The annual Jackson Hole symposium hosted by the Federal Reserve Bank of Kansas City commenced on Thursday. During the event, several Federal Reserve officials indicated that although there might not be…

Continue readingWeek in Review: Boris Johnson Resigns

After more than 50 ministers and several Cabinet members stepped down, U.K Prime Minister Boris Johnson announced his intention to resign. This comes weeks after Johnson narrowly survived a no confide…

Continue readingWeek in Review: Mixed Data as S&P500 Regains Bull Market Status

On Thursday, the S&P500 index experienced a significant development as it entered a bull market. The broad equities benchmark demonstrated a 0.6% increase, concluding the day at 4,292.93 points. This surge represents a notable 20% leap from its lowest point on October 12, 2022, when it stood at 3,577.03 points. Investors reacted favourably to indications from the Central Bank, which suggested that it is nearing the conclusion of its interest rate hiking cycle. Last week, the Federal Reserve hinted that it is likely to abstain from implementing a rate hike during its June 13-14 meeting. This anticipated pause has acted as a catalyst, propelling stock prices to higher levels.

On Thursday, the US Labour Department reported that weekly jobless claims had unexpectedly increased this week to 261,000, well above expectations and the highest level since October 2021.

Economists at the World Bank have revised their global GDP forecast for 2023, increasing it from the earlier projection of 1.7% to 2.1%. This upward adjustment indicates an improvement; however, it also suggests a significant deceleration compared to the 3.1% growth rate observed in 2022. In addition, the World Bank has reduced its growth outlook for 2024 from 2.7% to 2.4%.

While major economies have exhibited more resilience than anticipated in 2023, the economists caution that the impact of higher interest rates and tighter credit conditions will likely dampen growth in 2024. These factors are expected to take a toll on economic expansion going forward.During a meeting at the White House, US President Joe Biden and UK Prime Minister Rishi Sunak reached an agreement to initiate negotiations on a trade pact between their countries. This trade agreement holds the potential to benefit British automakers by allowing them to qualify for electric car subsidies. Furthermore, it could facilitate the joint development of advanced weaponry. The focus of the trade discussions would revolve around critical materials that play a vital role in the production of batteries used in electric vehicles. The proposed trade package aims to foster collaboration and strengthen economic ties between the US and UK.

According to revised GDP data, the Eurozone’s economy experienced a technical recession during the winter period, albeit by a small margin. The data reveals that the economy contracted by 0.1% in both the fourth quarter of 2022 and the first quarter of this year. This weak growth performance is not unexpected, considering the significant impact of the war in Ukraine on European energy markets.

In Japan, revised figures released this week by the Cabinet Office indicates that the economy experienced stronger growth than initially estimated during the first quarter of 2023. Gross domestic product (GDP) expanded at an annualized rate of 2.7% quarter on quarter, surpassing the initial reading of 1.6% and exceeding economists’ forecasts. The upward revision of first-quarter GDP can be largely attributed to robust corporate investment. Despite apprehensions surrounding a slowdown in global growth, particularly in China, businesses in Japan demonstrated increased spending as sentiment remained resilient.

Saudi Arabia has announced its intention to implement an additional reduction of 1 million barrels per day in oil supply during July. This decision has been prompted by a decline in crude prices and will bring the country’s production to its lowest level in several years. Despite the potential consequences, this bold step has been taken by Saudi Arabia, which holds significant importance as a member of the OPEC+ coalition, with the aim of stabilizing the market.

However, it is important to note that this move does involve some concessions to key allies. Russia, a prominent member of the coalition, has not committed to further output cuts. Additionally, the United Arab Emirates (UAE) has negotiated a higher production quota for the year 2024. Despite these compromises, Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, has expressed a strong commitment to taking whatever measures are necessary to restore stability to the market. Brent Crude Oil closed the week lower, down 1.65% to $74,94 bbl.

Chinese equities ended the week on a mixed note, following the release of the latest inflation data, which has increased concerns surrounding the post-pandemic recovery, China’s CPI rose 0.2% in May. The recent release of weak export and import data has fuelled expectations for increased economic stimulus in China. The data indicates that both domestic and international demand remain subdued. In May, exports experienced a significant decline of 7.5% compared to the previous year, surpassing initial forecasts for a weaker performance. Additionally, imports fell by 4.5% compared to the same period last year. Notably, China’s share of US goods imports in April reached its lowest level since 2006, as reported by The Wall Street Journal. Analysts are concerned that exports may further decline, despite their current elevation compared to pre-COVID levels.

