Monthly Update

March 2024

Despite deferred rate cuts, equity market optimism persisted over the quarter, bolstered by U.S. economic resilience, AI advancements, and waning global economic weakness. Developed market equities (MSCI World) gained +3.3% m/m and +9.0% over 1Q24, whilst emerging market equities relatively underperformed, with the MSCI EM Index returning 2.4% in 1Q24. Investors remained concerned about China’s growth prospects over the quarter, however, sentiment picked up in March, powered by improved economic data during the Lunar New Year holiday, coupled with easing measures from the People’s Bank of China.

Bonds struggled over the quarter against persistent inflation, robust economic growth and the ongoing “higher for longer” narrative. The change in the macroeconomic landscape was also evident in market expectations of interest rate cuts. The projected count of U.S. rate cuts for 2024 decreased from 6/7 cuts (end of 2023) to a maximum of three rate cuts overall, commencing in the summer. Consequently, global bond yields rose and prices fell, resulting in a quarter-end decrease of -2.1% (Bloomberg Global Aggregate).

Despite deferred rate cuts, equity market optimism persisted over the quarter, bolstered by U.S. economic resilience, AI advancements, and waning global economic weakness. Developed market equities (MSCI World) gained +3.3% m/m and +9.0% over 1Q24, whilst emerging market equities relatively underperformed, with the MSCI EM Index returning 2.4% in 1Q24. Investors remained concerned about China’s growth prospects over the quarter, however, sentiment picked up in March, powered by improved economic data during the Lunar New Year holiday, coupled with easing measures from the People’s Bank of China.

Bonds struggled over the quarter against persistent inflation, robust economic growth and the ongoing “higher for longer” narrative. The change in the macroeconomic landscape was also evident in market expectations of interest rate cuts. The projected count of U.S. rate cuts for 2024 decreased from 6/7 cuts (end of 2023) to a maximum of three rate cuts overall, commencing in the summer. Consequently, global bond yields rose and prices fell, resulting in a quarter-end decrease of -2.1% (Bloomberg Global Aggregate).

In commodity markets, the Bloomberg Commodity Index saw a marginal increase of 2.2% q/q. This rise came as the decline in gas prices was outweighed by an increase in oil prices, driven by continual supply cuts and geopolitical tensions. Spot Bitcoin ETFs debuted in the global market in January, marked by high trading volumes and net inflows totalling about $1.5bn. Bitcoin then reached all-time highs in March, with BlackRock’s Spot Bitcoin ETF (IBIT) becoming the fastest ETF to reach $10 billion in assets under management.

In recent months, inflation in the U.S. appears to be stabilising rather than declining, after rising to 3.2% in February (January: 3.1%) – still well above the Fed’s 2% target. While the U.S. Federal Reserve kept rates unchanged, as expected, during its January and March meetings, the market’s confidence in upcoming rate cuts is diminishing, influenced by inflation data proving more resilient than prevailing narratives imply.

In other central bank news, the Swiss National Bank (SNB) unexpectedly reduced borrowing costs by a quarter of a percentage point to 1.5% in March — the first cut in nine years. Additionally, the Bank of Japan (BoJ) made a much-anticipated policy shift, exiting its negative interest rate policy. The central bank delivered its first hike since 2007, scrapping the world’s last remaining negative interest rate. Whereas the BOE and ECB kept rates steady amidst easing inflation.

A robust U.S. GDP print of 3.4% y/y for Q4 2023 (2023: +2.5%) came in significantly above consensus expectations, underscoring the resilience of the U.S. economy while China’s annual GDP growth rate for 2023 marked the lowest since 1990. The Eurozone managed to avoid a shallow recession in Q4 2023, managing to grow a mere 0.1% for the year. The UK wasn’t as fortunate; slipping into a technical recession at year’s end. However, the economy is showing signs of recovery with a 0.2% increase in GDP in January.

Last year, China experienced its lowest annual foreign direct investment since the 1990s, amidst pandemic recovery challenges and investors searching for higher yields elsewhere. The market continues to face persistent deflationary pressures coupled with low levels of borrowing despite interventions by the People’s Bank of China. Additionally, China’s property market remains in decline, as new home prices fell for an eighth consecutive month.

Japan’s Nikkei 225 index reached a new all-time high for the first time in over 30 years, outperforming its global peers in Q1 2024. The Nikkei 225 ended up +20.63% in the first three months of the year, despite the Bank of Japan beginning normalisation of its monetary policy. Additionally, the yen depreciated to a 34-year low of 151.97 against the U.S. dollar during March. Japanese authorities voiced their objection to these developments, describing them as disorderly. Market expectations are converging on the likelihood of two more BoJ interest rate hikes within a year.

In South Africa, Finance Minister Godongwana’s 2024 budget speech proposed utilising funds from the Reserve Bank’s reserves over three years, introducing tax reforms and signalling increased private sector involvement in infrastructure funding.

February’s hot CPI print of 5.6% (up from January’s 5.3%), as well as previous above-target prints, are likely reinforcing the central bank’s commitment to maintaining borrowing costs at a 15-year-high of 8.25%. Currently, the first cut is only being priced in by the market for November 2024.

SA managed to avoid a technical recession in 2023, with growth coming in at 0.6% for the year. However, the overall situation remains unchanged: the economy persists in stagnation due to subdued domestic demand and various obstacles to supply-side growth.

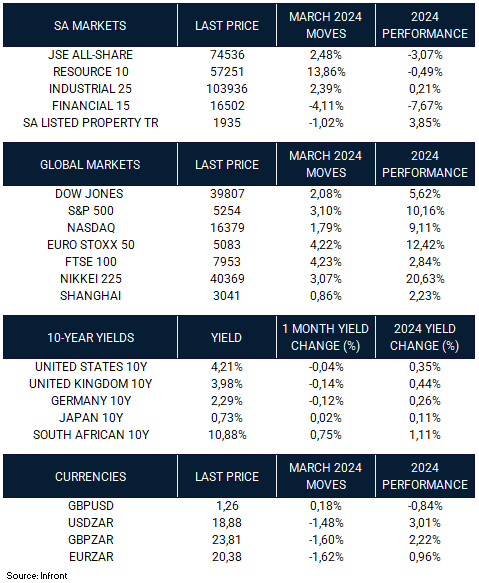

The JSE All Share Index gained +2.48% in March (1Q24: -3.07%) – the first positive month of the year. The property sector outperformed over the quarter (+3.85% q/q), driven by UK- and Europe-focused REITS (‘rand-hedges’). After a challenging two months, Resources surged in March (+13.86% m/m). With the gold price hitting record highs and PGM prices surging, mining counters emerged as the top performers. The rand strengthened against the U.S. dollar, rising +1.4% in March, yet remains down -3.1% for 1Q24.