists’ median forecast of 56.2. The drop suggests that consumer spending on services, including travel and restaurants, is decreasing due to high youth unemployment and a pessimistic income outlook. This data may prompt calls for the Chinese government to implement additional measures to support economic growth.

Source: Bloomberg.