The Shanghai Composite index posted a modest gain of 0.04% for the week, while Hong Kong’s Hang Seng Index extended the previous week’s gains, posting a strong 2.32% week-on-week return.

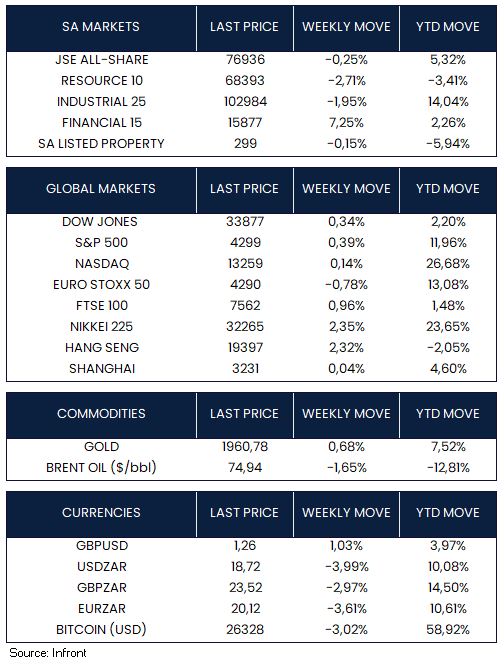

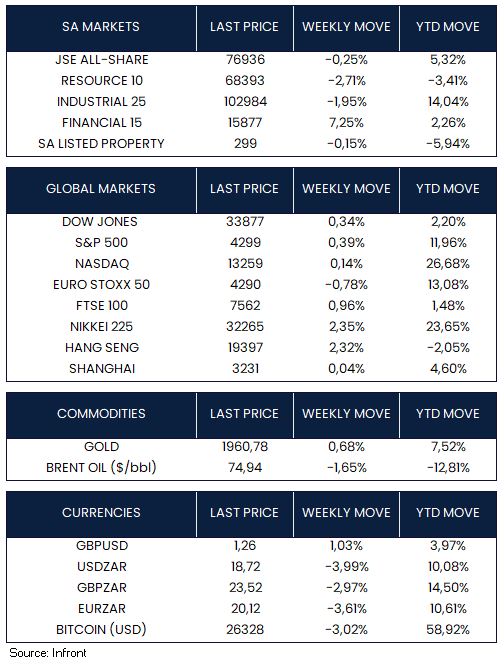

US stocks ended the week slightly higher, with the S&P 500 up 0.39%, the Dow Jones Industrial Average up 0.34%, and the tech heavy Nasdaq Composite rising slightly 0.14%. The Euro Stoxx 50 ended the weak lower (-0.78%), while the FTSE 100 (0.96%) closed the week in positive territory. Japan’s Nikkei 225 index gained 2.35% this week, continuing its positive trend for the year (23.65% YTD).

Market Moves of the Week:

On the domestic front, recent economic data indicates a notable resilience, as the South African economy narrowly averted a recession during the first quarter. According to the latest data released on Tuesday, the economy expanded by 0.4%, effectively returning to pre-COVID levels. Out of the ten industries monitored by Stats SA, eight experienced growth in Q1, with manufacturing and finance, real estate, and business services making the most significant positive contributions.

Furthermore, South Africa’s current account deficit exhibited a substantial narrowing, declining from 2.3% of GDP in Q4 2022 to 1.0% of GDP in Q1 2023, contrary to the consensus forecast of a widening deficit. The primary catalyst for this improvement was the balance of trade in goods and services, which shifted from a deficit of 0.8% of GDP in Q4 to a surplus of 0.6% of GDP in Q1.

Adding to the positive developments, there has been some relief from Stage 6 national loadshedding, and a constructive meeting between government officials and business leaders on Wednesday, which has reignited optimism that a potential solution could be identified to mitigate the persistent power outages.

Although there were some positive developments on the news and economic front, the JSE ALSI posted a modest decline for the week (-0.25%), the only positive sector contributor was Financials up 7.25%. Both Industrials (-1.95%) and Resources (-2.71%) were down for the week. The Rand made a strong recovery, receding below the R19/$ mark. The currency was trading at R18.72/$ by Friday close, appreciating 3.99% against the Dollar. The SA listed property sector continues to face headwinds, the sector closed the week marginally lower -0.15%.

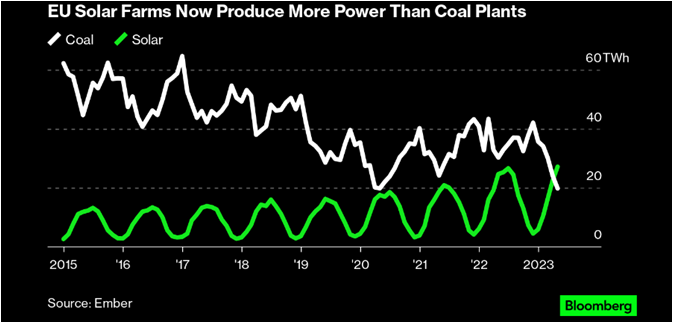

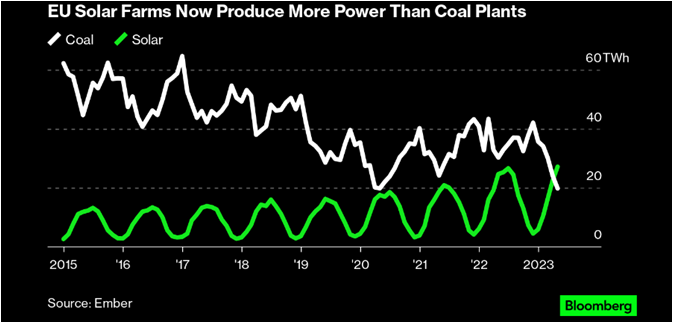

Chart of the Week:

In May 2023, the European Union’s transition to clean energy reached a remarkable milestone. Solar panel generation exceeded the bloc’s coal power plants for the first time, production should be further boosted over the summer months. Power prices turned negative during some of May’s sunniest days as grid operators struggled to handle the surge. Source: Ember & Bloomberg.

Week in Review: Fed Rate Hike Pause on the Cards

This week marked the end of May, with the S&P 500 reaching its highest level since mid-August 2022 and the Nasdaq Composite hitting its best level since mid-April 2022. The agreement reached between the White House and Republican congressional leaders to raise the federal debt limit and avoid a default did not significantly impact investor sentiment, as indications of a deal had already emerged. Economic data took centre stage, with U.S. employment data in the spotlight.

The Senate passed legislation to suspend the U.S. debt ceiling and impose restraints on government spending through the 2024 election. President Joe Biden is set to formally end the month-long debt-limit crisis this weekend.

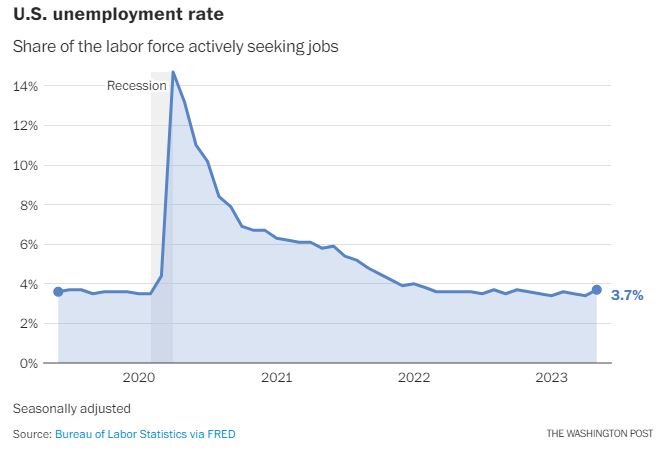

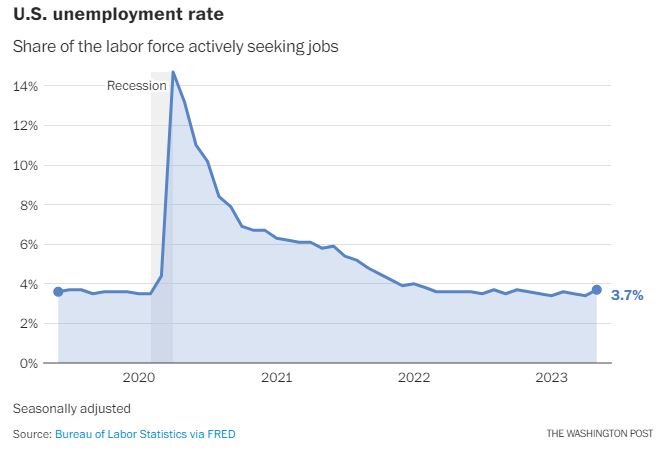

Employment data released during the week was mixed. A report on Wednesday showed that job openings rebounded much more than expected in April and hit their highest level (10.1 million) since January. However, Friday’s release showed that U.S. unemployment unexpectedly rose from 3.4% to 3.7%. The Labor Department also highlighted an increase in the number of people losing jobs or completing temporary positions, reaching the highest level since February 2022. Overall, these findings suggest a more challenging job market for workers. The Federal Reserve is signalling that they plan to keep interest rates steady in June while retaining the option to hike further in coming months. Friday’s unemployment data reinforces this possibility.

Another encouraging sign regarding interest rates was the release of U.S. manufacturing data for May. Data showed a seventh straight monthly contraction in factory activity, as expected. Encouragingly, prices paid for supplies and other inputs by manufacturers contracted at the fastest pace since December, defying expectations for a modest increase.

Eurozone inflation decreased more than expected in May, increasing by 6.1%, also down from a 7.0% increase in the previous month. The unemployment rate decreased to 6.5% in April, in line with market expectations, following a revised rate of 6.6% in March. Manufacturing PMI in the eurozone declined to 44.80 in May, down from 45.80 in the previous month.

UK house prices experienced a marginal decrease of 0.1% on a monthly basis in May, following a revised increase of 0.4% in the previous month. Market expectations had anticipated a 0.5% decline. This decline in house prices reflects wider concerns in the UK property market. Moody’s recently downgraded the debt of Canary Wharf, a prominent symbol of the global real estate downturn. The east London financial district, saw its debt rating lowered from Ba1 to Ba3.

In China, the official manufacturing Purchasing Managers’ Index (PMI) dropped unexpectedly to 48.80 in May, indicating a contraction for the second consecutive month. This suggests that the post-Covid recovery in China’s economy is facing challenges. However, the services PMI rose to 54.5, albeit below expectations, but still indicating expansion.

On the other hand, the private Caixin manufacturing PMI index surprisingly increased to 50.90 in May, contradicting the official data and showing a slight expansion in manufacturing activity. The Caixin index mainly covers smaller and export-oriented businesses.

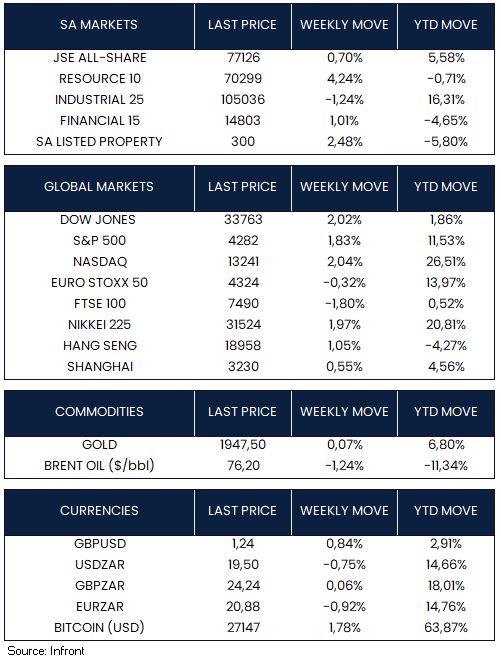

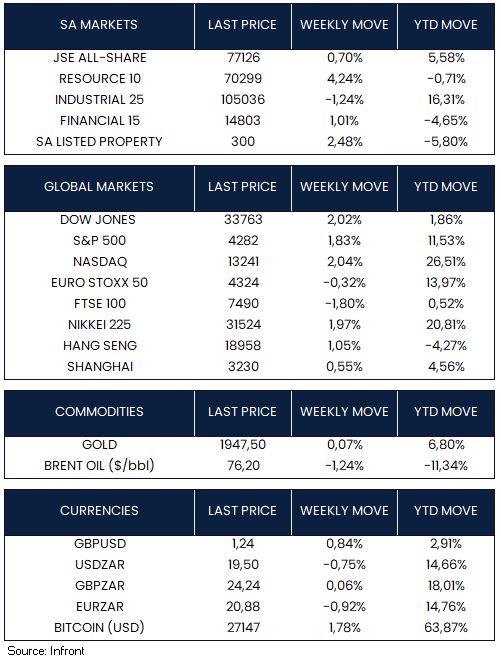

U.S. and Asian markets were stronger this week, whilst European markets ended in negative territory. In the U.S., the Dow Jones (+2.02%), S&P 500 (+1.83%) and Nasdaq (+2.04%) all ended the week higher. Similarly, the Nikkei 225 (+1.97%), Hang Seng (+1.05%) and Shanghai Composite Index (+0.55%) also ended the week higher, whilst the Euro Stoxx 50 (-0.32%) and FTSE 100 (-1.80%) were negative.

Market Moves of the Week:

Earlier this week, the foreign ministers of Brazil, Russia, India, China, and South Africa met in Cape Town. The BRICS nations have requested guidance from their dedicated bank regarding the potential implementation of a shared currency, aiming to shield member countries from the impact of sanctions like those imposed on Russia.

Despite a 9.61% tariff increase and a bailout of R21.9 billion from the Treasury, Eskom reported a loss before tax of R21.2 billion for the 2024 financial year, surpassing the projected loss of R13.6 billion. The company’s revenue fell short of expectations, while its expenses, particularly on diesel, amounted to R21.36 billion, more than double the previous year. Additionally, the Treasury informed legislators that the total invoiced municipal arrear debt rose to R58.5 billion.

South Africa’s trade surplus contracted to R3.54bn, lower than expectations, while the Absa Purchasing Managers Index (PMI) declined in May, indicating a contraction in manufacturing output for the second quarter following a modest rebound in the first quarter.

The JSE All-Share Index (+0.70%) ended the week in positive territory, driven higher by the resource (+4.24%) and financial (+1.01%) sectors, whilst industrial shares (-1.24%) were negative. By Friday close, the rand was trading at R19.50 to the U.S. Dollar, appreciating by +0.75% for the week.

Chart of the Week:

The U.S. unemployment rate rose in May to 3.7% from 3.4%, one of the fastest increases since early in the pandemic, according to Bureau of Labor Statistics data released Friday. About 440,000 more workers reported that they are unemployed; and most of those were from temporary jobs ending or layoffs, according to the data.

Source: Bureau of Labor Statistics via FRED, Washington Post.

Understanding UK Property Tax

The rules around tax are intricate enough when you’re buying property in your own country; when you take that process offshore, you quickly understand the value of consulting a qualified professional.

UK property as a long-term investment can yield high returns and is an effective means of hard currency exposure. Considering the impact and cost of taxes on your overall investment, it’s essential to ensure that you have (or at least your advisor has) a sound understanding of all the taxes that come with owning property in the UK.

Understanding the complete ins and outs of buying, holding and disposing of UK property assets can be complex and is often overlooked.

Transparency is the key word we stand by when assisting our clients in buying property overseas, and we work hand in hand with one of the UK’s top-rated accounting firms, HWFisher, to ensure our clients are fully informed

Our latest tax guide, in partnership with HWFisher, is available to download for everything you need to know about tax when looking at UK property as an investment for your 2023 portfolio.

Week in Review: China’s Post-Covid Recovery Shows Strong Progress

China’s National Bureau of Statistics (NBS) reported that the manufacturing purchasing managers’ index (PMI) rose to 52.6 in February from 50.1 in January, above the 50-point mark that separates expansion and contraction in domestic activity. Furthermore, the NBS emphasized that the non-manufacturing sector’s purchasing managers’ index (PMI) reached 56.3 in February, up from 54.4 in January. After lifting Covid restrictions, China’s economy is showing signs of a more robust recovery, with manufacturing seeing its most substantial progress in over ten years, services activity rising and the housing market stabilizing.

In the U.S. market sentiment received a boost this week after Atlanta Fed President Raphael Bostic published his written essay on Wednesday, commenting that he believes the Federal Reserve (Fed)should increase its policy rate by 50 basis points, to a range of 5%-5.25%, and maintain it at that level until well into 2024. As of now, rates are within a range of 4.5%-4.75%. Elsewhere, Fed Governor Chris Waller expressed doubt about whether the Fed is making the necessary headway to curb economic growth and decrease inflation. Citing robust inflation rates, as well as strong retail sales and the January jobs report, Waller indicated that if this trend persists, the Federal Reserve may have to increase rates beyond initial expectations. Officials next meet March 21-22, and by then they will have seen fresh reports on employment and inflation.

In Europe, official data indicated that the annual rate of inflation decreased slightly from 8.6% in January to 8.5% in February, and this was primarily driven by declining energy costs. On the other hand, core inflation, which provides a more accurate representation of underlying pricing pressures by excluding volatile food and energy expenses, increased from 5.3% to 5.6%. All combined, these factors contribute to the view that the European Central Bank (ECB) may maintain its hawkish stance for an extended period. It was suggested by the ECB President Christine Lagarde that a probable half-point increase in interest rates would occur during the March 16 meeting. European government bond yields increased over the week due to concerns about the aggressive tightening of monetary policy by the ECB as a result of persistent inflation data.

Following their sharpest weekly decline in two months, U.S. stocks rose Friday ending the week strongly, regaining some of their recent losses. The tech-heavy Nasdaq gained +2.58% for the week, while the S&P 500 and the Dow Jones were also both strongly up on the week, with gains of 1.90% and 1.75%, respectively. PMI’s in both Europe and the UK picked up in February with the Eurozone PMI rising to 52 from 50.2 in January and the UK composite rising to 53.1 versus 48.5 in January. Both the Euro Stoxx 50 and FTSE 100 ended the week positively, gaining 2.78% and 0.87% respectively.

For the second consecutive week, Chinese equities rose in anticipation of the National People’s Congress (NPC) meeting, as promising economic data raised expectations for a recovery that could surpass previous projections. The Shanghai Composite climbed by 1.87%. After four consecutive weeks of losses, the benchmark Hang Seng Index rebounded, increasing by 2.79%. The Nikkei 225 also secured positive gains of 1.73% this week.

Market Moves of the Week:

In local news, the Absa Purchasing Manager Index (PMI) indicated that factory activity in South Africa (SA) experienced a significant contraction in February. The seasonally-adjusted PMI dropped to 48.8 in February, down from 53 points in January, falling below the threshold of 50 points that distinguish between expansion and contraction. This is the first time it has fallen below this level since September 2022. This decline was likely due to the unprecedented seven days of Stage 6 loadshedding that occurred during the survey period. According to Absa, the business activity, new sales orders, employment, and inventories, sub-indices were all in contractionary terrain. Export sales, however, rose to the best level in a year, suggesting that manufacturers who solely supply the domestic market may have faced a challenging month.

Statistics South Africa (Stats SA) released their quarterly labour force survey during the week, and it highlighted that the official unemployment rate recorded a slight decline of 0.2 percentage points, reaching 32.7% in the final quarter of 2022 — marking its fourth consecutive decrease. During the quarter, the financial services sector was responsible for the largest share of job creation, hiring an additional 103,000 workers. The other sectors that contributed to the quarter’s job gains were private households, trade, and transport. The community and social services industry, however, saw a significant reduction in employment, shedding 122,000 jobs. Agriculture and construction were also among the sectors that made a negative contribution to the employment figures for the quarter. Although the unemployment rate has decreased in recent times, it remains higher than its pre-pandemic level of 30.1%.

This week, the JSE all-share index recorded a gain of +1.76%, fueled by gains in the resource sector (+3.73%), followed by industrials (+1.36%), and the financial sector (+1.18%). However, the gains were offset by a slight decrease in the property sector (-0.04%). The rand appreciated marginally to end the week at R18.15 to the dollar.

Chart of the Week:

The manufacturing sector in China saw significant growth in February 2023, expanding at its fastest pace in over a decade. This unexpected surge in production was attributed to the lifting of COVID-19 restrictions towards the end of last year.